Electric Bus Market Analysis

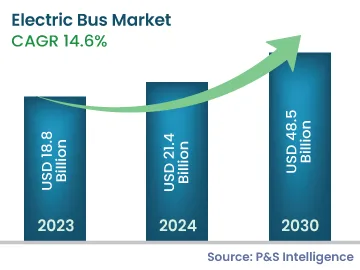

The electric bus market size was USD 18.8 billion in 2023, and it is expected to grow at a CAGR of 14.6% during 2024–2030, to reach USD 48.5 billion by 2030. It is due to the growing concerns over greenhouse gas (GHG) emissions, declining cost and improving operational efficiency of batteries, long-term cost benefits of electric buses, and increasing replacement sales.

The depleting oil reserves in major oil-producing countries have led to an increase in crude oil prices globally. Since crude oil imports constitute a significant amount of expenditure of most of the developing countries, an increase in the prices of this commodity have compelled these countries to cut down on imports via the adoption of alternative fuels.

Despite their high initial cost, electric buses have considerably low operating costs. This is the reason transit agencies in developing countries are focusing on the long-term environmental and cost benefits of these buses. The establishment of new cities and satellite cities in developing countries has offered significant space to support the infrastructure for electric buses.

An electric bus in its entire life cycle saves fuel worth USD 365,000 compared to a diesel variant and USD 225,000 as compared to one running on CNG. Moreover, electric buses are less noisy and require less maintenance s compared to their conventional counterparts.

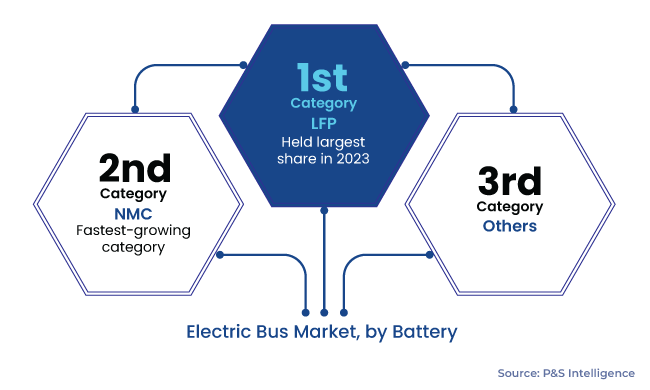

According to industry experts, the average price of Li-ion battery packs for large orders declined to approximately USD 139/kWh in 2023. As the battery accounts for around 40% of the electric bus manufacturing cost, any decline in its price would help OEMs cut down the price of their buses, thus boosting their sales. Moreover, an increase in the battery production, particularly in China, would further help achieve economies of scale, thereby lowering the battery prices during the forecast period.

Additionally, with technological advancements, the battery capacity is likely to increase to meet the demand for a longer driving range. Thus, manufacturers are consistently working to achieve a higher energy density and lower reliance on cobalt, an expensive raw material used in these batteries, which, in turn, would increase the operational efficiency of these batteries and lower their cost. It is expected that the running cost of electric vehicles will come down due to the declining cost of these batteries. As in the case of the ICE, the costs have reduced with decades of experience in manufacturing, those of electric buses too would also continue to fall during the forecast period.