Market Statistics

| Study Period | 2019 - 2030 |

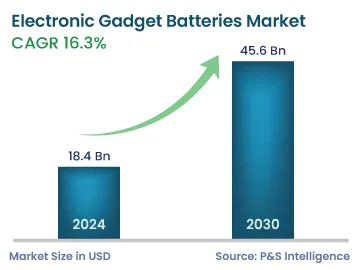

| 2024 Market Size | 18.4 Billion |

| 2030 Forecast | 45.6 Billion |

| Growth Rate(CAGR) | 16.3% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Nature of the Market | Consolidated |

Report Code: 12808

Get a Comprehensive Overview of the Electronic Gadget Batteries Market Report Prepared by P&S Intelligence, Segmented by Application (Portable PCs, Cellular Phones, Tablets, Wearables), End User (OEMs, Aftermarket), Distribution Channel (Online, Offline), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | 18.4 Billion |

| 2030 Forecast | 45.6 Billion |

| Growth Rate(CAGR) | 16.3% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Nature of the Market | Consolidated |

Explore the market potential with our data-driven report

The electronic gadget batteries market size stood at USD 18.4 billion in 2024, and it is expected to advance at a compound annual growth rate of 16.3% during 2024–2030, to reach USD 45.6 billion by 2030. This is ascribed to the increased customer preference for portable devices and growth in the urbanization.

Moreover, the key reason for the growth is that modern mobile devices such as smartphones and tablets come equipped with the power and software needed to run desktop and online apps. Processors, random memory and storage, Wi-Fi, an operating system, and other parts of hardware and software found in personal computers are all present in portable computing devices. Thus, rechargeable batteries help in running these electronic devices. Also, the selected technology of the battery influences the performance of devices, user interface, and mobility.

The gadgets that are widely adopted among consumers include Chrome books, smartphones, laptops, tablets, notebooks, and smartwatches. The battery is commonly known as an apparatus that aids in converting chemical energy into electrical energy with the use of the electrochemical process. The lithium-ion technology is one of a kind which is commonly used in batteries. These small-sized batteries power a large number of devices in order to enable several features such as portability.

Moreover, these batteries are widely used because advanced solutions such as high-resolution displays, more powerful processors, and sophisticated camera systems consume energy in a huge amount and thus require high-capacity batteries for their functioning.

Furthermore, the demand for mobile computers, smartphones, virtual reality devices, drones, and smart gadgets has increased vastly in recent years. The sale of computers has increased because of sudden growth in the consumer electronics and FMCG sectors, which, in turn, has increased the manufacturing and production of such systems. Also, virtual reality, augmented reality, and internet of things are incorporated into various consumer electronic products, which has increased their sales among youngsters. In addition, as the demand expanded, businesses have increased the manufacture of electronic devices. Thus, this factor drives the need for electronic gadget batteries.

The portable PCs category held the largest revenue share, of 40%, in 2023. This is because portable PC batteries are used widely in laptops, notebooks, and Chrome books, as these rechargeable devices are used to generate and store electricity, enabling portable PCs such as laptops to operate without a power cord. In addition, lithium-ion batteries are the most prevalent form of laptop batteries. They are available in various configurations, depending on the CPU speed, screen size, RAM, workload weight, and other specifications to keep the laptops running for several hours.

Furthermore, mobile phone batteries hold a significant share in the market. This is due to the increasing demand for cellular phones. For instance, the majority of developed nations exhibit cell phone penetration rates of at least 90%. Consumers accept cell phones as they have become a part of their daily lives. This huge acceptance and penetration of cellular phones and the advent of smartphones have fueled the demand for such batteries.

In addition, the need for tablet batteries is also growing because the sales of tablets are increasing rapidly. This is due to their features such as being highly portable and lightweight, making them convenient for on-the-go use. Also, their form factor strikes a balance between the larger screen of a laptop and the compact size of a smartphone, making them ideal for travel and commuting.

OEMs are major end users, with a share of 65% in 2023. This is because lithium-ion batteries are critical for the success of mobile computing battery OEMs' goals in increasing device efficiency, battery life, and price competitiveness. Even before the COVID-19 crisis, there were increasing reports of OEMs having production concerns due to battery and cell shortages. Following the initial wave of the pandemic and subsequent restarts, mobile computing device production felt the strain as the demand increased, affecting the output of crucial items.

Since batteries account for 8–10% or more of the value of mobile computing devices, established OEMs and battery suppliers desire tighter control over the supply chain rather than seeing revenues and jobs transfer to other companies and locales. Thus, this factor drives the market growth in this category.

Aftermarket refers to purchasing and selling replacement parts or equipment for a product after its initial sale. Consumers are increasingly resorting to aftermarket batteries. In addition, aftermarket batteries are OEM equivalent meant to meet or surpass original standards for a fraction of the price. Even aftermarket battery makers continue to provide it for older, more obsolete mobile phones. Thus, the sales of aftermarket batteries for electronic gadgets, especially for cellular phones, hold a significant share, as they have a small life span.

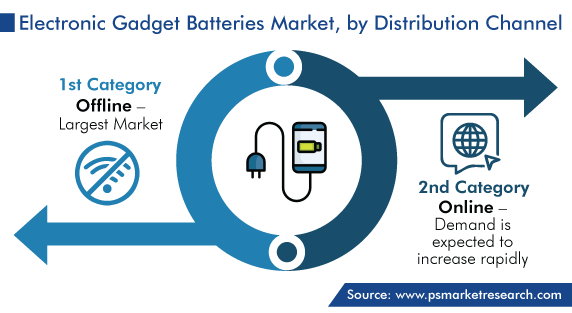

The offline category is the largest distribution channel in the market. This is because electronic gadget batteries are dispersed through B2B, brick-and-mortar stores, wholesalers, retailers, branded shops, hypermarkets, and others. The most prevalent offline distribution in the market includes distribution to OEMs and wholesalers through dealers and distributors. Also, most vendors sell their products directly through dealers or distributors. Almost all OEMs have stores spread across the globe and offer mobile-computing batteries as accessories in the aftermarket.

Based on Application

Based on End User

Based on Distribution Channel

Drive strategic growth with comprehensive market analysis

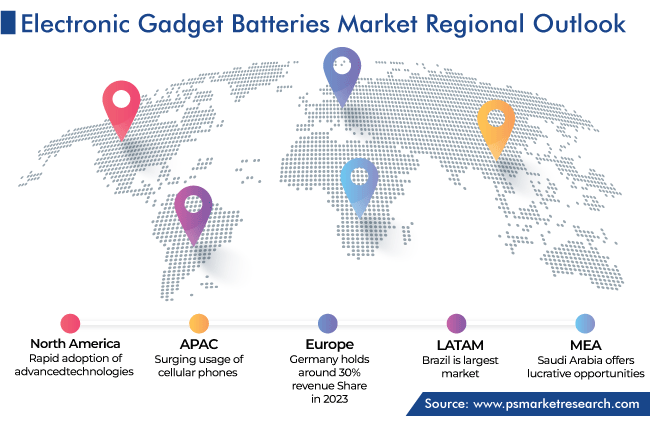

APAC has the highest position in the electronic gadget batteries market, and it will hold the same position during the forecast period, with a value of USD 25 billion by 2030. This is attributed to the surging usage of cellular phones and smartwatches and the presence of electronic device manufacturing hubs, such as China, Japan, Vietnam, South Korea, and India.

The countries that largely contribute to the mobile computing battery sector in the region include China, Vietnam, and South Korea. In APAC, the Chinese market holds the leading position in the coming years, owing to the fast adoption of new and advanced technologies in the country.

Furthermore, small enterprises in India are expected to grow year-on-year, and the growing number of small and medium enterprises and flourishing manufacturing sectors are leading to a surge in exports, thereby boosting the revenue generated from the sales of electronic gadgets. Also, investments in the Indian IT sector are rising continuously, and companies in the industry are expanding their footprint globally. Thus, the Indian market holds a significant share in the region.

Moreover, the presence of a well-established ICT infrastructure and the technology-savvy population in South Korea create favorable conditions for the growth of the market presently and also in the forecast period in the country.

The electronic gadget batteries market size stood at USD 18.4 billion in 2024.

During 2024–2030, the growth rate of the electronic gadget batteries market will be around 16.3%.

OEMs is the largest end user in the electronic gadget batteries market.

The major drivers of the electronic gadget batteries market include the surging focus on the use of electronic items, the paradigm shifts toward remote work and learning, and the rising use of smartphones to automate and control various aspects of their surroundings.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages