Report Code: 12057 | Available Format: PDF | Pages: 43

COVID-19 Impact Analysis on Electric Vehicle Industry

- Report Code: 12057

- Available Format: PDF

- Pages: 43

- Report Description

- Table of Contents

- Request Free Sample

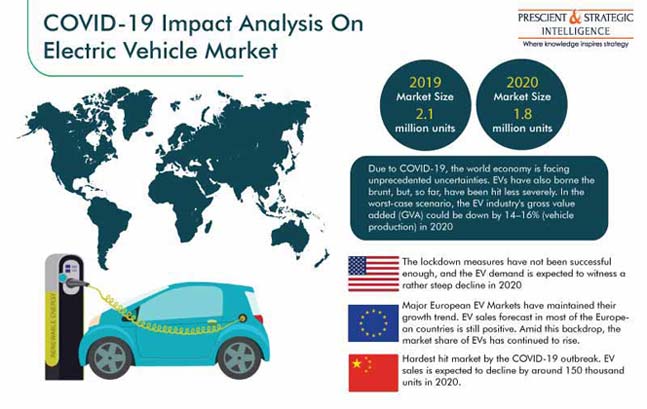

The global electric vehicle market has witnessed tremendous development since the mid-2010s. The shared vision among policymakers, industry players, and the society accelerated the electric vehicle adoption in the historical years (2014–2019), and by the end of 2019, the worldwide electric car fleet had exceeded 7.2 million units, up more than 40% from the previous year. Worldwide sales of electric vehicle s in 2019 totaled 2.1 million units. However, due to the COVID-19 outbreak, the global electric vehicle market is estimated to fall by around 15% in 2020, to 1.8 million units, compared to the sales witnessed in 2019 and by 43% as compared to the 2020 forecast done in the pre-COVID period.

Currently, due to COVID-19, the world economy is facing unprecedented uncertainties. Preventive measures, such as lockdowns and restrictions on mobility, to curb the spread of the pandemic, have led to a significant decline in vehicle sales across all major automobile markets. Electric vehicles have also borne the brunt, but, so far, have been hit less severely. In the worst-case scenario, the electric vehicle industry's gross value added (GVA) could be down by 14–16% (vehicle production) in 2020.

Geographical Outlook

The outbreak of the COVID-19 pandemic has brought a significant decline in electric car sales, globally. In the world’s biggest electric vehicle market, China, the drop in electric vehicle sales followed that of the overall car sales. The decline was the largest in the month of February, with electric car sales falling to 16,000 units, a plunge of around 60% from the same month in 2019. However, the sales rebounded strongly in the month of April, reaching around 80% of the April 2019 level. Further, in the month of May, plug-in car sales were down 32% than the previous year. It is estimated that the Chinese electric vehicle market will see an overall decline of 14% in 2020.

The U.S. electric vehicle market has also been hit hard by the COVID-19 outbreak. The lockdown measures have not been successful enough, and the electric vehicle demand is expected to witness a rather steep decline in 2020. However, electric car sales in European countries have maintained their growth trend, and amid this backdrop, the market share of electric vehicle s has continued to rise. In major European electric vehicle markets (France, Italy, Germany, and the U.K.), the sales of electric cars in the first four months of 2020 reached more than 145 thousand units (about 90% higher than in the same period in 2019). In Norway, the number of electric cars sold in the first four months of 2020 was about the same as in 2019.

In February 2020, the German government increased the electric car purchase subsidies. In Italy, the impact of the system introduced in 2019 to encourage electric car sales started to positively affect the market. Moreover, 2020 is the target year of the European Union (EU)’s CO2 emission standards, which limit the average CO2 emissions per km for new car sales.

Short-Term Impact of COVID-19 on Electric Vehicle Industry

At this moment, electric vehicles are resource guzzlers for original equipment manufacturers (OEMs), rather than something which add value to an already-stressed business. A contraction is inevitable for electric vehicle sales in the short run. A few factors, which have dented the market, are explained below.

- Consumer preference: There may be greater constraints for consumers in borrowing capital, which may hamper electric car sales, due to their higher-than-average purchase prices. However, this effect may be less severe, because electric vehicles tend to fall into the premium market segment, where capital-constrained customers are fewer.

- Delay in policies and regulations: The implementation of regulations and policies aiming to reduce greenhouse gas (GCG) emissions may be delayed. During and post the COVID-19 situation, it is highly speculated that the government in various nations will alter its priorities. The focus too may divert toward more-pressing social and economic issues, which could be a secondary blow to electric vehicle encouragement plans and subsidies.

- Crude prices: The ripple effects were visible in the crude prices as well, which stooped historically low, into negatives. Since the rising crude prices were a major driver for the adoption of electric vehicles, this will be a big setback for electric vehicle component manufacturers and marketing companies, because economies of scale would be highly bent against their favor.

- Auto plant shutdown: Automakers across the world have declared temporary plant shutdowns, and many have extended shutdowns beyond their original resumption dates, as COVID-19 continues to spread around the world, for ensuring employees’ safety. The situation continues to be petrifying, as an increasing number of European companies are suspending work, while U.S.-based automakers are extending shutdown periods.

- Delayed launch of new electric vehicle models: Car manufacturers may decide to delay or reduce the investments that they had lined up to diversify their electric vehicle models and meet the preferences of a broader range of consumers.

Mid- and Long-Term Impact of COVID-19 on Electric Vehicle Industry

On the other hand, a number of factors that suggest the longer-term outlook for the electric vehicle market could remain positive over the next decade and beyond. Opportunities for self-reinforcing cost reductions in electric vehicle production will persist. Resulting from the increasing scale of battery production as well as battery technology improvements, these factors will make it easier for battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) to compete with vehicles using internal combustion engines, in terms of the total cost of ownership.

Furthermore, the interest in and need for policy action on priority objectives, such as mitigating climate change, improving the local air quality, enhancing economic productivity, and fostering industrial development, will continue to be high. These priorities require support for innovation, including industrial progress in the electric vehicle and battery value chains.

OEMs Are Focusing on The New Normal for The Business Ahead

The major player in the market are focusing on taking precautionary measures such as increased frequency of sanitization at factory premises and work stations, restrictions in travel, sanitized delivery of product, and social distancing within the dealerships. The major player in the global electric vehicle market are Tesla, Inc., BYD Company Ltd., General Motors Company, Groupe Renault, Mitsubishi Motors Corporation, Nissan Motor Company, Toyota Motor Corporation, Volkswagen Group, and Ford Motor Company.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws