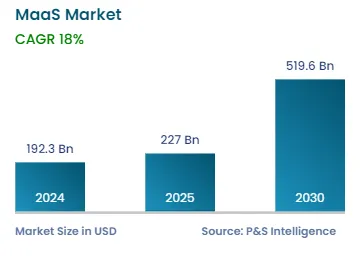

During 2024–2030, the growth rate of the mobility-as-a-service market will be 18%.

In 2024, the size of the mobility-as-a-service market will be 192.3 billion.

Ride hailing is the largest service type of MaaS.

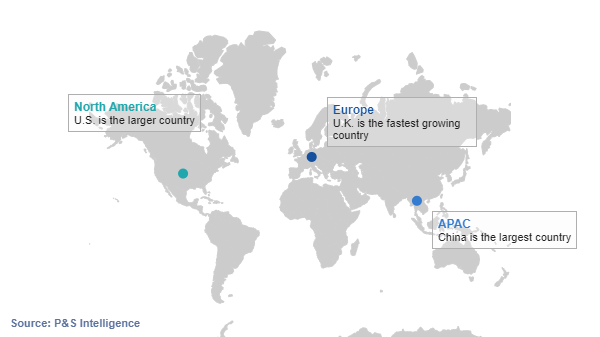

APAC is the largest market for MaaS.

Top players in the mobility-as-a-service market include ANI Technologies Pvt. Ltd., Lyft Inc., Uber Technologies Inc., Beijing Xiaoju Technology Co. Ltd., Grab Holdings Inc., Hertz Global Holdings Inc., Avis Budget Group Inc., Enterprise Holdings Inc., Europcar Mobility Group S.A., and Sixt SE.