Report Code: 10145 | Available Format: PDF | Pages: 140

Agricultural Biotechnology Market Research Report: By Technology (Genome Editing, DNA Sequencing, RNAi, Synthetic Biology, Biochip), Product (Transgenic Seeds, Crop Protection Products) - Global Industry Analysis and Growth Forecast to 2030

- Report Code: 10145

- Available Format: PDF

- Pages: 140

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

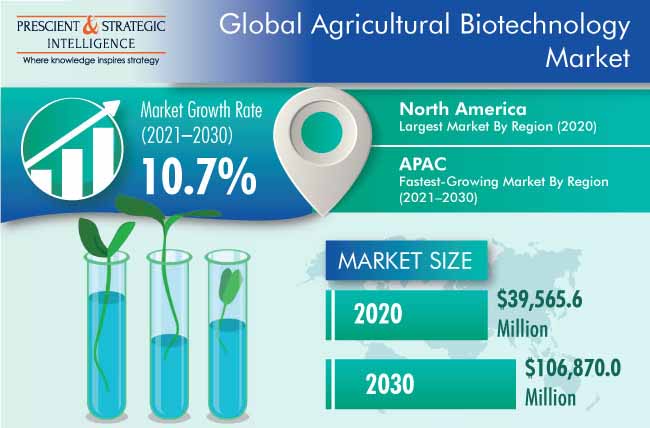

The global agricultural biotechnology market was valued at $39,565.6 million in 2020, which is expected to grow at a CAGR of 10.7% during the forecast period (2021–2030). The industry is expected to grow due to the rise in the demand for new breeding techniques, such as genomic sciences, plant grafting, genetic engineering, and plant molecular breeding. This is because of the growing use of biotechnology to create or modify traits of organisms-including plants, animals, and microbes-with respect to color, yield, or size.

The COVID-19 pandemic has affected every industry including agricultural biotechnology market. The pandemic has put a heavy burden on the food processing industry and producers, who are unable to work due to the lockdowns. Following the economic slowdown, biofuel prices collapsed in 2020 and so did the prices of their major feedstocks, such as maize and oilseeds. Despite the fact that the income losses during the lockdown and local supply chain disturbances have inevitably led to a vast food shortage in many industrialized economies, the demand for agricultural products didn’t reduce, owing to the sustained food consumption.

Genome Editing Category To Witness Fastest Growth due to Rising Popularity of Crops with Increased Insect Resistance

With genome editing, healthier crops can be produced that have an increased resistance to insects and lower risk of failure due to extreme weather conditions, such as floods and drought. Thus, the genome editing category is expected to witness the highest CAGR during the forecast period in the agricultural biotechnology market, on the basis of technology.

Due to Rising Demand for Genetically Modified (GM) Crops to Increase Efficiency of Farming Operations, Transgenic Seeds Category Led Market

The transgenic seeds bifurcation, on the basis of product, held the larger market share in 2020 in the agricultural biotechnology industry. This can be mainly ascribed to the increasing focus of market players on developing these seeds to improve the efficiency of farming operations. Additionally, these products help in the reduction in the effect of any external factor destroying the quality of the crop.

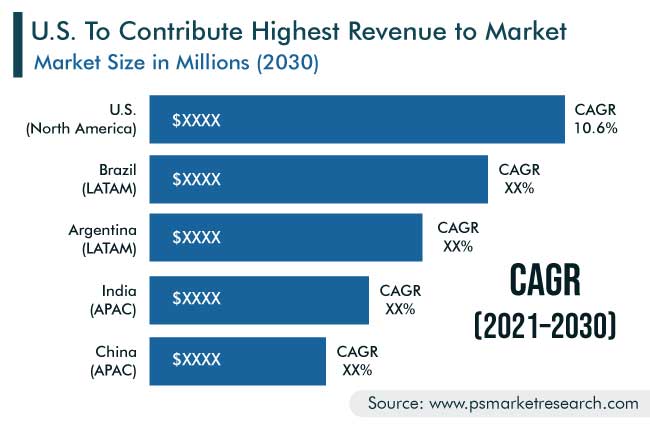

North America Is Largest Market for Agricultural Biotechnology Tools and End-Products

Globally, North America held the largest share in the agricultural biotechnology market in 2020. This leading position is majorly attributed to the increasing adoption of GM crops in the region. Moreover, the shortage of conventional fossil fuels has led to the development of biofuels, which, coupled with the regulatory approval for them by statutory bodies in the U.S., is expected to have a positive impact on the market growth. In addition, the several advantages of transgenic crops over normal crops, such as resistance to pests and toxic herbicides and additional nutritional values, are further expected to drive the region’s market during the forecast period.

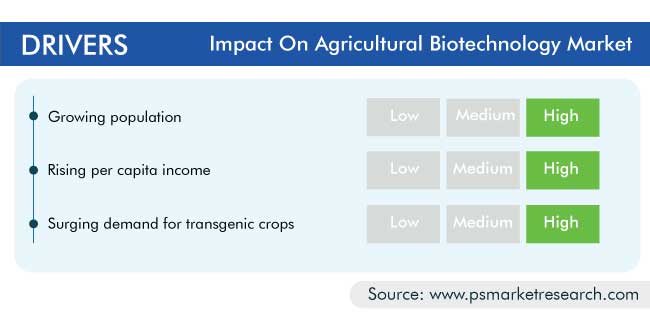

Increasing Adoption of Biofuels Is Accelerating Growth of Market

Biofuel sources mainly include crops such as wheat, corn, soybean, and sugarcane, but organic waste material can also be utilized as a potential feedstock. The increasing demand for biofuels across the world can be attributed to the fact that they burn cleaner than conventional fossil fuels and release fewer pollutants and greenhouse gases, such as carbon dioxide, into the atmosphere. Thus, the developed countries of Europe and North America have been witnessing a rise in the adoption of biofuels, which are mainly produced using biotechnology and offer higher fuel efficiency. Thus, the increasing adoption of biofuels is a key trend in the agricultural biotechnology market.

Increasing Demand for Food Products Is Major Factor Responsible for Market Growth

The increasing population is leading to a rise in the demand for food products and the consequent dependence on agricultural biotechnology. According to the United Nations Department of Economic and Social Affairs, the global population, which stood at 6.9 billion in 2010, increased to 7.7 billion in 2019. Moreover, during 2015–2050, half of the world’s population growth is expected to be concentrated in ten countries, namely Nigeria, China, India, the Democratic Republic of the Congo, Pakistan, Ethiopia, the U.S., Tanzania, Indonesia, and Uganda. The growing population would require an ample food supply to sustain, which, in turn, would drive the adoption of advanced biotechnology tools in the agricultural space, thereby supporting the agricultural biotechnology market growth.

| Report Attribute | Details |

Historical Years |

2015-2020 |

Forecast Years |

2021-2030 |

Base Year (2020) Market Size |

$39,565.6 Million |

Market Size Forecast in 2030 |

$106,870.0 Million |

Forecast Period CAGR |

10.7% |

Report Coverage |

Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Analysis, Companies’ Strategic Developments, Impact of COVID-19, Company Profiling |

Market Size by Segments |

By Technology, By Product, By Region |

Market Size of Geographies |

U.S., Canada, Germany, U.K., France, Italy, Spain, China, Japan, India, Australia, South Korea, Singapore, Brazil, Mexico, Argentina, Saudi Arabia, South Africa, U.A.E. |

Secondary Sources and References (Partial List) |

Australian Centre for International Agricultural Research (ACIAR), Consultative Group on International Agricultural Research (CGIAR), International Council of Biotechnology Associations (ICBA), Biotechnology Innovation Organization (BIO), European Federation of Biotechnology (EFB), International Service for the Acquisition of Agri-biotech Applications (ISAAA), Asia-Pacific Consortium on Agricultural Biotechnology and Bioresources (APAARI) |

Explore more about this report - Request free sample

Recent Strategic Developments of Agricultural Biotechnology Market Players

In recent years, major players have been involved in a variety of strategic developments to better their position in the global market:

- In February 2021, ADAMA Agricultural Solutions Ltd. launched a novel prothioconazole fungicide that offers improved cereal and oilseed rape disease (OSR) disease control.

- In August 2020, Syngenta AG announced the acquisition of Sensako (Pty) Ltd., a South African seed company specializing in cereals. Syngenta's entrance into the South African wheat, corn, and sunflower seeds markets will be helped by this acquisition, which will lay the foundation for its future expansion.

Key Players in Global Agricultural Biotechnology Industry Include:

-

Syngenta AG

-

DuPont de Nemours Inc.

-

Performance Plants Inc.

-

Certis USA LLC

-

Bayer AG

-

BASF SE

-

Vilmorin & Cie

-

Evogene Ltd.

-

ADAMA Agricultural Solutions Ltd.

-

KWS SAAT SE & Co. KGaA

-

Global Bio-Chem Technology Group Company Limited

-

Novozymes A/S

Market Size Breakdown by Segment

The global agricultural biotechnology market report offers comprehensive market segmentation analysis along with market estimation for the period 2015–2030.

Based on Technology

- Genome Editing

- Deoxyribonucleic Acid (DNA) Sequencing

- Ribonucleic Acid Interference (RNAi)

- Synthetic Biology

- Biochip

Based on Product

- Transgenic Seeds

- Soybean

- Maize

- Cotton

- Fruits and vegetables

- Crop Protection Products

- Biopesticides

- Biostimulants

Geographical Analysis

- North America

- U.S.

- Canada

- Asia-Pacific (APAC)

- India

- China

- Latin America (LATAM)

- Brazil

- Argentina

During 2021–2030, the market for agricultural biotechnology will witness a CAGR of 10.7%.

Under the technology segment of the agricultural biotechnology industry, the genome editing category holds the largest share.

End users in the market for agricultural biotechnology are increasingly purchasing transgenic seeds due to the rising popularity of GM crops around the world.

APAC is set to offer the best opportunities to the players in the agricultural biotechnology industry.

The competition in the market for agricultural biotechnology is currently shaped by acquisitions.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws