Report Code: 10536 | Available Format: PDF | Pages: 254

Automotive Adhesives and Sealants Market Research Report: By Type (Epoxy, Acrylics, Polyurethanes, Rubber, PVC, Silicones, Hot Melts), Application (Body-In-White, Under-The-Hood and Power Train, Paint Shop, Assembly), Vehicle (Passenger Car, Light Commercial Vehicle, Heavy and Medium Commercial Vehicle) - Global Industry Analysis and Growth Forecast to 2030

- Report Code: 10536

- Available Format: PDF

- Pages: 254

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

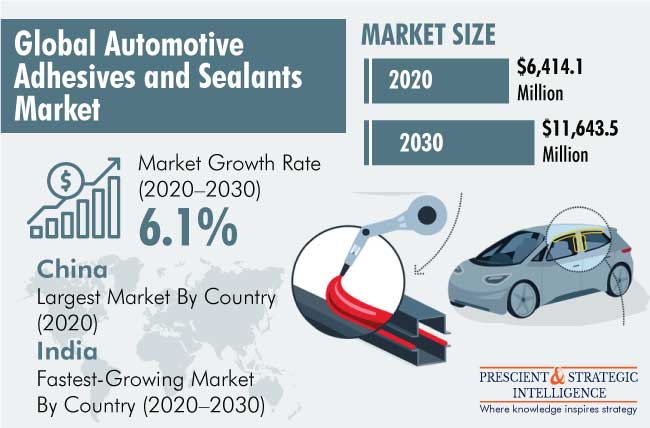

The global automotive adhesives and sealants market generated revenue of $6,414.1 million in 2020, and it is expected to grow at a CAGR of 6.1% during the forecast period. The key factors responsible for the growth of the market include the increasing demand for lightweight vehicles and surging vehicle safety standards and regulations. The demand for vehicles among consumers is surging, due to the rising people’s per capita income, which eventually boosts their purchasing power.

The COVID-19 pandemic had a negative impact on the automotive and its associated industries, including adhesives and sealants, since the whole value chain had been disturbed due to the pandemic. The growth of the market for automotive adhesives and sealants is directly proportional to the growth of the automotive industry, and the latter one is tightly interconnected with both upstream industries, such as chemicals, steel, and textile, and downstream, including repair and mobility services, which had shown a decline in this pandemic. Further, improvement in safety standards across the globe is expected to drive the demand for adhesives and sealants in the coming years.

Epoxy and Passenger Car Categories Dominated the Market

The epoxy category accounted for the largest share in the market in 2020, based on type. The superior property of epoxy-based adhesives is rigid bonding, which aids in enhancing the structural integrity of vehicles. Hence, with the increasing demand for vehicles, the need for epoxy-based adhesives and sealants is also expected to rise in the coming years.

The passenger car category held the largest share in the market in 2020, based on vehicle. This is majorly attributed to the increasing demand for passenger cars among people. Moreover, the rising number of mobility services around the globe is also boosting the demand for passenger cars, which eventually propels the need for adhesives and sealants.

Body-In-White (BIW) Category To Witness High Growth Rate

The BIW category is projected to record the fastest growth during the forecast period, based on application. This can be ascribed to the increasing popularity of high-performance adhesion solutions for BIW application of vehicles, which help in reducing overall vehicle weight, thereby saving fuel consumption.

Asia-Pacific (APAC) Market To Witness Fastest Growth in Coming Years

Geographically, APAC generated the largest revenue in the automotive adhesives and sealants market in 2020, owing to the surging economic growth, developing infrastructure, growing purchasing power of people, and shifting production facilities for adhesives and sealants from developed regions to APAC.

Moreover, the APAC market is expected to register the fastest growth during the forecast period globally. Countries such as China and India are witnessing a substantial increase in usage of automotive adhesives and sealants in vehicles, owing to the growing automotive industry and increasing consumer population in these countries. Further, low manufacturing and labor costs in these emerging economies attract new automotive players to invest in this fast-growing market and expand their business in the region. This is also expected to fuel the growth of the regional market.

Increasing Penetration of Electric Vehicles in Various Countries Is a Key Market Trend

The electric vehicle industry has been exhibiting high growth in recent years across the world. For instance, according to the International Energy Agency (IEA), new registrations of electric cars hit a new record, with over 3 million, in 2020, where Norway achieved the most successful deployment of electric cars in terms of market share. Moreover, the global electric car stock hit the 10-million mark in 2020, a 43% increase over 2019 and representing a 1% stock share. The use of adhesives and sealants in electric vehicles is low due to fewer engine-related assemblies, but as the focus on increasing structural integrity picks up the pace along with reducing the overall weight, the requirement of adhesives and sealants in electric vehicles is expected to rise in the coming years.

Increasing Demand for Lightweight Vehicles and Surging Vehicle Safety Standards and Regulations Are Driving the Market Growth

Automotive manufacturers are using lightweight materials, including plastics, composites, and aluminum. These materials are replacing the use of steel in automotive manufacturing. However, unlike steel or cast-iron components, lightweight materials cannot be welded or bolted to keep them together. In order to maintain the integrity of lightweight vehicles, adhesives and sealants are increasingly used by manufacturers worldwide. Also, the use of adhesives for automotive applications is extensive, ranging from small sensors to vehicle chassis. Hence, the increasing demand and production of lightweight vehicles strengthen the automotive adhesives and sealants market growth globally.

The rising awareness of consumers regarding vehicles’ safety results in increasing usage of various safety equipment. For instance, the European New Car Assessment Programme (EURO NCAP) provides consumer information on the safety of new cars. The use of adhesives and sealants in vehicles provides integrity to bonnet and other parts. Moreover, adhesives are capable of absorbing the impact of any head-on collision. For instance, mastics are rubber compounds that are used in non-structural application areas during the BIW stage and help fill up empty zone in a vehicle, which aids in shock absorption leading to increase passenger’s safety. All these factors boost the market for adhesives and sealants in the automotive industry.

| Report Attribute | Details |

Historical Years |

2015-2020 |

Forecast Years |

2021-2030 |

Base Year (2020) Market Size |

$6,414.1 Million |

Market Size Forecast in 2030 |

$11,643.5 Million |

Forecast Period CAGR |

6.1% |

Report Coverage |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Regional Breakdown; Impact of COVID-19; Companies’ Strategic Developments; Company Profiling |

Market Size by Segments |

By Type; By Vehicle; By Application |

Market Size of Geographies |

U.S.; Canada; Germany; France; U.K.; Italy; Spain; Russia; Slovakia; Czech Republic; China; Japan; India; Indonesia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Turkey; Iran |

Explore more about this report - Request free sample

Market Players Involved in Facility Expansions and Mergers and Acquisitions to Gain Competitive Edge

The automotive adhesives and sealants industry is competitive, due to the presence of several key players. In recent years, the players in the market have been involved in facility expansions and mergers and acquisitions in order to attain a significant position. For instance:

- In April 2021, Sika AG acquired Hamatite, the adhesives business of The Yokohama Rubber Co. Ltd. Hamatite offers adhesives and sealants to the automotive and construction industries. The acquisition would significantly strengthen Sika’s market position in Japan, increase market access to all major Japanese OEMs, and notably extend product offerings for sealing and bonding applications in the Japanese construction industry.

- In November 2020, Sika AG expanded its production capacity in the U.A.E., with the commissioning of a new manufacturing facility in Dubai. In addition to concrete admixtures, epoxy resins are now being produced by the company locally to target the flooring market.

Key Players in Global Automotive Adhesives and Sealants Market Are:

- Henkel AG & Co. KGaA

- The Dow Chemical Company

- Sika AG

- PPG Industries Inc.

- 3M Company

- H.B. Fuller Company

- Permatex Inc.

- Bostik S.A.

- Illinois Tool Works Inc.

- EFTEC AG

Market Size Breakdown by Segments

The automotive adhesives and sealants market report offers comprehensive market segmentation analysis along with market estimation for the period 2015-2030.

Based on Type

- Epoxy

- Acrylics

- Polyurethanes

- Rubber

- Polyvinylchloride (PVC)

- Silicones

- Hot Melts

Based on Application

- Body-In-White (BIW)

- Structural

- Epoxy

- Acrylics

- Polyurethanes

- Non-Structural

- Rubber

- Polyvinyl chloride (PVC)

- Structural

- Under-The-Hood (UTH) and Power Train

- Silicones

- Acrylics

- Paint Shop

- PVC

- Acrylics

- Silane (Silicones)

- Assembly

- Polyurethanes

- Hot melts

- Silicones

Based on Vehicle

- Passenger Car

- Light Commercial Vehicle (LCV)

- Heavy and Medium Commercial Vehicle (HMCV)

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Spain

- Russia

- Italy

- Slovakia

- Czech Republic

- Asia-Pacific (APAC)

- China

- India

- Japan

- Indonesia

- South Korea

- Thailand

- Latin America (LATAM)

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- Turkey

- Iran

- South Africa

In 2030, the value of the automotive adhesives and sealants market will be $11,643.5 million.

Epoxy is the largest category under the type segment of the automotive adhesives and sealants industry.

The major automotive adhesives and sealants market drivers are the increasing demand for lightweight vehicles and surging vehicle safety standards and regulations.

APAC is the largest and the fastest-growing automotive adhesives and sealants market.

Most automotive adhesives and sealants market players are adopting facility expansions and mergers and acquisitions strategies to sustain their business growth.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws