Report Code: 10504 | Available Format: PDF

Hypodermic Needles Market Report: Size, Share, Recent Trends, Strategic Developments, Segmentation Analysis, and Evolving Opportunities, 2024-2030

- Report Code: 10504

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

Hypodermic Needles Market Size & Share

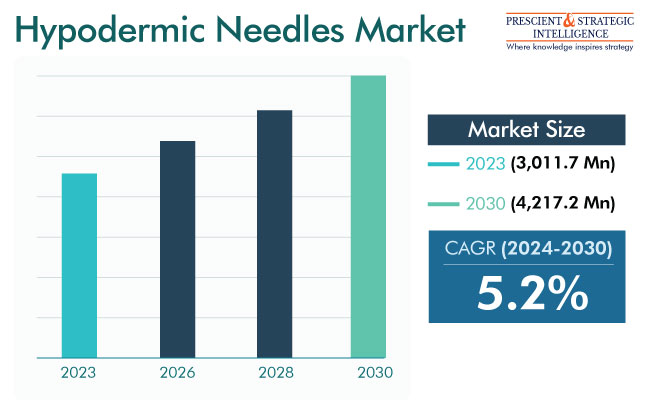

The hypodermic needles market size is USD 3,011.7 million (E) in 2023, and it will propel at 5.2% compound annual growth rate during 2024–2030, to reach USD 4,217.2 million by 2030.

A hypodermic needle is a hollow needle that is extensively utilized throughout medicinal settings for several applications, including blood specimen collection, drug delivery, and aspirations & biopsies. The increase in the need for them for blood collection, the surge in the per capita income, and the prospects in the developing nations of APAC and LAMEA are projected to offer several opportunities in the market.

Moreover, the technical advancements in the medicinal sector to offer better-quality hypodermic needles will propel the market. Additionally, the existence of major players engaged in the production and supply of these medical disposables and the surge in investments in healthcare items boost the industry development.

Rising Disease Incidence Is Biggest Driver for Market

The surge in the occurrence of chronic communicable illnesses, such as hepatitis C and hepatitis B, propels the development of the hypodermic needles market. As per the WHO, there were 296 million individuals with chronic hepatitis B infection in 2019, with 1.5 million new cases. Additionally, it caused around 820,000 demises that year. The disease requires the regular injection of drugs and drawing of blood for tests.

Furthermore, hypodermic needles are utilized for vaccination. The count of COVID-19 vaccination dosages given throughout the globe was projected to touch 11,324,805,837 by the World Health Organization on April 17, 2022. With booster vaccines continuing to be invented and approved, the demand for syringes will keep on rising over the forecast period.

The surge in the occurrence of lifestyle-related illnesses, particularly diabetes, the technical improvements in hypodermic needles, and the rise in demand for progressive variants are also projected to propel the industry development. The condition requires the daily administration of insulin to keep the blood sugar levels in check. As per the IDF, around 783 million individuals worldwide had diabetes in 2021, the majority in low-and middle-income nations.

Additionally, 1.5 million demises are directly ascribed to diabetes per annum. Both the count of cases and the occurrence of diabetes have progressively grown in recent years, which is projected to continue to propel the industry.

Safety Category Is Leading Market

On the basis of product type, the safety hypodermic needles category is leading the industry, and it is also projected to be dominant during the projection period. This is credited to the progress in research and development activities in the healthcare industry and the surge in the occurrence of needlestick wounds. Safety hypodermic needles are favored credited to the ease and safety provided by them. They are fortified with features such as a single-handed technique and luer locks.

Needlestick wounds are the major reason for blood-borne illnesses among healthcare experts. The majority of the healthcare employees are in a high danger of work-associated contagions, such as HIV, hepatitis B, and hepatitis C, because of the exposure to polluted needle sticks and sharp wounds. This is the biggest reason safety needles are preferred around the world.

| Report Attribute | Details |

Market Size in 2023 |

USD 3,011.7 Million (E) |

Revenue Forecast in 2030 |

USD 4,217.2 Million |

Growth Rate |

5.2% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

Drug Delivery Category Holds Largest Market Share

On the basis of application, the drug delivery category is dominating the industry, and it is also projected to be in the leading position throughout the projection period. This can be ascribed to the rising disease incidence and the fact that injections lead to less wastage of medications and a quicker onset. Moreover, biologics are majorly administered parenterally; hence, the growing popularity of biopharmaceuticals is another key market driver.

Hospitals Are Largest Users of Hypodermics Needles

Hospitals are increasingly using hypodermic needles for a variety of purposes, such as vaccination, administration of medicinal products, and blood collection. Additionally, the World Health Organization has suggested all healthcare workers to shift to safer needles to stop the spread of blood-borne illnesses, such as hepatitis, HIV, and viral hemorrhagic fevers.

The key reason behind the dominance of this category on the market is the huge patient volumes at these places. Patients hospitalized for long durations need their blood and other bodily fluids extracted numerous times for diagnostic testing, disease progression studies, and therapeutic monitoring. Similarly, a large number of drugs to them are given via injections, especially to those in a natural or chemically induced coma.

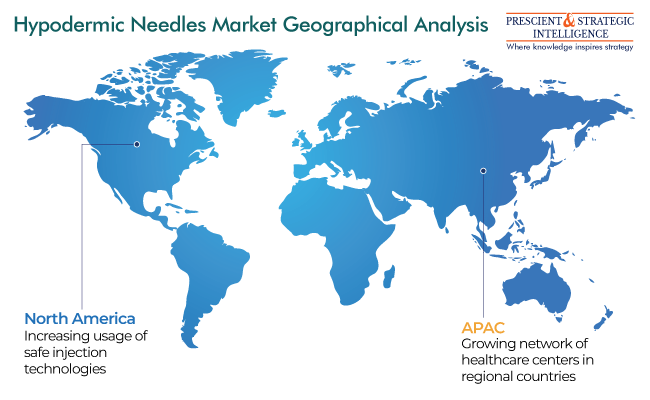

North America Is Holding Largest Revenue Share

North America us leading the hypodermic needle industry worldwide, and the revenue contribution of this continent is projected to grow at a significant rate. The increasing occurrence of chronic and lifestyle-related illnesses and the growing concentration on the utilization of safe injection technologies are boosting the need for hypodermic needles in the continent.

Hypodermic needles are efficient tools for people suffering from diabetes, as they permit the accurate distribution of insulin straight into the bloodstream. This aids in regulating blood sugar levels safely and efficiently. Moreover, the region witnesses a high incidence of heart diseases and cancer, both of which require the injection of different drugs, as well as regular blood tests.

APAC Is Projected To Advance with Highest Pace

The APAC hypodermic needle industry is projected to grow at the highest CAGR during the projection period. The expansion of the industry is primarily credited to the growing need for safety syringes and the rising count of infirmaries in the region. The increasing awareness of the danger of untreated contagions has also augmented the need for hypodermic needles as they effectively deliver drugs into the body.

Moreover, the development of this industry will be because of the existence of huge medication businesses in the region. In addition, to fulfill the increasing demand for healthcare, hospitals and clinics are emerging in more localities than ever. These establishments buy hypodermic needles in vast quantities, majorly through long-term contracts with manufacturers, retailers, and wholesalers, for a range of procedures, from delivering vaccines to drawing blood.

Technological Innovations in Drug Delivery Systems

One of the most-significant technical improvements in the field of hypodermics needles has been safety devices. Active and passive safety syringes are designed to prevent needlestick wounds, which can be a reason for serious contagions. The launch of such devices has not only enhanced the security of healthcare employees but also augmented the need for syringes, thus propelling the development of the industry.

Pre-filled syringes have also been a key technical advancement in medication delivery. These syringes are prepackaged with the precise dose of medication, which means that healthcare specialists are not required to draw it manually from a vial or ampoule. As the syringes can be used more effortlessly, they not only decrease the danger of dosing faults but also enhance patient compliance.

Key Players Offering Hypodermic Needles Globally

- Vygon S.A.

- Catalent Inc.

- Terumo Corporation

- Retractable Technologies Inc.

- Connecticut Hypodermics Inc.

- MedPro Safety Products Inc.

- B. Braun Melsungen AG

- Albert David Ltd.

- Medtronic plc

- Becton, Dickinson and Company

- Hindustan Syringes & Medical Devices Ltd.

- ICU Medical Inc.

- Cardinal Health Inc.

- Novo Nordisk A/S

- Cadence Science Inc.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws