Report Code: 11878 | Available Format: PDF | Pages: 158

Automotive Electronics Market Research Report: By Component Type (Electronic Control Unit, Current Carrying Device, Sensor), System (Engine Electronics, Transmission Electronics, Chassis Electronics, Passive Safety System, Driver Assistance System, Passenger Comfort System, Entertainment System, Electronic Integrated Cockpit System), Vehicle (Passenger Car, Commercial Vehicle), Distribution Channel (OEM, Aftermarket) - Global Industry Trends and Growth Forecast to 2030

- Report Code: 11878

- Available Format: PDF

- Pages: 158

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Outlook

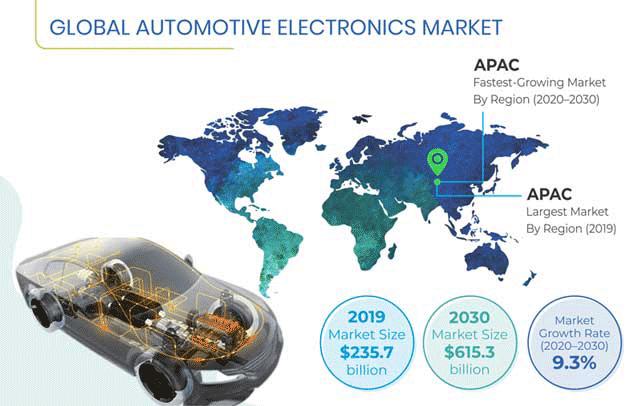

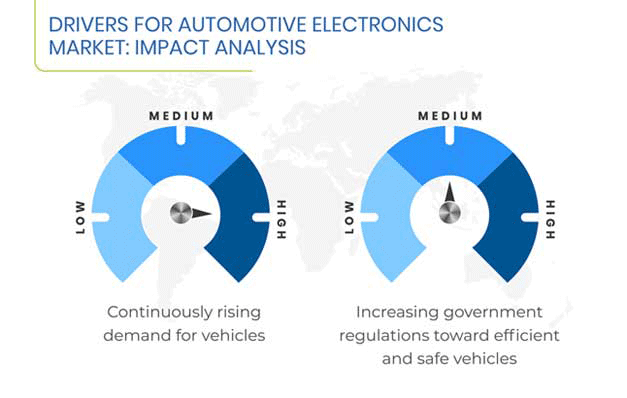

The automotive electronics market revenue stood at $235.7 billion in 2019, and it is predicted to rise to $615.3 billion by 2030. Furthermore, the market is predicted to progress at a CAGR of 9.3% between 2020 and 2030. The key factors driving the expansion of the market are the soaring sales of vehicles and increasing implementation of government regulations and policies in several countries for making vehicles fuel-efficient and safer.

Segmentation Analysis of Automotive Electronics Market

In 2019, the current carrying device category had the largest share in the automotive electronics industry, under the component type segment. This was because a vehicle contains nearly 200 electronic fuses and switches, and without these components, automobiles cannot work.

The driver assistance system category is predicted to demonstrate the fastest growth in the forthcoming years, based on system. This is credited to the surging requirement for driver assistance systems due to the growing deployment of autonomous vehicles around the world. As these systems are necessary for the smooth functioning of autonomous vehicles, particularly the ones equipped with level 5 automation features, the sale of automotive electronic components will surge sharply because of the increasing deployment of these vehicles across the world.

From 2014 to 2019, the passenger car category, under segmentation by vehicle, dominated the automotive electronics market. This was ascribed to the fact that passenger cars accounted for nearly 70% of the total automobile sales all over the world in 2019. Moreover, any newly developed automotive technology is first implemented and integrated into passenger cars.

The aftermarket category is expected to exhibit the faster growth in the market for automotive electronics in the upcoming years, under the distribution channel segment. This will be a result of the fact that people are rapidly getting their older vehicles retrofitted with new electronic systems at service centers and garages, on account of the enactment of strict vehicle safety and fuel emission norms.

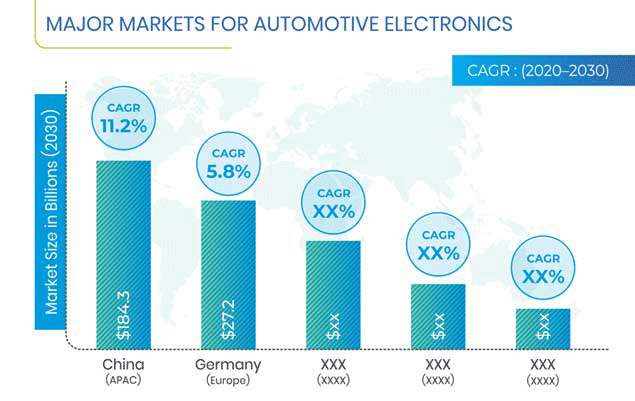

Geographically, the Asia-Pacific (APAC) region was the largest procurer of automotive electronic components in 2019. This was because of the huge production of automobiles in regional countries, such as India, China, South Korea, and Japan, on account of the abundant availability of affordable labor and raw materials. As a result, many leading automakers from all over the world have set up manufacturing plants in regional countries, which has made vehicles cheaper for inhabitants.

Integrated Cockpit Systems Emerging as Major Market Trend

The incorporation of integrated cockpit systems in automobiles is one of the major automotive electronics market trends. Unlike conventional cockpits, wherein the driver is required to manually control functions such as those related to infotainment, heads-up displays (HUD), navigation, voice assistance, embedded virtualization, and smart heating, ventilation, and air conditioning (HVAC), in an integrated cockpit, multiple screens are used for displaying the vehicle data, thereby providing greater convenience to the driver. Moreover, automobile manufacturing companies, such as Daimler AG, Bayerische Motoren Werke AG (BMW), Tata Motors, General Motors Company, and Toyota Motor Company, have begun incorporating these components in their vehicles on account of the rising customer preference for them.

Surging Sales of Automobiles Fueling Market Expansion

One of the major factors fueling the expansion of the market is the soaring sales of automobiles across the world. Currently, automotive electronics account for nearly 35% of the total cost of an average vehicle, compared to an only 5% share in 1970. Moreover, this share is predicted to grow to as much as 50% by 2030.

As per the observations of Organisation Internationale des Constructeurs d'Automobiles (OICA), 95.1 million automobiles were sold around the world in 2018, with this number growing at a CAGR of 1.8% from 2014 to 2018. The soaring sales of automobiles, especially electric and autonomous vehicles, are predicted to propel the automotive electronics market growth in the coming years.

Integration of ADAS Generating Lucrative Growth Opportunities

The increasing usage of advanced driver assistance systems (ADAS) is creating lucrative growth opportunities for the players operating in the market for automotive electronics. The growing incidence of road accidents and, resultingly, the concerns being raised over vehicle and passenger safety are fueling the demand for ADAS. Such systems reduce the chances of driver negligence, which, in turn, mitigates the occurrence of road accidents. Tesla Inc. claimed in its 2019 Q4 report that the accident rate of its automobiles was four times lower than the average rate in the U.S., after they were integrated with ADAS.

| Report Attribute | Details |

Historical Years |

2014-2019 |

Forecast Years |

2020-2030 |

Market Size by Segments |

Component Type, System, Vehicle, Distribution Channel |

Market Size of Geographies |

U.S., Canada, U.K., Germany, France, Spain, Italy, Russia, China, India, Japan, South Korea, Thailand, Indonesia, Mexico, Brazil, Argentina, Turkey, South Africa, Morocco |

Explore more about this report - Request free sample

Market Players Entering into Partnerships to Make Automobiles Safer

In the recent years, several players in the automotive electronics market have looked at partnerships as a means to develop advanced automotive electronics that can make vehicles safer. For instance, in January 2019, Mobileye NV and Valeo SA began co-creating a new safety standard for autonomous vehicles, whichis centered around Mobileye’s mathematical safety model.

Similarly, NTT Communications Corp. and DENSO CORP., in December 2019, announced that by January 2020, they would begin the testing of their jointly developed vehicle security operation center, which studies the security status of vehicles. This will allow the companies to come with better security features for connected cars.

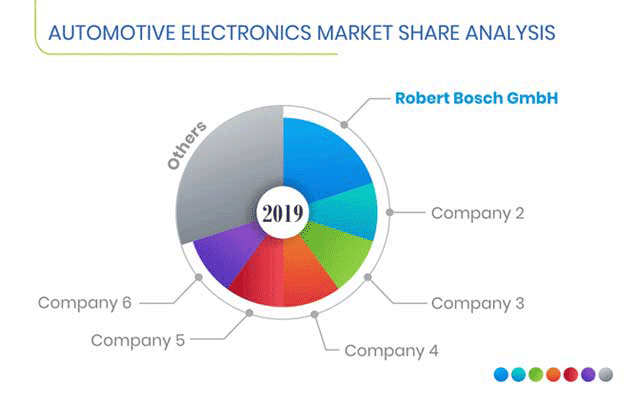

The global automotive electronics market is characterized by numerous players, including Robert Bosch GmbH, Continental AG, Hitachi Ltd., Delphi Technologies PLC, ZF Friedrichshafen AG, Texas Instruments Incorporated, DENSO CORP., NXP Semiconductors N.V., Valeo SA, Infineon Technologies AG, Hella Gmbh & Co. KGaA, Panasonic Corporation, Visteon Corporation, Xilinx Inc., Magna International Inc., Aisin Seiki Co., Hyundai Mobis Co. Ltd., Lear Corp., Faurecia, and Yazaki Corp.

Automotive Electronics Market Size Breakdown by Segment

The Automotive Electronics market report offers comprehensive market segmentation analysis along with market estimation for the period 2014–2030.

Based on Component Type

- Electronic Control Unit (ECU)

- Current Carrying Device

- Sensor

Based on System

- Engine Electronics

- Transmission Electronics

- Chassis Electronics

- Passive Safety System

- Driver Assistance System

- Passenger Comfort System

- Entertainment System

- Electronic Integrated Cockpit System

Based on Vehicle

- Passenger Car

- Commercial Vehicle

Based on Distribution Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Spain

- Italy

- Russia

- Asia-Pacific (APAC)

- China

- India

- Japan

- South Korea

- Thailand

- Indonesia

- Latin America (LATAM)

- Mexico

- Brazil

- Argentina

- Middle East and Africa (MEA)

- Turkey

- South Africa

- Morocco

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws