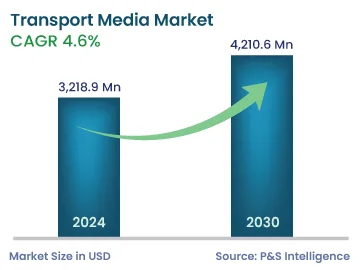

Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | 3,218.9 Million |

| 2030 Forecast | 4,210.6 Million |

| Growth Rate(CAGR) | 4.6% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12724

Get a Comprehensive Overview of the Transport Media Market Report Prepared by P&S Intelligence, Segmented by Product Type (Viral Transport Media, Universal Transport Media, Molecular Transport Media), Application (Diagnosis, Preclinical Testing), Indication (Viral Diseases, Non-Viral Diseases), End User (Hospitals and Clinics, Microbiology Laboratories, Diagnostic Laboratories, Homecare Settings), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | 3,218.9 Million |

| 2030 Forecast | 4,210.6 Million |

| Growth Rate(CAGR) | 4.6% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global transport media market size stood at USD 3,218.9 million in 2024, and it is expected to grow at a CAGR of 4.6% during 2024–2030, to reach USD 4,210.6 million by 2030. This is due to the rising prevalence of infectious diseases, such as herpes and influenza; growing demand for pre-clinical and diagnostic testing, surging R&D on viral diseases, and increasing number of initiatives taken by governments for propelling the adoption of testing kits.

For instance, in 2022, approximately 400,000 died due to influenza across the world. Similarly, around 4 billion people are suffering from herpes. The rise in the incidence of such infectious diseases leads to an increase in the rate of diagnosis and treatment, which further leads to the growth of the market.

In order to preserve a sample of biospecimen and reduce bacterial overgrowth from the collection period to the time of its receipt at the laboratory for further processing, special transport media are developed. The media can be modified depending on the type of organism suspected in the sample.

During the COVID-19 pandemic, with the increase in the number of tests, the market grew. For accurate tests, the sample quality and its transporting and storage conditions prior to processing are crucial. For this purpose, viral transport media have become common. Thus, life sciences and biotechnology companies started large-scale manufacturing of such products for transporting nasal and pharyngeal swabs to diagnostic laboratories.

For instance, in March 2021, Teknova increased its manufacturing capacity for its range of viral transport media, active viral transport medium (ATM), and also constructed new cleanrooms to meet the ISO 13485 and GMP standards required for the production of VTM, ATM, and saline.

Moreover, several academic and research institutes participated in and supported the production process, at the same time lowering their focus on their own projects, to restrict workplace crowding and follow the prevalent social distancing guidelines. Moreover, players switched to the custom manufacturing of viral transport media in order to produce more-effective COVID-19 testing kits. For instance, in 2021, Wexner Medical Center at the Ohio State University and several research labs collaborated in order to manufacture and distribute viral transport media tubes, to quicken up COVID-19 testing in Ohio.

Moreover, in March 2022 Thermo Fisher Scientific Inc. developed the InhibiSURE viral inactivation medium formula to support the safe collection and transportation of microbial samples. Currently available in Europe, the new transport medium allows for the collection and inactivation of the SARS-CoV2 virus and the stabilization of the viral RNA at ambient temperatures, for transportation and usage in in-vitro diagnostic testing procedures.

Apart from COVID-19, there has been a constant increase in the prevalence of other viral diseases, such as, Marburg virus disease and measles, which require rapid testing for diagnosis. Similarly, in the U.S., the incidence of salmonella, Lyme disease, tuberculosis, and meningococcal disease was ~60,000; 35,850; ~9,000; and ~500, respectively, in 2020. Infectious diseases account for a large share of early deaths around the world.

Viral transport media category held a share of, 35% in 2023. This is due to the sudden outbreak of infectious diseases, such as monkeypox and COVID-19, which propels the demand for diagnosis and testing among the infected individuals. Moreover, the increasing awareness of diagnosis and treatment during the COVID-19 pandemic has accelerated the demand for the associated products for the detection of many other infections.

In 2022, the World Health Organization issued and implemented biosafety laboratory guidelines to be adhered to while collecting, testing, and handling samples containing the monkeypox virus and their transportation in a viral transport solution. Moreover, the rising number of pharma and biotechnology companies and academic research institutes increases the demand for viral transport solutions, thus contributing to the growth of the market.

The launch of new products also plays a major role in this regard. For instance, in 2021, VIRCELL S.L. announced the launch of a new transport media for the collection and preservation of viruses, chlamydia pathogen, and mycoplasma. The medium, which is also suitable for COVID-19 testing, is provided with swabs for pediatric patients.

Similarly, in 2020, EKF Diagnostics added a new product, named PrimeStore MTM, to its portfolio. It is a novel viral transport media that enables the safe handling of sample and allows for testing for multiple infectious diseases from just one specimen.

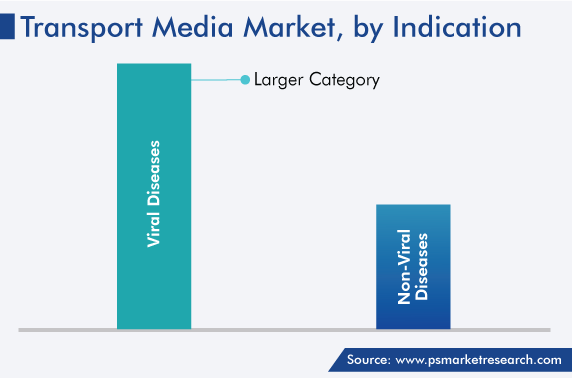

The viral diseases category dominates the market, based on indication. Moreover, this category is expected to witness the fastest growth in the forecast period. This is mainly due to the rising burden of viral diseases, such as influenza, herpes, monkeypox, coronavirus, Varicella zoster, and respiratory syncytial virus. Among them, the coronavirus and influenza virus are the most-contagious respiratory diseases and are, thus, a serious cause for concern across the world.

The COVID-19 pandemic has resulted in an unprecedented worldwide demand for laboratory testing. Hence, due to the increasing number of people with viral infections, diagnostic laboratories are witnessing a constant increase in the number of samples to be tested. With the rising prevalence of infectious diseases, the demand for transport media increased for detecting and diagnosing viral infectious diseases. This is likely to help the category generate significant revenue during the forecast years.

Furthermore, governments are increasing the awareness of the flu through various campaigns. These awareness campaigns highlight the importance of the prevention and early diagnosis of the disease, which directly increases the number of tests.

Diagnostic laboratories held the largest share due to the growing demand for diagnosis and testing for COVID-19. This has fueled the setup of diagnostic laboratories and augmented their workload. Furthermore, mutations in the genome of the virus result in changes in the viral structure, making standard vaccination ineffective. As a result, diagnostic laboratories are under pressure to not just identify the pathogen but also its specific disease-causing strain. In addition to the increasing awareness of diagnostic testing, the support of governments to improve the healthcare system drives the market.

According to the World Health Organization, the elderly population is expected to rise from 1 billion in 2020 to 1.7 billion in 2030, accounting for 1 in 6 people in the world 60 years of age or older. Infectious diseases are more prevalent in the geriatric population; therefore, these people are in greater need of healthcare services, which escalates the volume of diagnostic tests.

Drive strategic growth with comprehensive market analysis

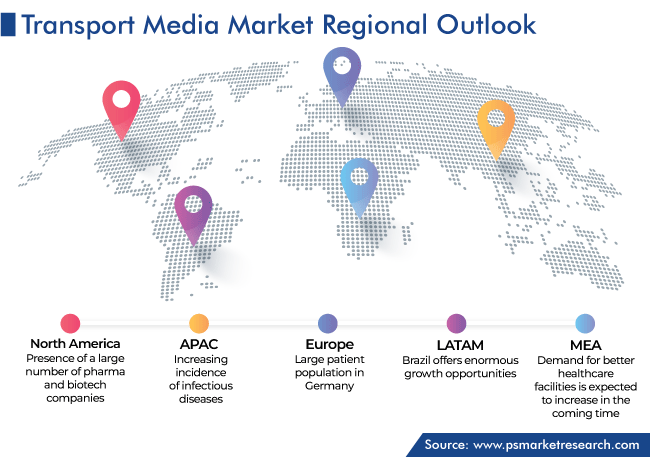

North America dominates the market due to the rising count of diagnostic tests, the presence of a large number of pharma and biotech companies, increase in R&D on infectious diseases, and well-established healthcare system.

Essentially, the rising prevalence of infectious diseases, especially viral diseases, is one of the major factors that contribute to revenue generation for market players. Additionally, the rising number of initiatives taken by regional governments for the usage of advanced testing solutions is driving the growth of the North American market. As per a government source, in 2020, approximately 3.5 million people visited the emergency room in the U.S. for infectious, including parasitic, diseases.

Moreover, the presence of many market players in the U.S. leads to an easy availability of the associated products. For instance, in April 2021, COPAN Diagnostics launched the UniVerse fully automated molecular specimen preparation instrument, to be used before testing, in North America.

The APAC region is expected to register the fastest growth during the forecast period, due to the increasing incidence of infectious diseases, such as COVID-19, Lyme disease, and tuberculosis. The population riddled with infectious diseases is quite large in this region, especially in China and India, which are the foremost countries in this regard. Thus, many market players have come forward to fulfill the vast unmet requirement for diagnosis.

The European region also holds a significant share due to the large patient population with infectious diseases. For instance, in 2022, there was an outbreak of the monkeypox virus. Similarly, in 2019, MERS-CoV and SARS-CoV emergence was declared by regional governments. Moreover, the continuous increase in the prevalence of influenza accelerates the growth of the market.

The report analyzes the impact of the major drivers and restraints on the transport media industry, to offer accurate market estimations for 2019–2030.

Based on Product Type

Based on Application

Based on Indication

Based on End User

Geographical Analysis

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages