Smartwatch Market Analysis

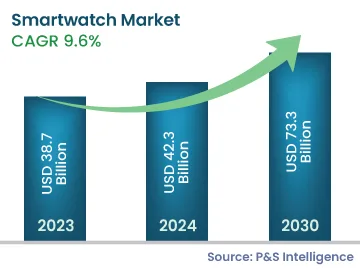

The global smartwatch market size stood at USD 38.7 billion in 2023, and it is expected to grow at a CAGR of 9.6% during 2024–2030, to reach USD 73.3 billion by 2030. The growth can be primarily ascribed to the rising urbanization rate and the increasing demand for advanced products with multiple features, including pulse rate tracking, sleep quality monitoring, and step counting. Furthermore, the growing millennial population is widely spending on wearables because of its improving lifestyle.

The hybrid smartwatch, which is a fusion of a traditional mechanical watch and smart features, but without a touch display and charging functionality, is creating a huge opportunity for players. It is smart because of its Bluetooth connectivity and added functionalities, such as a heart rate and a calorie (burned) tracker; but it resembles a normal mechanical watch.

Consumers, particularly those belonging to the upper and business classes, have shown great interest in such electronic gadgets as they find less interest in complex smartwatches requiring long charging hours and sound technical knowledge for their optimal usage.

Additionally, the demand for computerized wristwatches with functionalities that go beyond just timekeeping and basic smart features has been driving the growth of the market. While the early models were capable of performing tasks such as calculations and sending notifications, over the last few years, these products have been enabled with media and digital features and a proper OS.

New automotive control features embedded in, or compatible with, next-gen smartwatches are one of the prime factors driving the global market growth. Smartphones have already been integrated with automotive control features in the past decade, and smartwatches with automotive control capabilities are being seen as the next big thing in the smart and autonomous cars industry.

Companies are rolling out app-based offerings that are compatible with new series of smartwatches and go beyond the smart locking and unlocking of cars, remote starting of cars, and driver assistance. For instance, Viper SmartStart 4.0 is a next-generation smartwatch-compatible technology tailored to work with Apple Watch and Android Wear devices.

The technology puts the vehicle control on the user’s wrist through the installed SmartStart module, enabling the remote start system and CDMA/3G technology and connecting the vehicle to a wireless network. The ongoing developments in extended automotive functionalities compatible with the latest smartwatches are also expected to drive the global adoption of smartwatches at a high rate in the years to come.