Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 1,603 Million |

| 2030 Forecast | USD 2,320.6 Million |

| Growth Rate(CAGR) | 6.4% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Europe |

| Nature of the Market | Fragmented |

Report Code: 12716

Get a Comprehensive Overview of the Polyphthalamide Resin Market Report Prepared by P&S Intelligence, Segmented by Product (Unreinforced, Plain, Glass-Fiber Reinforced, Carbon-Fiber-Reinforced, Mineral-Filled, Hybrid), End User (Automotive, Electrical & Electronics, Industrial Machinery, Personal Care), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 1,603 Million |

| 2030 Forecast | USD 2,320.6 Million |

| Growth Rate(CAGR) | 6.4% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Europe |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

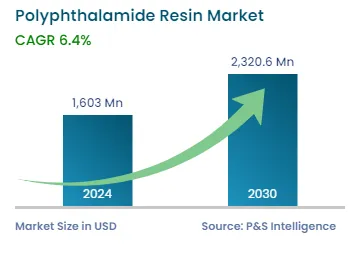

The polyphthalamide resin market size stood at USD 1,603 million in 2024, and it is expected to advance at a CAGR of 6.4% during 2024–2030, to reach USD 2,320.6 million by 2030.

The growth can be primarily ascribed to the rising usage of PPA resin as an alternative to metals in vehicles and the burgeoning R&D investments. The material has various advantageous properties, such as higher thermal and electrical tolerance, hygroscopicity, and high tensile strength. Other good chemical and mechanical properties of this material include opaqueness, semi-crystalline structure, and moisture resistance.

Hence, the growing trend of eco-friendly materials, coupled with the rising need for fuel efficiency, is expected to propel the consumption of these resins. It is well-understood now that if approximately 100 pounds of vehicle weight can be reduced, its fuel consumption could come down by up to 2%.

In addition, a range of electrical appliances are used extensively because of their increasing necessity and the rising disposable income of consumers. PPA resin also has a wide range of applications in the medical field, such as catheters and toothbrush bristles. Further, it is used in sports equipment, valve bodies, bearing pads, and bushings.

The demand for PPA is also growing at a significant pace in the aerospace industry because this field requires lightweight and rigid materials for various applications, such as robots, high-speed machine parts, power transmission lines, helicopter rotor blade sleeves, fighter aircraft ventral fins, and jet engine fan exit guide vanes, where material weight significantly affects performance. Therefore, the demand for PPA resin in this industry is increasing owing to its low weight and high impact resistance. The need for weight reduction in aircraft is propelled by the skyrocketing fuel prices, which, in turn, has triggered the need for a higher fuel efficiency.

The glass-fiber-reinforced category holds the largest share as this variant is non-flammable, compressive, and resistant to humidity and temperature and does not bend easily. Additionally, it is easily available, and the automotive and electronics sectors are widely using it. Moreover, it offers good value for money and possesses chemical resistance, which will, in turn, propel the growth of the market in this category.

The demand for carbon-fiber-reinforced PPA is expected to register considerable growth, attributed to its high strength, extreme stiffness, and low weight, which make it an important building material. Moreover, this product is stable and electrically conductive and can be used for replacing magnesium and aluminum without the loss of strength. Due to all these benefits, it can be used for the manufacturing of chassis, powertrains, and other parts of vehicles.

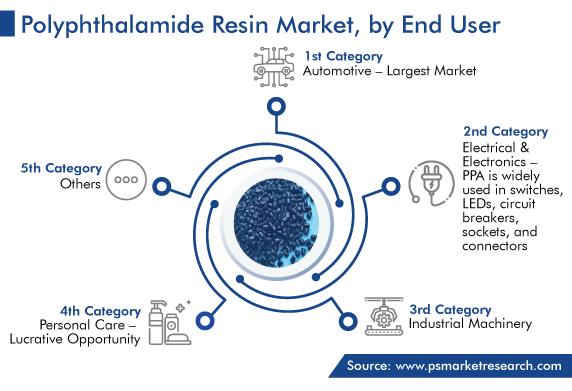

Electrical and electronics applications are expected to show the highest CAGR, of 7.0%, over the forecast period, because PPA resin retains its size and structure under varying environmental conditions, possesses surface-mount capability, and has an excellent processing ability. The material is used in a variety of electronics and electrical components, such as switches, LEDs, circuit breakers, sockets, and connectors. The key benefits that make it ideal for these applications, as well as electric cars, are good electrical properties and flame retardance.

The automotive industry is growing due to the rise in the per capita income. With this, the sale of passenger cars continues to surge in developed and developing countries. Additionally, in recent years, the industry has seen an enormous uptake of advanced technologies as a result of the rising competition among manufacturers. Moreover, the demand for electric vehicles is increasing with the rising concerns for the environment and the several steps governments around the world are taking to enable a low-emission transport system.

Around 4.3 million EVs were sold all over the world in the first half of 2022, which was more than the sales in 2021. The rising demand for lightweight automobiles and minimized emissions is the major factor contributing to the usage of polyphthalamide resin in vehicles. The development of such vehicles has increased, in part, due to the stringent regulations in various countries, such as the U.S., Japan, China, and India, for reducing the ecological impact of transportation.

Drive strategic growth with comprehensive market analysis

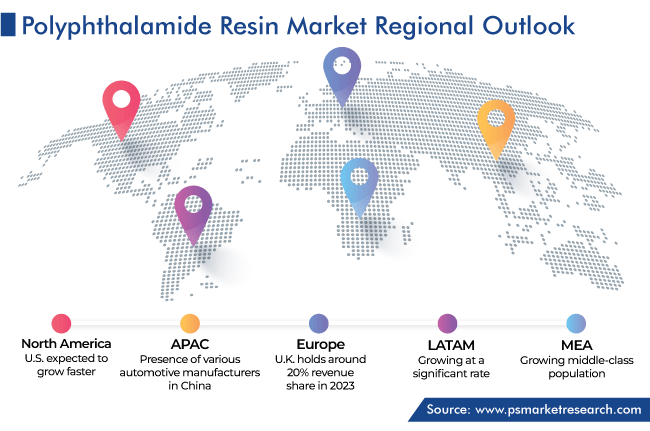

North America has the second-highest position in the market, with a value of USD 0.3 billion in 2023. This is ascribed to the rising adoption of electrical vehicles and of advanced materials in a range of applications.

In North America, the U.S. dominates the market, ascribed to the initiatives taken by the government for reducing emissions, the most prominent of which is the implementation of stringent regulations on industries, aircraft, and automobiles.

Moreover, companies are focusing on expanding their production capacities in the region. For instance, in October 2022, Solvay planned to augment its Amodel brand PPA resin production by 15% at its Georgia site, in order to help reduce CO2 emissions from vehicles. In the automotive sector, this chemical is heavily used in power electronics, electric motors, batteries, and various other components.

In 2021, the government announced an investment of USD 100 billion in the manufacturing of electric vehicles and doubling of the number of EV chargers.

APAC is the highest revenue contributor because of the rising sales of vehicles, which is augmenting automobile manufacturing. Across China, India, and Japan, the presence of a large number of automobile manufacturing centers boosts the growth of the market. Due to the availability of financial incentives and the low cost of producing automobiles, the automotive industry is growing consistently in Indonesia, China, Thailand, and India.

Moreover, the implementation of the Corporate Average Fuel Economy (CAFE) standards has made it imperative for automakers to reduce the overall emissions from their entire fleet. Thus, making automobiles lighter will be crucial to meet the regulations, as the weight of an automobile directly influences the amount of fuel it consumes. In addition, by reducing the weight of the chassis, the other heavy components that cannot be substituted can be accommodated. Hence, auto manufacturers are utilizing a rising volume of PPA resin in order to improve the overall performance of automobiles and meet the stringent environmental regulations.

This fully customizable report gives a detailed analysis of the polyphthalamide resin industry from 2019 to 2030, based on all the relevant segments and geographies.

Based on Product

Based on End User

Based on Region

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages