Report Code: 10898 | Available Format: PDF

MEMS Foundry Outsourcing Market Revenue Forecast Report: Size, Share, Recent Trends, Strategic Developments, Segmentation Analysis, and Evolving Opportunities, 2024-2030

- Report Code: 10898

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

Market Overview

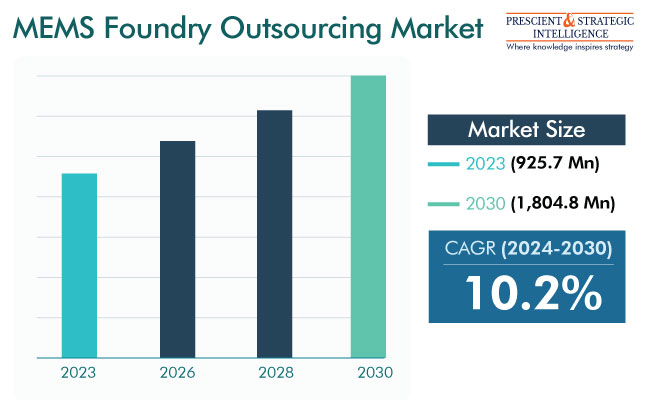

The MEMS foundry outsourcing market will grow from USD 925.7 million (E) in 2023 to USD 1,804.8 million in 2030 at a compound annual growth rate of 10.2% between 2024 and 2030.

The growth of this industry can be mainly attributed to the development of the fabless business model. Moreover, the constantly decreasing average selling price, evolving new applications of microelectromechanical systems, and the booming acceptance of 300-mm MEMSs will boost the industry revenue in the years to come.

Microelectromechanical systems can be described as miniaturized electronic and mechanical elements created via the method of microfabrication. There are different kinds of MEMS sensors, such as inertial measurement units, accelerometers, magnetometers, oscillators, pressure sensors, gyroscopes, and thermopiles.

These sensors are employed for numerous applications, such as handling & controlling equipment, navigation systems, managing robots, pressure sensing, car grippers, and airbags of cars. The players either produce these sensors in the house or outsource their manufacturing to foundries.

MEMS foundries offer low-to-high-volume manufacturing, enhanced process development, and prototyping services. They also provide the flexibility to employ substrate materials such as gallium arsenide, silicon-on-insulator, glass, quartz, complementary metal-oxide-semiconductor wafers, and silicon, based on the specific application.

Increasing Smart Consumer Electronics Demand To Boost Market

The requirement for consumer electronics, including tablets, headphones, and smartphones, is continuously increasing since the pandemic. This is because of the rise in the work-from-home trend and the surge in the utilization of indoor entertainment devices. Moreover, people are speedily accepting new and evolving products, including wearable medical devices, video game consoles, automotive electronics, and voice-activated smart speakers.

MEMS-based sensors are extensively used in consumer electronics for monitoring, measuring, control, and data logging applications. Such sensors comprise proximity, pressure, motion, flow & level, temperature, acoustic, image, and touch sensors. Microelectromechanical-system-based inkjet heads are an important part of printers, whereas gyroscopes and accelerometers based on these components are included in almost all smartphones.

Numerous manufacturers in this industry are accepting advanced MEMS technology to enhance their products, with the increasing demand for innovative features.

Rising Autonomous Vehicle Demand Is another Major Driver

As per the National Highway Traffic Safety Administration (NHTSA), an estimated 31,785 individuals died due to traffic accidents in the first nine months of 2022 in the U.S. Moreover, as per the WHO, road traffic injuries are the major cause of mortality for young adults and children between 5 and 29 years of age. Therefore, the increasing concern of consumers regarding vehicle security and safety has led to an increasing need for fully autonomous and semi-autonomous automobiles.

MEMS automotive sensors, such as fuel sensors, pressure & inertial sensors, and impact & crash sensors, are used in autonomous vehicles for fuel level indication, braking control, airbag deployment, and impact detection. The number of light-duty vehicles on the road across the globe is expected to reach approximately 3 billion by 2050. With the surging count of vehicles, the demand for MEMSs is also expected to increase continuously.

Additionally, autonomous vehicles can help in resolving traffic congestion problems as they can communicate with other vehicles to find alternative routes and avoid collisions.

| Report Attribute | Details |

Market Size in 2023 |

USD 925.7 Million (E) |

Revenue Forecast in 2030 |

USD 1,804.8 Million |

Growth Rate |

10.2% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

IDM (Mixed Mode) Holds Significant Share

The IDM (mixed mode) category, on the basis of business model, accounts for a significant share of the industry. The constant decline in microelectromechanical systems’ ASPs has encouraged several IDMs to enter MEMS foundry outsourcing.

Moreover, integrated device manufacturers (IDMs) hold a stronger competitive advantage than fablight and fabless players since they have better expertise in microelectromechanical system design. In addition, IDMs attain advantages from the economies of scale, especially from application-specific integrated circuit MEMS.

The pure-play category is expected to witness considerable growth during the projection period. The new players in the semiconductor foundry industry are likely to implement the fabless business model for MEMSs. This will allow them to compete amid dropping profit margins and decrease the total economies of scale, by removing capital investment in design support, foundry setup & maintenance, and tools.

Consumer Electronics Is Leading Application

The consumer electronics category, on the basis of application, is the largest contributor to the MEMS foundry outsourcing industry. This is primarily because of the increasing penetration of various kinds of consumer electronic products, including tablets, smartphones, computers, electronic gadgets, home appliances, and smart wearables.

For instance, in January 2023, xMEMs Labs Inc. launched Skyline, a discrete solid-state microelectromechanical system DynamicVent. It integrates smart TWS hearing aids and earbuds with active ambient control by combining open-fit and closed-fit, spatially conscious earbuds.

The automotive category is another significant contribution to the market, primarily due to the increasing sale of vehicles with ADAS features. The constituent systems in such vehicles are meant to prevent collisions and keep passengers and pedestrians safe. Hence, a range of sensors, which are increasingly being based on the MEMS technology, are integrated into these automobiles. The demand for these ADAS sensors is essentially propelled by the rising per capita income in the APAC region.

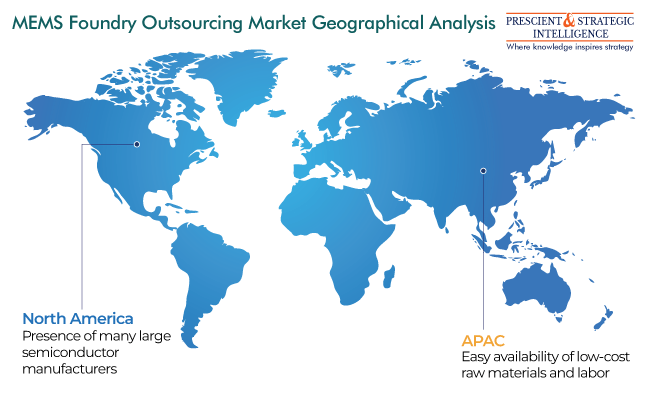

Taiwan Is Market Leader in APAC

Taiwan is leading the MEMS foundry outsourcing industry in APAC. The major semiconductor foundries in this country are increasing their production volume because of the rising requirement for MEMSs in applications such as automotive and consumer electronics. For instance, in February 2022, United Microelectronics Corporation declared a plan for building a new manufacturing facility in Singapore, which is expected to offer its 22/28-nm chips.

Further, China has observed significant growth in the semiconductor and microsystem manufacturing infrastructure, mainly because of the growth of the automotive and consumer electronics sectors. Moreover, the increasing export of semiconductor and microsystem-enabled products, including smartphones, drones, and tablets, is driving MEMS production in the country.

Additionally, the requirement for these solutions in Japan is being boosted by the increasing need for autonomous vehicles, tablets, smartphones, and laptops. Additionally, Japan is a technologically advanced country with the capability to meet the stringent semiconductor product quality requirements of the West. This Japan achieves at significantly lower costs than North American and European semiconductor foundries, which results in a drop in the price of MEMSs and the end products.

Key Players in MEMS Foundry Outsourcing Market

- STMicroelectronics N.V.

- Atomica Corp.

- Sony Group Corporation

- Koninklijke Philips N.V.

- Taiwan Semiconductor Manufacturing Company Limited

- ROHM Co. Ltd.

- TDK Corporation

- Teledyne Technologies Inc.

- Dover Corporation

- X-FAB Semiconductor Foundries SE

- United Microelectronics Corporation

- Silex Microsystems AB

- Asia Pacific Microsystems Inc.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws