India EV Battery Swapping Market Analysis

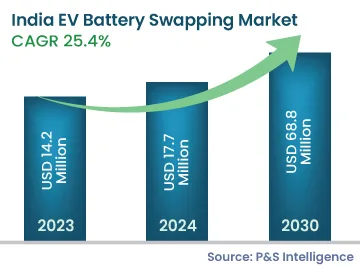

The Indian EV battery swapping market stood at USD 14.2 million in 2023, and it is expected to reach USD 68.8 million by 2030, growing at a CAGR of 25.4% between 2024 and 2030. This is ascribed to the reduced upfront costs for EVs and no wait time for charging.

Moreover, due to the rising deployment of electric rickshaws, the increasing sales of electric scooters and their acceptance in several business-to-business (B2B) services including scooter sharing and moto-taxi, the growing usage of electric cars in ride-hailing services, and the surging deployment of electric buses in public transit, there are many opportunities for infrastructure developers in the Indian market for electric vehicle battery swapping.

Furthermore, the government has announced that the registration of vehicles without batteries would be authorized in the country, which will boost industry development during the forecast period.

EVs are expensive, particularly because of the battery, which constitutes around 30–50% of the total cost of an EV. Currently, Li-ion battery prices are around USD 139/kWh and even if the battery prices are projected to decline to USD 100/kWh in coming years, it will still hold a significant share in the total cost of an EV.

In India, the price of a battery of an electric tree-wheeler is around 25–28% of the total vehicle cost. By separating the vehicle from its battery, the upfront cost of an EV comes down to levels competitive to or below internal combustion engine (ICE) counterparts, enabling higher demand.