Report Code: 11399 | Available Format: PDF | Pages: 125

Polyvinylidene Difluoride (PVDF) Membrane Market by Type (Hydrophilic, Hydrophobic), By Technology (Ultrafiltration Membrane, Microfiltration Membrane, Nanofiltration Membrane), by Application (Biopharmaceutical, Water & Wastewater Treatment, Food & Beverage), by Geography (U.S., Canada, Germany, France, U.K., Italy, China, Japan, India, South Korea, U.A.E, South Africa, Saudi Arabia, Brazil, Mexico) - Global Market Size, Share, Development, Growth, and Demand Forecast, 2013-2023

- Report Code: 11399

- Available Format: PDF

- Pages: 125

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

PVDF Membrane Market Overview

The global PVDF membrane market is estimated to account for $720.1 million in 2017 and is projected to witness a CAGR of 7.9% during the forecast period. The growing demand for filtration technologies from water treatment plants, food and beverage, biopharmaceutical, and chemical industries is driving the growth of the market.

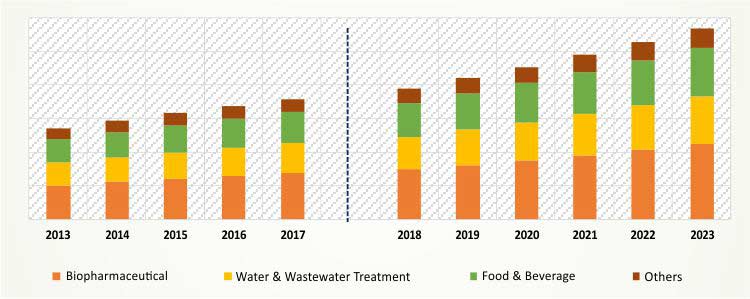

GLOBAL PVDF MEMBRANE MARKET, BY APPLICATION, $M (2013-2023)

On the basis of type, the PVDF membrane market is categorized into hydrophilic and hydrophobic membranes. The hydrophilic PVDF membrane is estimated to be a larger category, accounting for more than 50.0% share in 2017. It provides high flow rates, throughputs for solvent-based as well as mobile-phase chromatographic applications, and serves the requirement of major biopharmaceutical applications; hence, owing to its many benefits in varied applications, hydrophilic membrane has been recording a larger share in the market so far.

In terms of technology, the PVDF membrane market is categorized into ultrafiltration (UF), microfiltration (MF), and nanofiltration (NF) membranes. NF PVDF membranes are expected to be the fastest growing technology during the forecast period, with 8.2% CAGR. The high growth of these membranes is due to their application in water purification process, and the ability to operate in low pressure environment with high water flux and improved rejection for even the smallest monovalent ions.

Based on application, the PVDF membrane market is segmented into biopharmaceutical, water and wastewater treatment, food and beverage, and others. The biopharmaceutical category is estimated to hold the largest share in the market, accounting for more than 35.0% share in 2017. This is attributed to the increase in biopharmaceutical sector all over the world, owing to increase in disease prevalence, which results in surge in the demand for more purified drugs and vaccines; thus, reiterating the high application of PVDF based membranes in the biopharmaceutical industry.

Globally, Asia-Pacific is expected to be the fastest growing PVDF membrane market owing to the increasing demand of membrane separation technologies from the water treatment industry in the region. The rising water scarcity issue across Asia-Pacific is intensifying the demand for reusable water, leading to the emergence of membrane processes that are projected to be a promising solution for water reclamation. Also, due to the increasing advancements in biopharmaceutical and life sciences areas, the membrane technology is estimated to witness a remarkable growth across the emerging economies of the region, such as China, India, and South Korea.

PVDF Membrane Market Dynamics

Increasing strategic developments by industry players is the major trend witnessed in the PVDF membrane market. The scarcity of clean water, growth in the biopharmaceutical industry, and increasing demand of membrane separation technologies from the food and beverages sector are the major drivers fueling the growth of the market. However, high cost of production of PVDF membrane is expected to restrain the market growth.

Trends

The players in the PVDF membrane market are undergoing strategic developments such as collaborations, mergers, launches, and acquisitions in order to expand their footprints in this fast-growing market, as well as cater to the increasing demand of filtration technologies for wastewater treatment. For instance, in October 2017, Arkema announced to increase its PVDF Kynar production capacity in China by 25% to meet the strong demand in water treatment applications. In April 2015, Sterlitech offered PX, PY, and PZ polyacrylonotrile (PAN) membranes (a new synder filtration UF membrane), ideal for oil removal in wastewater treatment. Hence, strategic developments made by key players is the major trend being witnessed in the market.

Drivers

Increase in health issues arising from the consumption of toxic food and beverages is fueling the need of PVDF based membrane as it helps in filtering out any toxic material present in food and beverage products. PVDF based membranes are widely used in beer brewing, removal of contaminants and spoilage organisms from food and beverage items. Hence, the potential benefits of these membranes in the food and beverage industry is driving the growth of the PVDF membrane market. Therefore, many food and beverage companies are adopting the use of membrane separation technologies to meet the consumer demand for fresh and non-contaminated food and beverage products.

Restraints

The high cost of production of PVDF is the major restraint for the growth of the PVDF membrane market, as this membrane is more expensive than other membranes, such as nitrocellulose.

The production of PVDF hydrophobic membrane is expensive, as it requires an activation step prior to use. The membrane must be soaked in 100% methanol before reaction equilibrium in transfer buffer. Improper wetting of the membrane can hinder its binding properties, which can result in uneven western blots or failure to detect the protein of interest. Such added laboratory production steps increase the cost of production for these membranes, which in turn hampers the PVDF membrane market growth.

PVDF Membrane Market Competitive Landscape

Some of the major players operating in the global PVDF membrane market are Arkema Group, Danaher Corporation, Toray Industries Inc., Thermo Fisher Scientific Inc., CITIC Envirotech Ltd., Bio-Rad Laboratories Inc., Merck Group, Koch Membrane Systems Inc. (KMS), General Electric Company, and Membrane Solutions LLC.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws