Report Code: 11622 | Available Format: PDF | Pages: 244

Automotive Sensors Market Research Report: By Type (Pressure Sensor, Temperature Sensor, Position Sensor, Oxygen Sensor, Motion Sensor, Optical Sensor, Torque Sensor, Gas Sensor, Level Sensor), Application (ADAS, Powertrain, Chassis, Body), Technology (MEMS, Non-MEMS), Vehicle Type (Passenger Car, Commercial Vehicle), End Use (OEM, Aftermarket) - Global Industry Share, Size, Growth and Demand Forecast to 2030

- Report Code: 11622

- Available Format: PDF

- Pages: 244

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Outlook

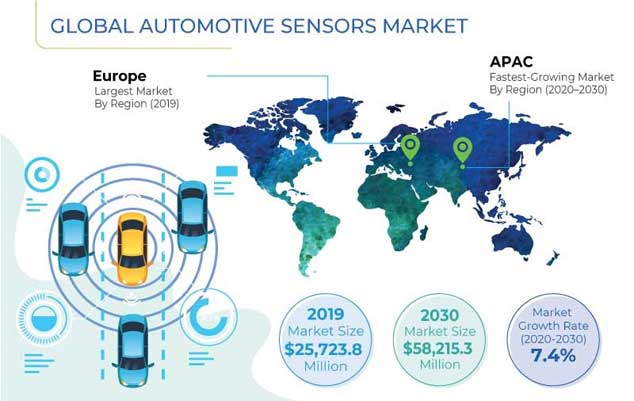

The value was $25,723.8 million in 2019, and the market is predicted to progress at a CAGR of 7.4% between 2020 and 2030, to reach $58,215.3 million by 2030.

Asia-Pacific (APAC) had the largest share in the market, in terms of volume, from 2015 to 2019, and it is predicted to be the fastest-growing region in the forthcoming years. On the other hand, Europe was the largest market, in terms of value, during 2015–2019. This was because of the huge requirement for automotive sensors on account of the presence of several regulations regarding the incorporation of safety features, such as automatic emergency braking systems, in vehicles in the region.

Market Dynamics

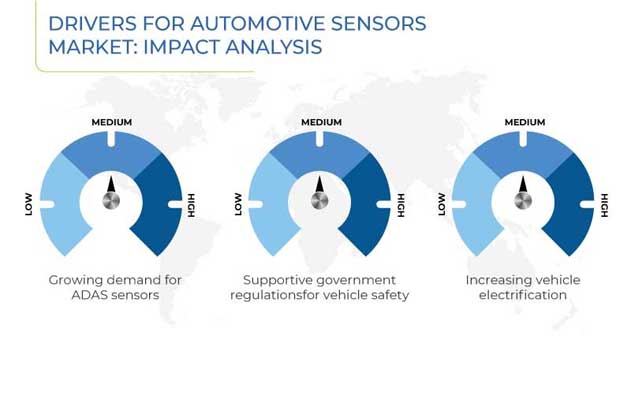

One of the major trends currently being witnessed in market for automotive sensors is the innovations in these instruments and the automotive industry, as a whole. For example, several advanced driver-assistance system (ADAS) sensors, such as light detection and ranging (LiDAR), ultrasonic, camera, and radar sensors, have been developed in recent years. Furthermore, over the last few years, the popularity of sensor fusion has risen sharply in the automotive industry. Although all ultrasonic, LiDAR, radar, and other sensors have their limitations, they significantly improve ADAS features, such as obstacle prevention and cross-traffic assistance, when combined and used together.

The enactment of laws that mandate the installation of vehicle safety systems and a reduction in the greenhouse gas (GHG) emissions are driving the expansion of the automotive sensors market, by pushing up the demand for highly advanced automotive sensors. For example, in Europe, governments and other regulatory authorities have mandated the installation of various driving assistance features, such as emergency stop signal, advanced emergency braking, lane keeping assist, tire pressure monitoring, intelligent speed assistance, drowsiness and attention detection, and reversing camera, in vehicles.

As a result, in many countries, huge investments are being made for developing advanced sensors, which is, in turn, creating lucrative growth opportunities for the players operating in the automotive sensors industry. Major global investors and automotive giants are increasingly focusing on developing advanced sensors. For example, Porsche Automobil Holding SE, which is a subsidiary of Volkswagen AG, made an investment in a LiDAR producing startup, called Aeva Inc., in December 2019. Moreover, an investment worth $100 million was made in Luminar Technologies Inc. by Moore Strategic Ventures LLC, The Westly Group, and G2VP LLC in July 2019. These investments took the total funding of Luminar Technologies beyond $250 million.

Segmentation Analysis

The position sensors category dominated the type segment of the automotive sensors market during 2015–2019. This was because of the large-scale adoption of these sensors in various vehicle parts, such as clutches, brakes, transmissions, chassis, and engines, for determining the steering wheel position, gear position, motor rotor position, seat position, pedal position, throttle position, and the position of different actuators, valves, and knobs.

The ADAS application category is predicted to exhibit the fastest growth in the market for automotive sensors in the upcoming years. This is credited to the fact that in several countries, the incorporation of certain ADAS features in vehicles has been made mandatory.

The micro-electromechanical system (MEMS) category is predicted to register the faster growth in the market in the future, under the technology segment. The ballooning popularity of this technology is ascribed to its lesser power consumption characteristics and greater tolerance for heat.

The passenger car category led the market under the vehicle type segment in 2019. This was because of the higher requirement for automotive sensors in passenger cars on account of the fact that the majority of the technological advancements being made in the automotive industry, such as those pertaining to autonomous driving and electrification, are first implemented in these vehicles.

Original equipment manufacturers (OEMs) had the larger share in the automotive sensors market in 2019, based on end use. This was because a large number of sensors that are integrated in an automobile are installed during the manufacturing process itself, as they are extremely crucial for the proper functioning of the vehicle.

Global Scenario of Automotive Sensors Market

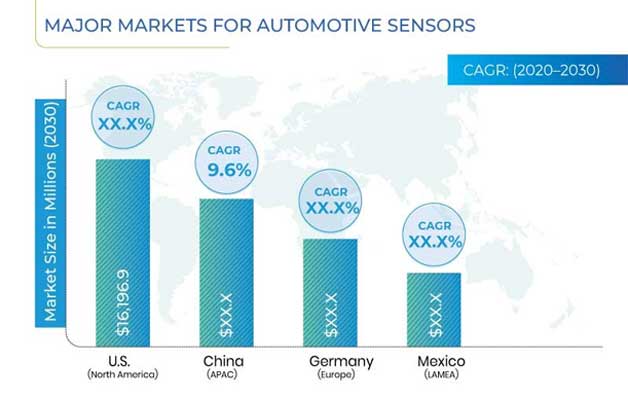

Globally, APAC was the largest market, in terms of volume, in the years gone by, and this trend is predicted to continue in the coming years. Moreover, the market is predicted to demonstrate the highest growth rate in this region. China is the leading automobile manufacturer in the APAC region and the world. According to various reports, APAC accounts for more than 50% of the global automobile manufacturing output every year. This is the primary reason behind the mushrooming sales of automotive sensors in APAC. The other major factor driving the advance of the market here is the surging deployment of electric vehicles. APAC is witnessing the large-scale electrification of automobiles because of the stringent emission laws and government support for clean mobility.

Competitive Landscape of the Automotive Sensors Market

The global automotive sensors market is moderately fragmented in nature, with the top six players accounting for around 60.0% of the total revenue in 2019. Robert Bosch GmbH was the market leader attributed to its robust product portfolio along with its vibrant presence in over 60 countries across the world. Some of the other major players operating in the market are DENSO CORP., Valeo SA, Panasonic Corp., OmniVision Technologies Inc., ON Semiconductor Corp., Sensata Technologies Holding plc, TE Connectivity Ltd., NXP Semiconductors N.V., Analog Devices Inc., Continental AG, Delphi Technologies PLC, Infineon Technologies AG, Melexis NV, and Allegro MicroSystems LLC.

| Report Attribute | Details |

Historical Years |

2015-2019 |

Forecast Years |

2020-2030 |

Market Size by Segments |

Type, Application, Technology, Vehicle Type, End Use |

Market Size of Geographies |

U.S., Canada, Germany, U.K., France, Italy, Spain, Japan, China, India, Brazil, Mexico |

Explore more about this report - Request free sample

Recent Strategic Developments of Major Automotive Sensors Market Players

In recent years, the major players in the automotive sensors market have taken several strategic measures, such as product launches, partnerships and collaborations, and facility expansion, to gain a competitive edge in the industry. For instance, in November 2019, Allegro MicroSystems LLC launched the industry’s first gear tooth sensor integrated circuit (IC) ATS17501. The sensor is designed to provide incremental position for electric vehicle traction motors operating up to 30,000 revolutions per minute (RPM) and would provide highest speed switching up to 40 kHz. Also, in October 2019, ON Semiconductor Corp. entered into a partnership with Almotive GmbH to develop prototype sensor fusion platforms for automotive applications.

Automotive Sensors Market Size Breakdown by Segment

The Automotive Sensors Market report offers comprehensive market segmentation analysis along with market estimation for the period 2015–2030.

Based on Type

- Pressure Sensor

- Temperature Sensor

- Position Sensor

- Oxygen Sensor

- Motion Sensor

- Optical Sensor

- Torque Sensor

- Gas Sensor

- Level Sensor

Based on Application

- Advanced Driver-Assistance System (ADAS)

- Radar

- Light detection and ranging (LiDAR)

- Camera

- Ultrasonic

- Powertrain

- Chassis

- Body

Based on Technology

- Micro-Electromechanical System (MEMS)

- Non-MEMS

Based on Vehicle Type

- Passenger Car

- Conventional fuel car

- Alternative fuel car

- Commercial Vehicle

- Light commercial vehicle (LCV)

- Medium and heavy commercial vehicle (M&HCV)

Based on End Use

- Original Equipment Manufacturer (OEM)

- Aftermarket

Based on Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K,

- France

- Italy

- Spain

- Asia-Pacific (APAC)

- China

- Japan

- India

- Latin America, Middle East, and Africa (LAMEA)

- Brazil

- Mexico

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws