Lithium-ion Battery Market Analysis

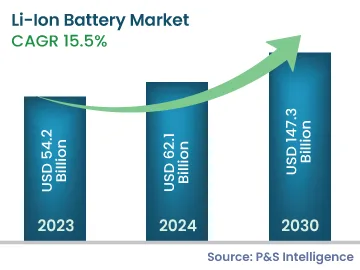

The Li-ion battery market generated revenue of USD 54.2 billion in 2023, which is expected to witness a CAGR of 15.5% during 2024–2030, to reach USD 147.3 billion by 2030.

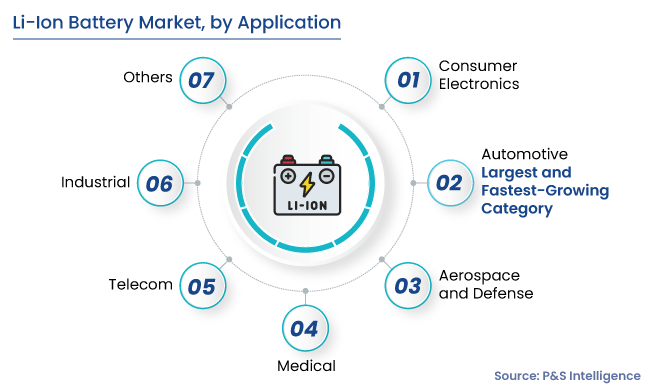

Li-ion batteries are mostly used in hybrid and electric vehicles as well as in computers and cell phones. Since they are lightweight, have a high energy density to extend battery life, and can be recharged, their use is expanding across a variety of applications. From smartphones to power tools and electric vehicles to aerospace parts, a wide array of things are driven by such batteries. As opposed to disposable batteries, which make use of metallic lithium as the electrode, lithium-ion batteries employ intercalated lithium compounds as the electrode.

The demand for such products is increasing rapidly across industries, predominantly in manufacturing and automotive. This is due to the increasing adoption of electric vehicles, the decreasing costs of these energy storage systems, the surging government initiatives, and the rising number of innovations.

Moreover, companies are investing in R&D in order to increase productivity and efficiency, which is expected to increase the demand for Li-ion variants.