Report Code: 10917 | Available Format: PDF

Pharmaceutical Filtration Market Research Report: Size, Share, Key Trends, Growth Drivers, Regional Outlook, Revenue Estimation and Forecast, 2024-2030

- Report Code: 10917

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

Market Overview

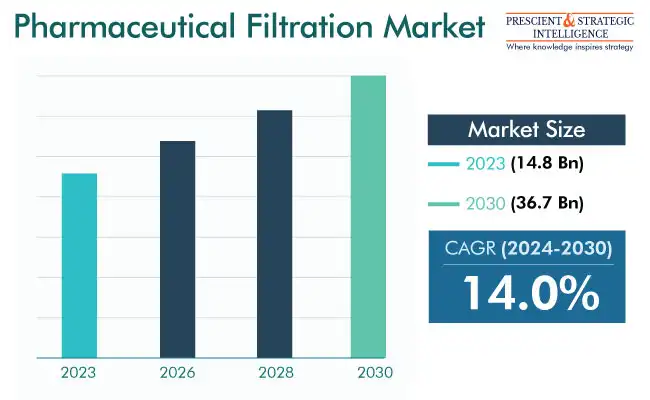

The pharmaceutical filtration market size has been estimated at USD 14.8 billion in 2023, and it will touch USD 36.7 billion by 2030, powering at a rate of 14% between 2024 and 2030.

This is due to the increasing prevalence of chronic diseases, stringent drug safety and efficacy regulations, and mounting investments in biopharmaceutical R&D activities by various manufacturers. Moreover, the rising geriatric population, increasing awareness of effective drugs, surging adoption of single-use products, and growing public expenditure on healthcare drive the market.

Growing Demand for Generic

The growing demand for generic medications is a strong market driver as these drugs are produced at a much larger scale than patented ones. This is because only the company that holds the protected patent can produce that drug, while drugs with expired patents can be produced by many companies at once. This also makes generics cost-effective over patented drugs; however, they undergo the same level of scrutiny and trials as patented ones, to assure the desired efficacy and patient safety.

Pandemic Had Positive Impact on Market

The COVID-19 pandemic had a multifaceted impact on the industry. With the increase in the expanse and severity of the pandemic, the demand for vaccines and biologics went up. Most methods of biopharmaceutical manufacturing that are relevant to vaccines involve filtration techniques, which was the key reason for the rapid surge in the market revenue in 2020 and 2021.

In addition, the outbreak of COVID-19 resulted in higher attention to safety parameters and quality in the pharmaceutical industry. This brought about a greater use of more-advanced pharmaceutical filtration products. In this regard, a major trend that emerged during the pandemic is single-use filtration assemblies and equipment. They not only reduce the risk of cross-contamination inherent with traditional permanent systems but also help boost the demand for pharmaceutical filtration products.

For example, in September of 2022, Pall Corporation announced the release of three new Allegro Connect System variants as an extension to its portfolio of single-use filtration systems. These products deliver automation control and risk management, thus adding value to the production of vaccines and other kinds of drugs.

Manufacturing Category Is Dominating Market

In 2023, the manufacturing category, based on the scale of operation, dominates the industry. This is mainly because of the growing efforts by pharma and biopharma firms to augment their output and the stringent regulations related to such operations.

Pharmaceutical filtration procedures guarantee drug purity, efficacy, and safety. Moreover, the final product quality is completely dependent on the methods of pharmaceutical filtration used during its production. Further, different regulatory standards force manufacturers to ensure optimum product quality and safety with minimal side-effects. For instance, the U.S. FDA commands stringent adherence to cGMP procedures, which also comprise guidelines on the correct filtration methods.

Additionally, the requirement for large-molecule medications has increased substantially over the years, and manufacturers need efficient pharmaceutical filtration methods for such medications.

Final Product Processing Category Is Highest Revenue Generator

The final product processing category, based on application, leads the industry in 2023. This is because of the indispensable nature of this step in ensuring the safety, efficacy, contaminant-free property, and quality of the products for final use, thus enabling compliance with regulatory standards.

The EMA, U.S. FDA, and Japan's Ministry of Health all have strict requirements for the biologics and vaccine manufacturing process, which involves multiple steps for quality, purity, and safety. Not complying with these contingency measures can lead to approval termination or credibility loss for the production facility.

The cell separation category will advance at a significant rate in the coming years. This is because of the constantly increasing need for cell therapies for genetic illnesses and various other health disorders. Stem cell therapies and CAR-T cell therapies are gaining the greatest traction for the treatment of autoimmune disorders and cancer.

| Report Attribute | Details |

Market Size in 2023 |

USD 14.8 Billion |

Revenue Forecast in 2030 |

USD 36.7 Billion |

Growth Rate |

14.0% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

Membrane Filters Dominate Industry

On the basis of product, the membrane filters category dominates the industry. This is because of the uniform as well as tight pore size distribution of membrane filters, which leads to a reliable and consistent filtrate quality. This way they guarantee that the products achieve meet the specifications and quality standards.

Membrane filters can be made from various material, including nylon and PTFE, as well as PVDF. Therefore, they are flexible in their application throughout the production of pharmaceuticals. Additionally, product enhancement and new product introductions help the category’s expansion. For example, Alfa Laval introduced a multipurpose membrane filtration system for pharmaceutical and food applications at both downstream and upstream levels in November 2022.

The single-use systems category will advance at a significant rate in the coming years. One of the biggest advantages of using single-use systems is a higher degree of flexibility to adjust the volume as per demand. Additionally, they are well suited to small-scale manufacturing and research activities. Thus, the rising need for customized drugs will drive the usage of single-use systems because they are generally produced on a smaller scale.

Microfiltration Is Most-Used Technique

On the basis of technique, the microfiltration category holds the largest share, owing to the versatility and ability of this technique to remove many impurities from biopharmaceutical products. Furthermore, the method does not affect the biological stability or activity of the substance being filtered.

Moreover, manufacturers of microfiltration systems are involving themselves in several strategic projects to tap new customers and applications. For example, Meissner Corporation announced plans in April 2023 to invest USD 250 million in a new manufacturing facility for advanced microfiltration and drug production machines in the U.S.

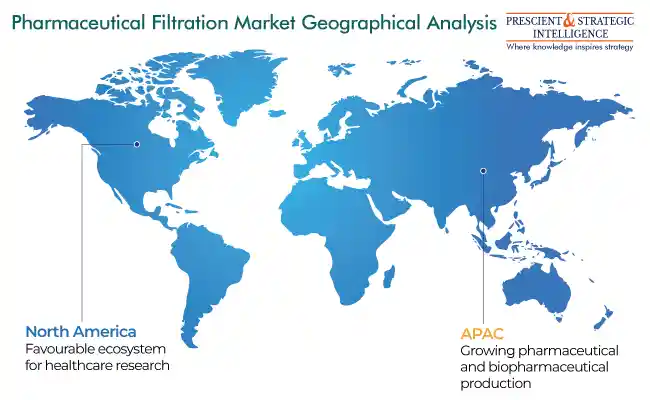

North America Leads Market

In 2023, North America is the largest contributor to the industry, primarily owing to the existence of key pharmaceutical and biopharmaceutical firms in this region. The advanced healthcare infrastructure as well as the availability of improved products is also aiding this expansion. Moreover, in the U.S., healthcare coverage policies enable patients to get proper treatment, which further allows academic establishments and biopharma manufacturing firms to discover advanced medications.

The market in APAC is likely to propel at the highest rate in the years to come. This would be because of the rapid expansion in the overall biopharmaceutical manufacturing activity in China and India. According to a BioProcess International article of 2022, India and China rank third and second, respectively, in global pharmaceutical production capacities. In addition, the rapid rise in biosimilar and specialty pharmaceutical development will boost the expansion of this industry.

Key Companies in Pharmaceutical Filtration

- Merck KGaA

- Thermo Fisher Scientific Inc.

- Amazon Filters Ltd.

- Parker Hannifin Corp.

- Sartorius AG

- 3M

- Danaher Corporation

- Graver Technologies LLC

- Meissner Corporation

- General Electric Company

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws