Report Code: 10310 | Available Format: PDF

Influenza Vaccine Market: Size, Share, Key Trends, Growth Drivers, Regional Outlook, Revenue Estimation and Forecast, 2023-2030

- Report Code: 10310

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

Market Overview

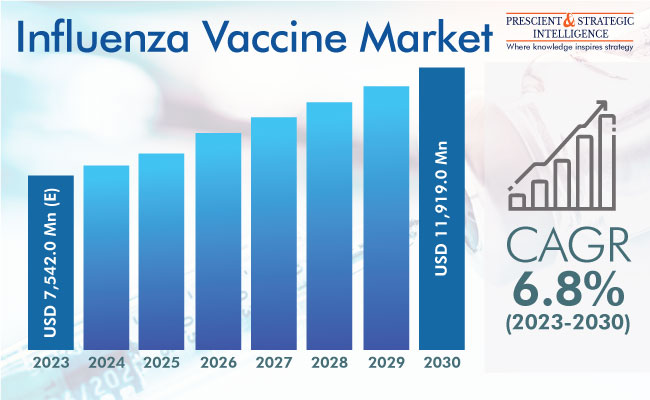

The influenza vaccine market size has been estimated at USD 7,542 million in 2023, and it will power at a CAGR of 6.8% during 2023–2030, to reach USD 11,919 million by 2030. The increase in the occurrence of seasonal influenza and the growth in the number of doctors recommending vaccination against it will increase the market size.

As per the CDC’s estimates of December 2022, there were a minimum of 15 million new cases of influenza, with about 9,300 deaths and more than 150,000 hospitalizations, in the 2022 flu season. Furthermore, the increase in surveillance and support by governments for monitoring the delivery, supply, and administration of vaccines is one of the major growth drivers for the industry. The WHO, along with government organizations, progressively monitors prophylaxis requirement and conducts vaccination programs.

Furthermore, there are numerous seasonal influenza vaccines approved by the WHO, CDC/FDA, and other regulatory bodies. Additionally, governments globally recommend that people get immunized against this common yet often severe infection. Additionally, the Advisory Committee on Immunization Practices (ACIP), in September 2022, proposed influenza vaccination for people over 6 months old, particularly those with acute COVID-19.

Furthermore, the surge in research and development investments by key vaccine manufacturers and the existence of a strong investigational pipeline will power the growth of the industry. The prominent pipeline products in numerous development stages are OVX836, GSK3206641A, ALVR106, DAS181, AV5080, INNA-051, and UniFlu.

Vaccines with Inactivated Virus Continue To Be Preferred

Between live attenuated and inactivated, the inactivated category dominates the type segment of the market. These vaccines are created to fight a particular virus strain, which is why they are effective and preferred by pharmaceutical companies and doctors. For instance, in a recent study published by Elsevier, a particular high-dose quadrivalent flu vaccine, which was administered in children between 6 and 35 months of age, prompted a strong immune response up to a year after primary administration.

Hospitals and Pharmacies Have Largest Revenue Share

Based on distribution channel, hospitals and pharmacies lead the industry in 2023 due to a large count of hospitals and pharmacies providing flu vaccinations. Additionally, large vaccination drives are usually done at smaller institutions. Additionally, the high number of influenza cases, resulting in an increasing number of hospital admissions, will power the category forward.

The government and institutional supply category will grow the fastest over this decade. The continuing immunization programs and the inclusion of influenza in them are credited for the growth of this category. Furthermore, global health agencies, for example, the WHO, are obtaining vaccines in large volumes and supplying them to emerging economies with high unmet requirements at reasonable rates and often, free of cost.

Influenza Vaccines Are Mostly Administered via Injections

Injections leads the influenza vaccine market in 2023, based on route of administration, and this trend will continue till 2030. This is because of the large count of intramuscular vaccine candidates available. Additionally, injections have been the oldest vaccination administration method in use and are known for their direct delivery of the drug into the bloodstream.

Nasal spray will grow the fastest due to the rising acceptance of intranasal vaccines at homecare settings. They offer self-administration ease and the capability to boost systemic and mucosal immunity. Furthermore, the continuing efforts of researchers to create intranasal flu vaccines will support the industry expansion. In addition, several people, especially children, are afraid of needles, which results in poor patient compliance with immunization programs.

Vaccine Usage on Pediatric Population To Grow Significantly

A significant revenue share is held by adults in 2023, because of the efforts to augment immunization rates and procure massive counts of doses by the GAVI, UNICEF, and PAHO. Additionally, the availability of immunization cost coverage has led to an increase in the elderly population getting immunized. Furthermore, adult vaccination is crucial to decrease the number of flu hospitalizations and deaths. As per the CDC, in 2021, about 85% of the deaths related to influenza took place in people more than 65 years old.

Moreover, the pediatric category is growing swiftly, because of the high infant vaccination rate. Additionally, an increase in the R&D activities for the development of novel vaccines for children drives the category. For example, Penn scientists, in November 2022, developed a 20-subtype mRNA flu vaccine. Further, the increase in the population in China and India creates a high requirement for pediatric vaccines, thus powering the growth of the category.

Quadrivalent Is Largest and Fastest-Growing Category

The quadrivalent category is the leader of the industry, and it will have the higher growth rate over this decade. This is because of the high effectiveness of quadrivalent vaccines against all the four major flu subtypes, as well as their affordability and easy availability in hospitals and clinics.

Furthermore, the increasing preference for quadrivalent vaccines among medical professionals will play a vital role in increasing the demand for them. For example, as per a survey, physicians and pharmacists recommend such drugs for those aged over 65 years.

| Report Attribute | Details |

Market Size in 2023 |

USD 7,542 Million (E) |

Revenue Forecast in 2030 |

USD 11,919 Million |

Growth Rate |

6.8% CAGR |

Historical Years |

2017-2022 |

Forecast Years |

2023-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

North America Leads Market

North America will dominate the influenza vaccine market till 2030, as a result of U.S. government agencies' strong concentration on collaborations for increasing the supply of influenza vaccines. The CDC, FDA, NIH, and BARDA are working together for developing novel and better influenza vaccines, as part of inter-agency efforts. Furthermore, vaccination is suggested by the ACIP for decreasing the disease's burden. As per the WHO, around 37.2 million influenza flu cases were discovered in the U.S. in 2021.

APAC Region Will Grow Fastest

APAC will witness the fastest growth over this decade, driven by the snowballing populace in the region. Furthermore, the increasing count of initiatives by governments for providing flu vaccines and the growing consciousness of this infection drive the market. In addition, the increasing investments by the leading players in the region will provide exponential growth prospects to the industry.

Who Are Key Players in Influenza Vaccine Industry?

- GSK plc

- AstraZeneca plc

- Sinovac Biotech Ltd.

- Pfizer Inc.

- Vaxess Technologies Inc.

- CSL Limited

- EMERGENT BIOSOLUTIONS INC.

- Merck & Co. Inc.

- Viatris Inc.

- OSIVAX SAS

- Emergex Vaccines Holding Ltd.

- Sanofi Pasteur SA

- Abbott Laboratories

- Johnson & Johnson Services Inc.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws