Report Code: 11848 | Available Format: PDF

ADAS Sensor Market Research Report: By Type (Radar, LiDAR, Camera, Ultrasonic), Vehicle Autonomy (Semi-Autonomous Vehicle, Fully-Autonomous Vehicle), Vehicle Type (Passenger Car, Commercial Vehicle), Application (ACC System, AEB System, BSD System, LKAS, AFL System, CTA System, DMS, IPA System, NVS) - Industry Size, Trend, Growth and Demand Forecast to 2030

- Report Code: 11848

- Available Format: PDF

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Valued at $11.5 billion in 2019, the global advanced driver-assistance system (ADAS) sensor market is expected to reach $40.8 billion by 2030, advancing with a CAGR of 11.7% during 2020–2030 (forecast period).

Europe was the largest region, in terms of value in the ADAS sensor market, during the forecast period. The development rate of autonomous vehicles is growing significantly in the region, which majorly contributes to the progress of the market. Moreover, the ongoing technological innovations by the major automotive players, along with the governments’ extensive support, in terms of policy implementation and financial benefits, is further expected to drive the growth of the region’s market.

-SENSOR-MARKET.png)

Fundamentals Governing the ADAS Sensor Market

The growing adoption of long-range radar (LRR) sensors in vehicles is a major trend being observed in the ADAS sensor market. An LRR has the ability to detect signals from a greater distance (covering three motorway lanes, equaling up to 150 m in distance), when compared with a short-range radar (SRR). Thus, the superior data detecting capacity of LRRs generates adequate push for its rapid adoption, which is why such products are trending in the market.

The growing adoption of semi-autonomous vehicles is a major driver propelling the growth of the ADAS sensor market. Different countries across the world have made it mandatory for vehicle manufacturers to install different advanced driver-assistance features. The compelling promise of enhanced passenger safety and smoother road traffic the autonomous technology holds is a primary reason for the adoption of these vehicles. As a result, most of the major vehicle manufacturers are now providing advanced driver-assistance system, such as automatic emergency braking, adaptive cruise control, anti-lock braking system, and automatic parking, in their new vehicles, to provide a safer driving experience to customers. This, in turn, is driving the demand for advanced driver-assistance system sensors across the world.

ADAS Sensor Market Segmentation Analysis

Ultrasonic sensors dominated the ADAS sensor market during the historical period (2014–2019), in terms of volume, on the basis of type. This is because, at present, a level 1 autonomous vehicle, on an average, comprises four ultrasonic sensors, compared to one or two each of radar, light detection and ranging (LiDAR), and camera sensors. However, the radar sensor category held the largest value share during the historical period, owing to its higher price than camera and ultrasonic sensors.

Semi-autonomous vehicles, led by level 1 automation, were the larger ADAS sensor market category during the historical period, based on vehicle autonomy. This is because, in many countries, the basic ADAS features in level 1 autonomous vehicles have been made mandatory in vehicles. To achieve level 1 automation, the vehicle should be equipped with at least one of the ADAS features (either for steering or acceleration) or electronic stability control (ESC). The National Highway Traffic Safety Administration (NHTSA) in the U.S. has mandated the use of ESC in all passenger vehicles being manufactured since 2012. This eventually made all passenger cars semi-autonomous, as ESC-equipped cars are considered level 1 autonomous cars.

| Report Attribute | Details |

Historical Years |

2014-2017 |

Forecast Years |

2020-2030 |

Market Size by Segments |

Type, Vehicle Autonomy, Vehicle Type, Application |

Market Size of Geographies |

U.S., Canada, Germany, U.K., France, Italy, Spain, Netherlands, Japan, China, India, South Korea, Brazil, Mexico, South Africa |

Explore more about this report - Request free sample

Geographical Analysis of ADAS Sensor Market

Geographically, Europe was the largest region in the ADAS sensor market during the historical period. This is because the prevalent regulations in the region are well suited for the enhancement of the autonomous car market. For instance, in Spain, the regulations implemented by the Directorate General of Traffic (DGT) encourage the functionality of all self-driving vehicles up to level 5 on the roads. Further, the initiatives taken by the major players operating in the region have further contributed toward the growth of the regional market. For instance, in April 2019, Groupe PSA launched a pilot project, as part of the European L3Pilot project, in order to test level 3 autonomous driving functions. The testing operations are being carried out on the open roads of France.

Competitive Landscape of ADAS Sensor Market

Some of the major players operating in the global ADAS sensor market are Robert Bosch GmbH, NXP Semiconductors N.V., Velodyne Lidar Inc., Valeo SA, Texas Instruments Inc., TE Connectivity Ltd., Quanergy Systems Inc., Pixelplus Co. Ltd., ON Semiconductor Corp., OmniVision Technologies Inc., LeddarTech Inc., Littelfuse Inc., HELLA GmbH & Co. KGaA , Autoliv Inc., and Continental AG.

Recent Strategic Developments of Major ADAS Sensor Market Players

In recent years, the major players in the ADAS sensor market have undertaken several strategic measures, such as investments, partnerships, and service launches, to gain a competitive edge in the market. For instance, in January 2020, Robert Bosch GmbH announced that it has developed a sensor that would enable cars to see a 3D view of the road. The development is intended to lower the cost of technology and speed up the development of self-driving vehicles. Further, in April 2019, NXP Semiconductors N.V. entered into a strategic collaboration with Hawkeye Technology Co. Ltd., to develop autonomous vehicles in China. Under the partnership, Hawkeye Technology Co. Ltd. would offer its deep expertise in 77 GHz radar sensors to NXP Semiconductors N.V., in order to create 77 GHz radar solutions for the Chinese automotive market.

ADAS Sensor Market Size Breakdown by Segment

The ADAS sensor market report offers comprehensive market segmentation analysis along with market estimation for the period 2014–2030.

Based on Type

- Radar

- 24 GHz

- 77 GHz

- LiDAR

- Short and Medium-Range

- Long-Range

- Camera

- Complementary Metal Oxide Semiconductor (CMOS)

- Charge-Coupled Device (CCD)

- Ultrasonic

Based on Vehicle Autonomy

- Semi-Autonomous Vehicle

- Level 1

- Level 2

- Level 3

- Fully-Autonomous Vehicle

- Level 4

- Level 5

Based on Vehicle Type

- Passenger Car

- Commercial Vehicle

Based on Application

- Adaptive Cruise Control (ACC) System

- Automatic Emergency Braking (AEB) System

- Blind Spot Detection (BSD) System

- Lane Keeping Assistance System (LKAS)

- Adaptive Front Light (AFL) System

- Cross Traffic Alert (CTA) System

- Driver Monitoring System (DMS)

- Intelligent Park Assist (IPA) System

- Night Vision System (NVS)

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Netherlands

- Asia-Pacific (APAC)

- Japan

- China

- India

- South Korea

- Latin America, Middle East and Africa (LAMEA)

- Brazil

- Mexico

- South Africa

Key Questions Addressed/Answered in the Report

- What is the current scenario of the advanced driver-assistance system sensor market?

- What are the emerging technologies for the development of advanced driver-assistance system sensors?

- What are the historical size and the present size of the categories within the market segments and their future potential?

- What are the existing government regulations and policies encouraging the adoption of ADAS sensors around the world?

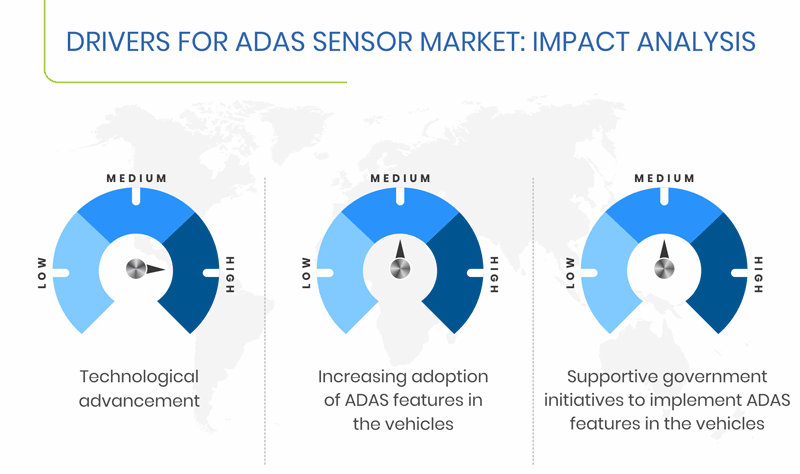

- What are the major catalysts for the market and their expected impact during the short, medium, and long terms?

- What are the evolving opportunities for the players in the market?

- Which are the key regions from the investment perspective?

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws