Report Code: 11756 | Available Format: PDF | Pages: 230

Ride-Hailing Market Size and Share Analysis by Vehicle Type (Economy, Executive, Luxury), Commuting Pattern (Daily/Weekly, Monthly, Occasionally), End User (Personal, Business) - Global Industry Revenue Estimation and Demand Forecast to 2030

- Report Code: 11756

- Available Format: PDF

- Pages: 230

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Ride-Hailing Market Statistics

| 2023 Market Size | 2024 Market Size | 2030 Market Size | 2024-2030 CAGR | Nature of Market |

| USD 153.3 Bn | USD 173.6 Bn | USD 248.3 Bn | 6.1% | Consolidated |

Key Information Available in this Report

|

|

|||

Major Players

Ride Hailing Market Outlook

The ride-hailing market size stood at USD 153.3 billion in 2023, and it is expected to reach USD 248.3 billion in 2030, with a compound annual growth rate of 6.1% during 2024–2030. The increasing development of smartphones and information technology has led to significant changes in the travel and transportation industry. The ride-sharing service requires three parties to operate, namely, drivers, passengers, and service providers.

- Population growth is causing problems such as increasing traffic congestion, lack of adequate public transport, and long waiting times for public transport. As a result, demand for ride-hailing services is attracting more travelers by offering faster and on-demand services.

- Rising fuel prices, increased vehicle maintenance, and the introduction of stringent emission standards have effectively made ride-hailing services more cost-effective than owning a vehicle.

- In recent years, the trend of passengers preferring car-sharing services in developing countries such as India, China, and Vietnam has increased, along with the high demand in developed countries such as the U.S. and the U.K.

- This has prompted companies to improve their mobile app selection and expand operations to maintain their respective share in a highly competitive market.

- Moreover, ride-sharing companies are working to eliminate exhaust emissions and reduce the total carbon footprints of vehicles globally by converting gasoline-powered vehicles to electric vehicles.

- The fleet transformation brings many direct and indirect environmental benefits to other markets. It can support public charging infrastructure and increase individual consumers’ access to electric vehicles.

The Impact of On-Demand Transportation

- A key driver of the market is on-demand transportation services that provide comprehensive real-time feedback on drivers and their vehicles.

- It also offers advanced features such as precise location tracking and panic/SOS buttons, helping passengers ride safer.

- Moreover, increasing government initiatives on digitization have brought about major changes in the transportation sector. The carpooling marketplace offers passengers various payment options according to their convenience, in cash or online. These service providers accept payments via digital wallets, online banking, and many other electronic payment methods.

- Ride-hailing companies are working to eliminate exhaust emissions and reduce the total carbon footprint of vehicles globally by converting gasoline-powered vehicles to electric vehicles. The fleet transformation brings many direct environmental benefits and indirect benefits to other markets.

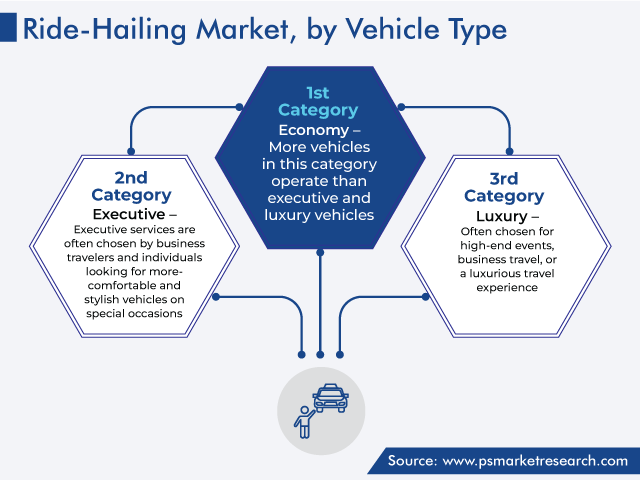

Economy Ride-Hailing Dominates the Market

The economy category held the highest market share, around 80%, within the vehicle segment in 2023. This is because more vehicles in this category operate than full-size and luxury vehicles. Many users choose short-to-medium distance ride-sharing services, so they prefer to choose a cheap car without investing too much.

In addition, economy ride-hailing services are designed to be cost-effective vehicles, such as compact cars. These services appeal to drivers who value affordability over luxury and are perfect for daily commutes and short trips. Economy services are growing in popularity among a wide range of demographics, including students, daily commuters, and those seeking convenient and affordable transportation.

Moreover, executive ride-hailing offers an extra level of comfort and services compared to the economy option. It usually features more premium vehicles such as sedans and SUVs with amenities such as leather seats and luxury interiors. Executive services are often chosen by business travelers and individuals looking for more comfortable and stylish vehicles are special occasions. A good balance between affordability and increased comfort.

Furthermore, luxury ride-hailing services cater to drivers seeking the ultimate in comfort, style, and luxury. These services use top-of-the-range vehicles such as luxury sedans and luxury cars such as Mercedes-Benz and BMW. Luxury ride-hailing services are more than just a means of transportation. Passengers who use these services are willing to pay extra for luxury chauffeured rides. It is often chosen for high-end events, business travel, or simply a luxurious travel experience.

Three different types of ride-hailing vehicles are covered in the report:

- Economy (Largest Category)

- Executive (Fastest-Growing Category)

- Luxury

Daily/Weekly Category To Generate Largest Revenue

Those who primarily utilize these services for their daily shipping requirements select the daily or weekly shipping category. It offers a practical and adaptable alternative to personal vehicle ownership. Travelers can book excursions to work, to get things done, or to repeat arrangements, making transportation more dependable and open, which will produce the most incredible income before long.

Depending on the type, monthly drivers use ride-sharing services less frequently, typically for one-time or occasional trips. Drivers in this category do not require daily transportation assistance but still take advantage of the convenience and adaptability offered by car-sharing platforms in this more relaxed usage model. These users can use car-sharing services for a variety of reasons, including social outings, vacations, monthly trips, and more.

In light of the rare classification, driving assistance clients utilize these administrations irregularly relying upon their ongoing classification. Try not to depend on carpooling for your day-to-day or normal travel needs, use it when vital. In situations where public transportation is unavailable and for specific occasions like airport transfers and cruises, occasional drivers can use carpooling services.

Below type of commuting patterns are studied in the report:

- Daily/Weekly (Largest and Fastest-Gowing Category)

- Monthly

- Occasionally

Individual Category Holds Larger Share

- In view of individual classes, customized carpooling administrations are custom-made for every traveler searching for helpful transportation that suits their necessities.

- It is generally utilized for regular errands, for example, going to work, going to the supermarket, or visiting companions. People who don't want to own a car or who don't need additional transportation use personal car-sharing services, and this group is growing at the highest rate.

- In view of the sort of business, business-explicit vehicle-sharing administrations are intended to meet the particular necessities of business clients. These administrations frequently offer highlights like business installments, cost following, and extraordinary expert profiles.

- They are utilized by organizations to go with representatives, meet with clients, make organization introductions, and the sky is the limit from there. Business-driving administrations focus on unwavering quality, impressive skill, and cost control, making them important business resources.

There are two types of end users are covered:

- Individual (Larger Category)

- Business (Faster-Gowing Category)

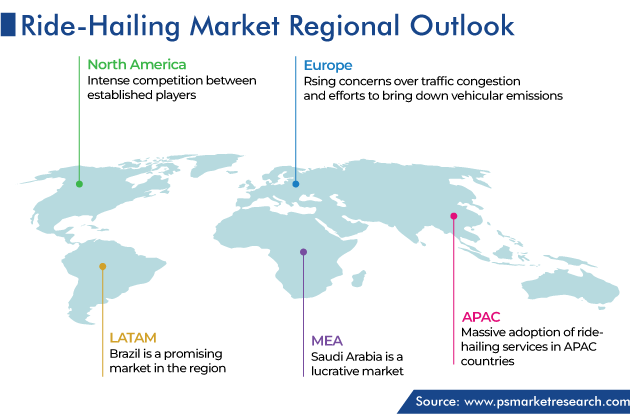

North America Market To Register Highest CAGR

The North American market is expected to record the highest CAGR of 8% in the coming years. The market is characterized by intense competition between established players such as Uber and Lyft and emerging regional providers. Moreover, the region has a complex regulatory environment, such as a focus on safety, sustainability, and compliance with local regulations.

The Asia-Pacific (APAC) market is also experiencing explosive growth, due to the rising middle-class population, urbanization, and rapid technology adoption. Local providers often compete with international ride-hailing giants, and services can be customized to local preferences and payment methods.

Deep-dive of below regions and countries are provided in this publication:

- Asia-Pacific (APAC) (Largest Regional Market)

- China (Largest Country Market)

- Japan

- India (Fastest-Growing Country Market)

- South Korea

- Singapore

- Australia

- Rest of APAC

- Europe

- U.K. (Largest Country Market)

- France

- Spain

- Germany

- Poland

- Italy

- Netherlands (Fastest-Growing Country Market)

- Portugal

- Rest of Europe

- North America (Fastest-Growing Regional Market)

- U.S. (Larger and Faster-Growing Country Market)

- Canada

- Latin America (LATAM)

- Brazil (Largest and Fastest-Growing Country Market)

- Mexico

- Rest of LATAM

- Middle East and Africa (MEA)

- Saudi Arabia (Largest Country Market)

- South Africa

- U.A.E. (Fastest-Growing Country Market)

- Rest of MEA

Competitive Analysis

- In recent years, several companies have entered the ride-hailing market and expanded their services.

- For example, Uber Technologies launched its Uber Comfort, a new ride tier that offers customers access to fast rides, vehicle temperature control, and highly rated drivers at a premium price.

- The service was rolled out in 44 cities in three US states: New Jersey, Connecticut, and Rhode Island.

- Furthermore, Didi Mobility Japan Co. Ltd., a joint venture with Softbank Corp. and Didi Chuxing (Beijing Koi Technology CO. Ltd.) has started a ride-hailing service in Hokkaido, including the capital Sapporo.

- This would follow a further expansion of services to Tokyo, Kyoto, Osaka, Hyogo, and other areas in the upcoming months.

Top Ride Hailing Companies:

- DiDi Global Inc.

- Uber Technologies Inc.

- Grab Holdings Inc.

- OLA Cabs

- Yandex Taxi B.V.

- Gett Inc.

- FREE NOW

- inDrive

- RideCekk Inc.

- Bolt Technology OÜ

- VOXTUR SAS

- Addison Lee Ltd.

- Aptiv PLC

- Be Group JSC

- BlaBlaCar

- Lyft Inc.

- Ridecell Inc.

- TomTom N.V.

The industry for ride-hailing will reach USD 173.6 billion in 2024.

The ride-hailing market value will reach USD 248.3 billion in 2030.

The North American market for ride-hailing will grow at the highest CAGR.

On-demand transportation services that offer inclusive real-time feedback on drivers and their automobiles is a key ride-hailing industry driver.

Individual end user hold the larger ride-hailing market share.

The ride-hailing industry is consolidated in nature.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws