Electric Car Market Future Outlook

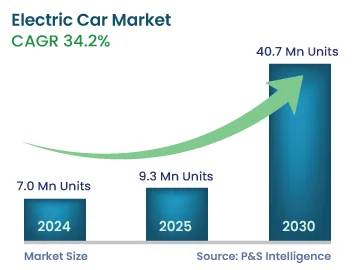

The global electric car market size is estimated to have stood at 7.0 million units in 2024, and it is expected to grow at a CAGR of 34.2% during 2024–2030, to reach 40.7 million units by 2030. In recent years, electric cars have become a major area of focus for significant automakers, including Ford Motors, General Motors, and BMW AG.

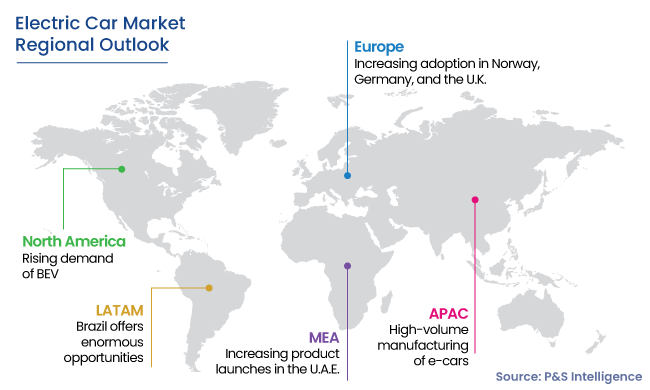

Additionally, key factors that are propelling the demand for battery cars include the rising consumer interest in reducing their vehicles’ carbon footprint, favorable government policies, and improving battery technology. The advancement of EV batteries is the primary reason for the lowering price and extending the driving range of electric cars. New cell chemistries are being researched to make EV batteries lighter, smaller, and able to store more energy, in order to allow these vehicles to compete with conventional fuel-based ones.

Moreover, due to the elimination of emissions and the opportunity to expand the usage of renewable energy sources, EVs have a significant advantage over internal combustion engine (ICE) vehicles. Additionally, as people become more aware of climate change, regulatory agencies are enacting strict fuel efficiency laws and actively promoting the deployment of e-cars, through subsidies and programs that support the production of battery cells. Essentially, the concerns about vehicular emissions would accelerate the growth of the industry in the next few years.

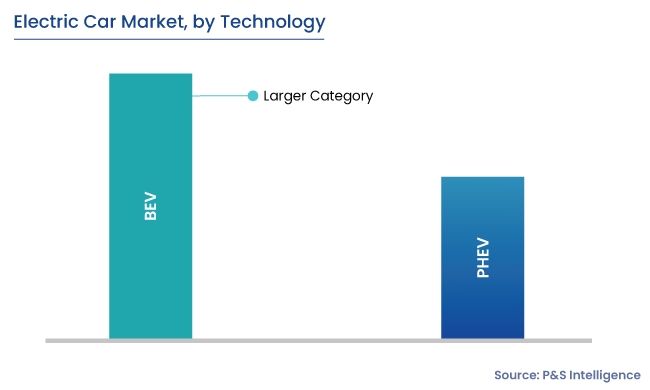

Furthermore, battery accounts for a considerable share of the total cost of an electric car. For BEVs to become cost-competitive with conventional cars, the cost of battery packs should fall below USD 120/kWh. Electric car battery pack prices dropped by more than 77% during the 2010–2016 period to USD 227/kWh. The cost of lithium-ion (Li-ion) batteries is expected to further decrease in the coming years, which is expected to benefit the electric car market.

The lower price of batteries will open new opportunities for players in the industry to increase their battery capacity and range, which, in turn, will expand the market too.