Market Statistics

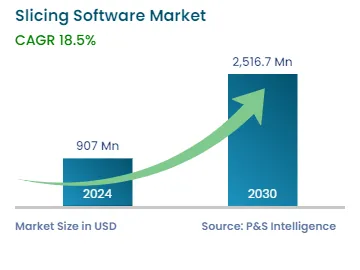

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 907 Million |

| 2030 Forecast | USD 2,516.7 Million |

| Growth Rate(CAGR) | 18.5% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12073

Get a Comprehensive Overview of the Slicing Software Market Report Prepared by P&S Intelligence, Segmented by Product Type (Standalone, Integrated), Deployment (On-Premises, Cloud), Application (Prototyping, Functional Part Manufacturing, Tooling), Technology (Stereolithography, FDM, DLP), Industry (Aerospace & Defense, Education, Architecture & Construction, Automotive, Consumer Products, Healthcare, Jewelry), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 907 Million |

| 2030 Forecast | USD 2,516.7 Million |

| Growth Rate(CAGR) | 18.5% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global slicing software market size is estimated to have stood at USD 907 million in 2024, and it is expected to reach USD 2,516.7 million by 2030, exhibiting a CAGR of 18.5% between 2024 and 2030. This is due to the rising demand for integrated slicing software and the increasing use of 3D printing technology in end-use sectors such as healthcare, manufacturing, automobile, and aerospace; and the increasing demand for next-generation 5G network that has improved bandwidth and speed compared to previous mobile network and it also enables the creation of virtual networks, which can be customized to meet specific needs for latency, security, coverage, and reliability.

Moreover, the usage has increased due to the growing requirements for the manufacturing of advanced products with a better process, the increasing demand for prototyping, the surging need for customized products, and sudden and strong investments by the private and public sectors for the overall development of 3D technology.

Some of the popular 3D print software include Slic3r, Ideamaker, Mattercontrol, and IceSL. These software programs cater to users’ preferences and also provide a wide range of customization options according to their needs. Currently, cloud-based software is becoming more popular, as it helps enable an easy connection with 3D printers and remote printing and slicing and the easy management of printers from different locations.

The integrated category holds a larger share of the slicing software market. This is mainly ascribed to its advanced features such as design optimization, machine integration, model simulation, analysis, and repair capabilities, along with the high requirement for slicing operations. As a result, companies are focusing on expanding the practicality of their software, to capitalize on the latest advancements in additive manufacturing (AM) technology and cater to the growing demand for slicing software among various end users.

Whereas, standalone slicing software provides a more limited range of features and collaborations, and focuses on converting 3D models into layered instruction (G-CODES) for printers.

The on-premises category holds a larger market share, owing to the surging need to understand sensitive data locally, compliance requirements, and data security, and as a result, slicing software is widely adopted on-premises by end users.

Whereas, during the forecast period, the adoption of cloud-based slicing software is projected to witness higher growth in the market. This can be because of its advantages such as its ability to provide enhanced management of the 3D printing process straight from a web browser, and users can access software easily from any device with an internet connection, allowing them flexibility while managing 3D prints.

Moreover, cloud-based slicing software is integrated with various business applications by collecting and analyzing the required data related to 3D printing such as printing metrics and performance analytics. Another significant advantage of such software is the capability of helping in remote printing in which a user can print 3D models from any other location, making it a very useful function for printing and leading to empowering users and improving their productivity. Additionally, it enables the users to store and access computer-aided design (CAD) files from anywhere and anytime.

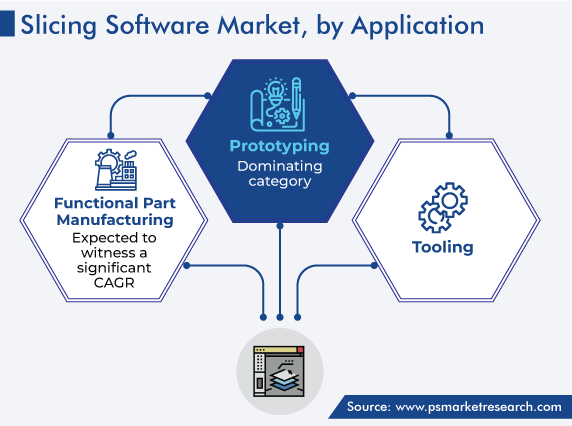

The prototyping category emerges as the top revenue generator in the market, and it is also expected to witness the highest growth rate in the coming future. This is ascribed to the increasing usage of prototyping due to the rising demand for agile products and their development, the surging need for customization of products, and the growing utilization of 3D printing and rapid prototyping. It also plays an important role in the realm of additive manufacturing by facilitating the transition from digital design to physical prototypes. Moreover, it enables designers to generate a number of iterative designs rapidly and change the designs of products according to the requirements of customers.

The fused deposition modeling (FDM) category dominates the market, mainly due to its widespread use in many industries, such as aerospace, automobile, and medical. This is also because FDM is a widely adopted technology that revolutionized traditional manufacturing by creating three-dimensional objects from digital design and offers many advantages such as complex shapes to be created precisely, compatibility with maximum filaments, reduced need for post-processing, and user-friendly operations for faster production.

On the other hand, the digital light processing category is expected to witness significant growth in the coming years. This can be because DLP uses light to cure or solidify photosensitive resin layer-by-layer to create a detailed object.

Based on industry, the aerospace & defense category holds the largest market share. This is primarily driven by the surging demand for lightweight parts and components used in the aerospace industry and the surging need to reduce the production time of components. Aircraft, rockets, and satellites, and their relative components are comparatively heavy, which increases the overall cost of their operations. A heavy-weighted aircraft will also consume much more fuel and exhibit pollution through high carbon dioxide emissions. Therefore, 3D printing came into effect, which is used to manufacture lightweight engine parts and other related components used in aircraft.

The healthcare sector is expected to experience the fastest growth in the coming years. This can be primarily driven by the global expansion of 3D printing technology, which is used to design most of the complex and customized medical devices, prosthetics, and implants. Another important factor contributing to the market growth is major industry players are acquiring 3D printing material providers to gain access to advanced materials used in 3D printing, particularly biocompatible polymers used in medical devices. The materials are crucial for creating a safe and durable medical product.

In addition, in the healthcare industry, 3D printing technology is widely utilized to reduce the risk while operating during complex procedures, minimize infection-related risks with prosthetic devices, and decrease the use of anesthesia requirements. Thus, these factors boost the demand for slicing software in this industry.

There is a rapid expansion of 3D printing that has become a significant driving force behind the growth of the market. This is also due to a rise in the adoption of 3D printing technology across a diverse range of industries such as healthcare, aerospace, automotive, fashion and design, architecture and construction, and food; and the surging need for improved product manufacturing processes across the world. Also, 3D printing offers the potential for efficient and cost-effective production compared to traditional manufacturing methods.

In addition, both the private and public sectors are making substantial investments in 3D printing technology by recognizing its potential to revolutionize various industries. It allows companies to accelerate product development and quickly iterate on design improvement. Moreover, there is a hike in demand for mass customization, and 3D printing is well-suited to fulfill this.

Drive strategic growth with comprehensive market analysis

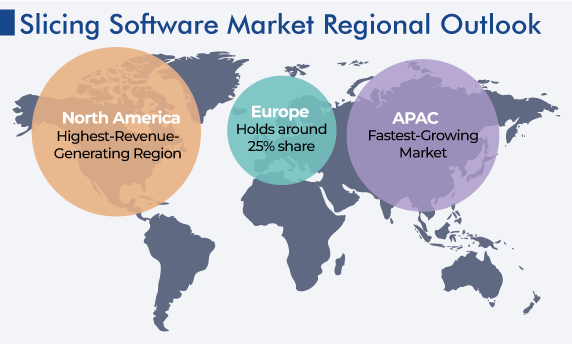

Globally, North America has emerged as the dominant region in the market, with a revenue share of 45% in 2030. This is because the region is technologically advanced, where newly introduced technology is widely accepted, therefore, it is the early adopter of 5G services and is actively participating in the development of advanced technologies; the presence of major industry players; and the growing end-use industries in the region.

Europe grips the second-highest revenue share in the global market. This is due to the increasing concerns related to handling a huge amount of data with improved efficiency, the evolution in technology, and the surging demand for new products in the region.

The Asia-Pacific slicing software market is projected to experience the highest CAGR during the forecast period. This growth can be fueled by the presence of economies such as Japan, China, and India, the increasing collaborations and partnerships among regional companies, and governments actively supporting 3D printing across different industries in the region. Moreover, the rising demand for new products leads multiple industries to adopt 3D printing technology as an alternative to the traditional methods of manufacturing.

This report offers deep insights into the slicing software industry, with size estimation for 2019 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Product Type

Based on Deployment

Based on Application

Based on Technology

Market Segmentation by Industry

Geographical Analysis

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages