Report Code: 12177 | Available Format: PDF | Pages: 193

Vials Market Research Report: By Glass Type (Borosilicate, Fused-Silica), End User (Pharmaceutical and Biotech Companies, Biomedical Research Organizations, Medical) - Global Industry Forecast to 2030

- Report Code: 12177

- Available Format: PDF

- Pages: 193

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

The global vials market generated revenue of $1,263.0 million in 2020, and it is expected to grow at a CAGR of 8.6% during the forecast period (2021–2030). The factors responsible for the growth of the market include the rising production capacity of vial manufacturers, increasing healthcare expenditure, and growing pharmaceutical industry. Moreover, the surging demand for vials for the packaging of COVID-19 vaccines is supporting the market growth.

In the wake of the COVID-19 pandemic, the pharmaceutical industry, across the world, is witnessing significant growth, with several primary packaging manufacturers, including those of vials, focusing on increasing their production capacity to meet the demand from research organizations, in addition to pharmaceutical and biotech companies. Moreover, an increased need for COVID-19 vaccines has led to a high demand for vials, globally.

Demand for Borosilicate Glass Vials for COVID-19 Vaccine Packaging Is on the Rise

The borosilicate category held the larger share in the vials market in 2020, based on glass type. Furthermore, the category is expected to retain its position in the coming years. This is due to the high preference of vial manufacturing companies for borosilicate glass due to its impermeability, chemical inertness, and thermal stability. These factors have, thus, resulted in the high demand for borosilicate vials, particularly to support the ongoing COVID vaccination programs across the globe.

Pharmaceutical and Biotech Companies To Constitute Fastest-Growing Category

Pharmaceutical and biotech companies are expected to constitute the fastest-growing category in the vials market during the forecast period, based on end user. This can be majorly attributed to the rising demand for high-quality drugs, including biologics, coupled with the growing geriatric population and age-related ailments. These factors are fueling the demand for packaging containers, such as vials, among pharmaceutical and biotech companies around the world.

Strong Foothold of Key Vial Manufacturing Companies in Europe Leading to Its Largest Share

Geographically, Europe was the largest contributor to the vials market in 2020. This can be mainly attributed to the presence of key market players, such as Schott AG, Gerresheimer AG, Stevanato Group, and SGD S.A., growth in end-use industries, growing geriatric population, increased awareness on newly developed drugs, and high per capita income in the region.

The vials market is expected to witness the fastest growth in the Asia-Pacific (APAC) region during the forecast period. This can be mainly attributed to the increasing focus of key players on expanding their business operations and installing new manufacturing facilities across the region to meet the rising demand for COVID -19 vaccines. For instance, SCHOTT AG established new production plants in India and China in 2020. It also made a $14 million investment into its already existing production facilities in Gujarat, Daman, and Himachal Pradesh in India.

Increasing Preference for Glass Vials Is Key Trend

Glass is the preferred material for vials for the vaccine fill–finish process, owing to its durability, robustness, inertness, which prevents reaction with the drug, and strong resistance to delamination. As compared to plastics and metals, glass is more suitable for the primary packaging of high-end pharmaceutical products. Moreover, glass vials have a longer shelf life and they are recyclable and eco-friendly as well. Therefore, the demand for these vials is increasing worldwide.

Growing Pharmaceutical Industry Leading to Rising Demand for Packaging Containers

The growing pharmaceutical industry is one of the major drivers for the vials market. Glass vials manufacturing companies, such as SCHOTT AG and Gerresheimer AG, have witnessed a rise in the demand for vials from the pharmaceutical industry, particularly for the production of COVID-19 vaccines. Moreover, pharmaceutical and biotech companies are heavily investing in the expansion of their production capacities, to meet the requirement for COVID-19 vaccines, which, in turn, is propelling the demand for vials across the world.

| Report Attribute | Details |

Historical Years |

2014-2020 |

Forecast Years |

2021-2030 |

Base Year (2020) Market Size |

$1,263.0 Million |

Market Size Forecast in 2030 |

$3,047.0 Million |

Forecast Period CAGR |

8.6% |

Report Coverage |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Regional and Country Breakdown; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis; Company Profiling; Pricing Analysis |

Market Size by Segments |

By Glass Type; By End User; By Region |

Secondary Sources and References (Partial List) |

American Pharmaceutical Manufacturers’ Association, Association for Accessible Medicines, China National Pharmaceutical Packaging Association, Consumer Healthcare Products Association, Drug Information Association, Drug, Chemical and Associated Technologies, Federal Union of German Associations of Pharmacists, German Association of Research-Based Pharmaceutical Companies, Germany Trade & Invest, Healthcare Compliance Packaging Council, India Brand Equity Foundation |

Explore more about this report - Request free sample

Increasing Healthcare Expenditure Propelling Demand for Vials

Consumer awareness on health-related issues has increased over the past few years. The rising outbreak of life-threatening diseases, such as COVID-19, and the continuous threat of infections have resulted in awareness around the world, which is further driving the use of glass vials for pharmaceutical packaging. The rising spending on healthcare in developing countries, such as India and China, is also contributing to the growth to the market.

Market Players Focusing on Expansions to Gain Competitive Edge

The vials market is fragmented in nature. Some of the major players operating in the market are SCHOTT AG, Phoenix Glass LLC, Pacific Vial Manufacturing Inc., Gerresheimer AG, Hanna Instruments, O.Berk, and Acme Vial and Glass Company LLC.

In recent years, players in the vials industry have been majorly involved in expansions, in order to increase their market share. For instance:

- In December 2020, SCHOTT AG established a new pharmaceutical tubing factory in Zhejiang Province, China, to manufacture FIOLAX borosilicate glass tubing for vials, cartridges, ampoules, and syringes. The factory is equipped with a state-of-the-art production technology and will have an initial capacity of 20,000 tons of glass per year.

- In July 2020, Gerresheimer India announced about tripling its production capacity of tubular glass by the end of 2020 and doubling its capacity of molded vials. With this, the company would be able to manufacture 300 million units of multi-dose borosilicate vials from its existing capacity of 150 million units by the end of 2021

Some Key Players in Vials Market

-

Phoenix Glass LLC

-

Pacific Vial Manufacturing Inc.

-

Hanna Instruments

-

PIRAMIDA d.o.o

-

O.Berk

-

Acme Vial and Glass Company LLC

-

SGD Pharma

-

Stevanato Group

-

SCHOTT AG

-

Gerresheimer AG

-

Corning Incorporated

Market Size Breakdown by Segment

The global vials market report offers comprehensive market segmentation analysis along with market estimation for the period 2014–2030.

Based on Glass Type

- Borosilicate

- Fused-Silica

Based on End User

- Pharmaceutical and Biotech Companies

- Volumetric filling

- Liquid-level filling

- Biomedical Research Organizations

- Medical

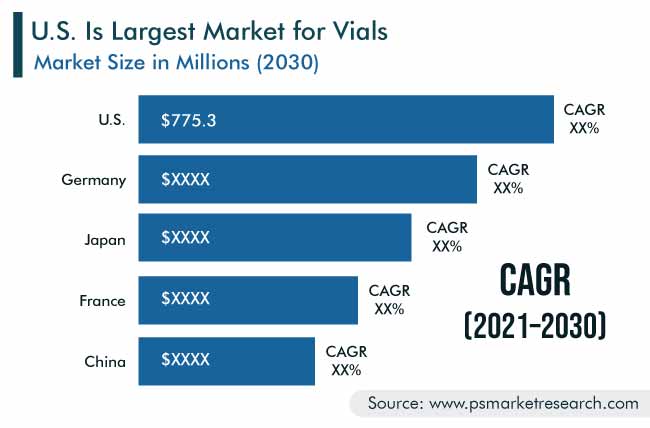

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Netherlands

- APAC

- China

- Japan

- India

- Australia

- LATAM Vials Market

- Brazil

- Mexico

- Argentina

- MEA

- Saudi Arabia

- South Africa

- U.A.E.

During 2021–2030, the market for vials is projected to register a CAGR of 8.6%.

Of the two glass vial types, borosilicate glass vials dominate the industry.

Growing pharmaceutical industry, rising production capacity of vial manufacturers, and increasing healthcare expenditure are the key factors contributing to the market growth around the world.

APAC is expected to offer lucrative opportunities to the players operating in the vials industry in the coming years.

Facility expansion can be viewed as a major strategic measure focused upon by players in the market.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws