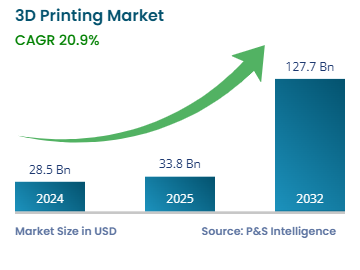

3D Printing Market Size & Share Analysis - Emerging Trends, Growth Opportunities, Competitive Landscape, and Forecasts (2025 - 2032)

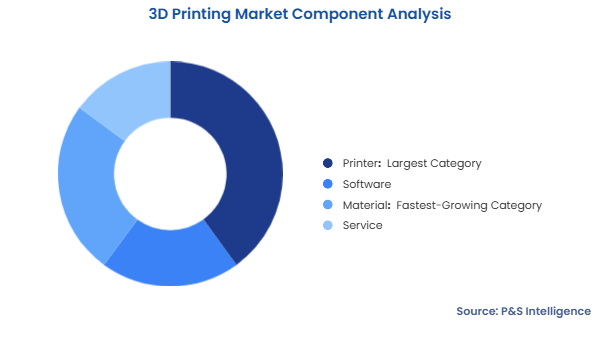

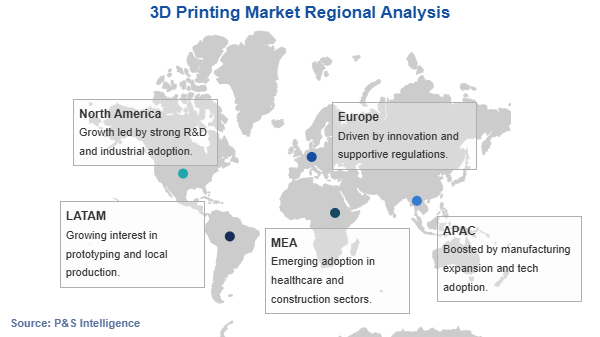

This Report Provides In-Depth Analysis of the 3D Printing Market Report Prepared by P&S Intelligence, Segmented by Component (Printer, Software, Material, Service), Process (Powder Bed Fusion, Binder Jetting, Direct Energy Deposition, Sheet Lamination, Vat Photopolymerization, Material Extrusion, Material Jetting), Technology (Stereolithography, Fuse Deposition Modelling, Selective Laser Sintering, Laminated Object Manufacturing, Digital Light Processing, Polyjet Printing, Inkjet Printing, Direct Metal Laser Sintering, Electron Beam Melting, Laser Metal Deposition), Application (Prototyping, Product Development, Innovation, Efficiency Increment, Cost reduction, Supply Chain Improvement), Industry (Aerospace & Defense, Healthcare, Jewelry, Automotive, Industrial, Architecture & Construction, Energy), and Geographical Outlook for the Period of 2019 to 2032