Report Code: 12164 | Available Format: PDF

Generic Drugs Market Analysis by Type (Simple, Super, Biosimilars), Application (Neurological Diseases, Cardiological Diseases, Metabolic Diseases, Infectious Diseases, Orthopedic Diseases, Genitourinary/Hormonal Diseases, Respiratory Diseases), Route of Administration (Oral, Injection, Cutaneous, Mucosal, Inhalation), Distribution Channel (Indirect, Direct) - Global Industry Growth and Demand Forecast to 2030

- Report Code: 12164

- Available Format: PDF

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

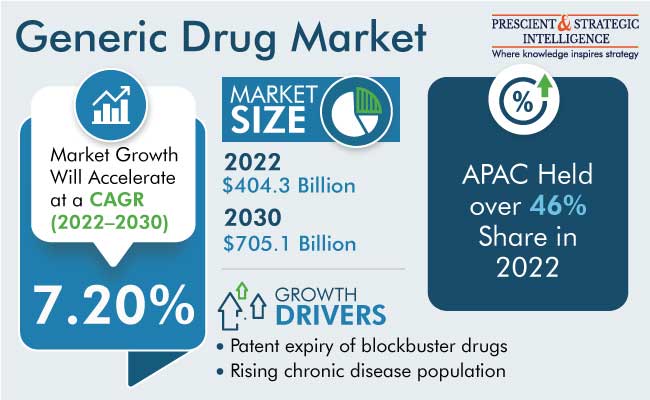

The global generic drugs market estimated to generate revenue of $404.3 billion in 2022, and it is expected to advance at a compound annual growth rate of 7.20% during 2022–2030, to reach $705.1 billion by 2030.

The growth can be primarily ascribed to the rising geriatric population, increasing number of branded drugs losing their patents, surging cases of chronic and acute diseases, growing R&D expenditure of biotech and pharma companies, and lower cost of non-patented pharmaceuticals than branded ones. For instance, phenytoin is the common name, while Dilantin is a brand name, for the same anti-seizure drug.

Due to Low Development Cost, Simple Category To Witness Fastest Growth

The simple category is expected to witness the fastest growth, at a CAGR of 8.4%, during the forecast period. The growth can be attributed to the rising preference for this type of non-patented medication due to its lower development cost than the other types. Moreover, this type has larger acceptance among patients and doctors due to its known mechanism of action and predefined efficacy and safety profile.

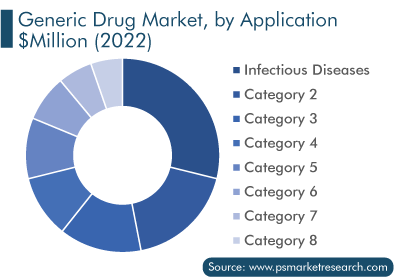

Infectious Diseases and Oral Categories Dominate Market

The infectious diseases category is expected to lead in generic pharmaceutical sales during the forecast period. This is majorly due to the rising cases of infectious diseases across the globe because of the growing geriatric population, low immunity because of malnutrition, and poor living conditions.

Moreover, the oral category is expected to dominate the generic drugs market over the next few years. This route of administration is preferred by patients due to its ease and painlessness. For this reason, a large number of medicines are designed to be administered orally. For instance, Accolate, Ciloxan, and Cardura are oral non-patented medications used to treat asthma, eye infections, and hypertension, respectively.

Increasing Number of Hospitals, Clinics, and Pharmacies Drives Indirect Category

The indirect category is expected to witness a CAGR of 7.5% during the forecast period, due to the surging cases of chronic diseases and the rising number of hospitals, clinics, and pharmacies across the globe. For instance, in India, there are more than 38,000 hospitals.

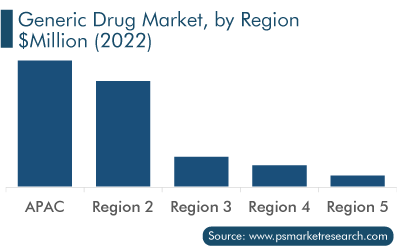

APAC Holds Largest Share

The Asia-Pacific (APAC) region generated the highest revenue in 2022, and it is expected to maintain its position in the coming years. This is majorly ascribed to the growing healthcare expenditure, increasing cases of chronic diseases, government initiatives to promote generics usage, and rising geriatric population. In this region, China and India contribute significantly more revenue than the other countries. For instance, according to the United Nations Population Fund (UNFPA), one in four individuals in APAC will be over 60 years of age by 2050, which is indicative of a huge boom in the demand for non-patented medications.

India Is Fastest-Growing Market in APAC Region

India is expected to be the fastest-growing market in the region over this decade. As per the IBEF, India is the top supplier of generic pharmaceuticals in the world. Currently, the Indian pharmaceutical industry is ranked third by volume. Moreover, Indian pharmaceutical companies meet more than half the global demand for several vaccines, 40% of the generic demand in the U.S., and 25% of the requirement for all drugs in the U.K.

There are more than 3,000 pharmaceutical companies and more than 10,500 manufacturing plants in India. India is the 12th largest exporter of medicines across the world, catering to more than 200 countries and territories. Some of the major areas of focus for pharma companies in the country are drugs with expired patents, over-the-counter medications, bulk pharmaceuticals, and vaccines.

China Is Largest Generics Consumer in APAC

China dominated the APAC market, with a share of 45.9%, in 2022, and it is expected to remain in the lead during the forecast period. This is ascribed to China’s healthcare industry transformation, which is visible in the increase in R&D activities, along with production. In this regard, the country’s pharmaceutical industry is driven by the government subsidies and public insurance. Moreover, a U.S. Food and Drug Administration (FDA) study has revealed that more than 70% of the API facilities supplying the U.S. market are overseas, with 13% of those located in China. In all, in 2021, China had more than 5,000 pharmaceutical manufacturers and 4,000 API manufacturers.

| Report Attribute | Details |

Historical Years |

2017-2022 |

Forecast Years |

2023-2030 |

Market Size in 2022 |

$404.3 Billion |

Revenue Forecast in 2030 |

$705.1 Billion |

Growth Rate |

7.20% CAGR |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Type; By Application; By Route of Administration; by Distribution Channel; By Region |

Explore more about this report - Request free sample

Shift in Preference toward Generic Drugs

According to the World Bank, in 2020, the economy shrank by 5.2% globally, which was the worst recession since World War II. The falling economy affected the healthcare expenditure of individuals negatively and caused consumers to look for low-cost yet effective medications. Therefore, the generic drugs market would see a sudden expansion in its size, which would prove to be beneficial for the manufacturers of such medications.

Rising Number of Collaborations and Partnerships

Many pharmaceutical companies are entering into partnerships and collaborations to enhance their prominence as suppliers of medications the patents of which have expired in key markets, such as the U.S. and China.

For instance, in July 2021, Sandoz Inc. unveiled Ferumoxytol, to treat iron deficiency anemia (IDA). Moreover, in August 2020, Teva Pharmaceutical Industries Ltd. and Alvotech hf entered into a partnership for the commercialization of five biosimilar products in the U.S. market. A key factor encouraging pharma firms to focus on generics are the less production time and costs involved in these medications.

Increasing Aging Population Is Propelling Product Demand

The increasing aging population is a key factor stimulating the growth of the market. According to a report by the World Health Organization (WHO), people are living longer and the average life expectancy of the population has increased. This has led to a huge rise in the geriatric population. As treatment with branded drugs costs a fortune, such patients are expected to prefer low-cost generic variants.

Patent Expiration of Blockbuster Drugs Is Pushing Product Demand

The rise in non-proprietary drugs’ approvals and their market entry have proved to be beneficial for healthcare systems and patients preferring cost-effective treatments. This is because the low cost of developing such pharmaceuticals results in their lower market prices compared to branded ones. This opportunity has been recognized by several pharma companies, which are now waiting for several blockbuster drugs to lose their patents. For instance, DULERA, which is marketed by Merck Sharp & Dohme Corp., lost its patent in December 2020; and FORADIL, a drug marketed by Novartis AG, lost its in November 2020.

Growing Prevalence of Chronic Diseases Is Boosting Demand for Generic Drugs

The burden of chronic diseases has increased globally. According to the WHO, in 2020, chronic illnesses claimed up to three-quarters of the deaths worldwide. Globally, almost 71% of the deaths because of ischemic heart disease, 70% due to diabetes, and 75% because of stroke occur in LMICs. Moreover, the low health insurance coverage for chronic diseases, such as cancer, chronic obstructive pulmonary disease (COPD), and stroke, in emerging economies has created a high demand for the low-cost generics.

Key Players in Global Generic Drugs Market Are:

- Cipla Ltd.

- Aurobindo Pharma Limited

- Dr. Reddy’s Laboratories Ltd.

- STADA Arzneimittel AG

- Alkem Laboratories Limited

- Hikma Pharmaceuticals plc

- Teva Pharmaceutical Industries Limited

- Sawai Pharmaceutical Co. Ltd.

- Mylan N.V.

- Mallinckrodt plc

- Lupin Limited

- Torrent Pharmaceuticals Ltd.

- Endo International plc

- Amneal Pharmaceuticals Inc.

Generic Drugs Market Size Breakdown by Segment

This report offers deep insights into the market, with size estimation for 2017 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Type

- Simple

- Super

- Biosimilars

Based on Application

- Neurological Diseases

- Cardiological Diseases

- Metabolic Diseases

- Infectious Diseases

- Orthopedic Diseases

- Genitourinary/Hormonal Diseases

- Respiratory Diseases

Based on Route of Administration

- Oral

- Injection

- Cutaneous

- Mucosal

- Inhalation

Based on Distribution Channel

- Indirect

- Direct

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- South Africa

- U.A.E.

- Saudi Arabia

By 2030, the market for generic drugs will be worth $705.1 billion.

Based on route of administration, the generic drugs industry is dominated by the oral category.

APAC is the largest market for generic drugs.

The generic drugs industry is driven by the patent expiry of blockbuster drugs and rising chronic disease population.

The market for generic drugs was impacted positively by the pandemic.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws