Market Statistics

| Study Period | 2019 - 2030 |

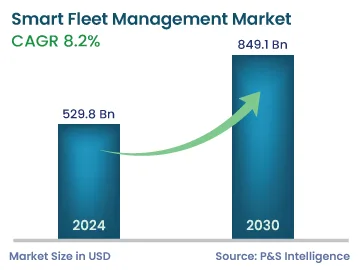

| 2024 Market Size | 529.8 Billion |

| 2030 Forecast | 849.1 Billion |

| Growth Rate(CAGR) | 8.2% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Consolidated |

Report Code: 12776

Get a Comprehensive Overview of the Smart Fleet Management Market Report Prepared by P&S Intelligence, Segmented by Connectivity Type (Short Range, Long Range, Cloud), Mode of Transportation (Roadways, Marine, Airways, Railways), Application (Tracking, ADAS, Optimization, Fuel Cards, Automatic Vehicle Identification), Operation (Private, Public), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | 529.8 Billion |

| 2030 Forecast | 849.1 Billion |

| Growth Rate(CAGR) | 8.2% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Consolidated |

Explore the market potential with our data-driven report

The global smart fleet management market size stands at USD 529.8 billion in 2024, and it is expected to grow at a CAGR of 8.2% during 2024–2030, to reach USD 849.1 billion by 2030. The market is majorly driven by the rising usage of cloud-based solutions, implementation of government regulations to reduce carbon emissions, and increasing disposable income. Moreover, the growing need for cost-efficiency and real-time tracking and the rising safety concerns will lead to the market expansion.

‘Smart fleet management’ refers to the use of advanced technologies, data analytics, and connected systems to optimize the operations, efficiency, and safety of a fleet of vehicles. It involves the integration of various technologies, such as GPS tracking, telematics, sensors, and software, to collect and analyze data related to vehicle performance, fuel consumption, and maintenance. The primary goals are to streamline operations, reduce cost, enhance safety, and improve fleet performance by leveraging real-time insights and automation.

A smart fleet is a group of vehicles that utilize cloud-based software to automate their management process. Such a system simplifies the process of managing commercial vehicles by making them more connected, thus resulting in reduced overall costs and better fleet usage. In addition to this, cloud-based management solutions deal with driver monitoring, fleet optimization, and other aspects important to entities that press multiple vehicles into passenger transportation or freight/logistics services. Furthermore, cloud enables the backup and recovery of data and applications on a secondary storage or infrastructure.

In addition, the transportation industry faces a lot of risks and hurdles, ranging from the changing regulatory frameworks to an increasing emphasis on . With its vast insights, reporting frameworks, and recordkeeping tools, cloud-based fleet management helps organizations manage this issue even if they lack the technical expertise to do so on their own.

Furthermore, by combining digital tools, fleet managers can maximize fleet tracking even when connectivity is a problem. The efficiency of GPS trackers has increased with cloud connectivity. With the latest in linked technology and software, live fleet tracking enhances end-to-end fleet movement transparency substantially. Despite varying levels of Wi-Fi availability, a fleet manager can monitor the fleet’s position, ETA, and status in the real time. Moreover, the majority of the OEMs deploy sensors to track automobiles; the sensors are connected to the cloud and share instantaneous data.

Carbon dioxide (CO2) emissions are reduced by electric vehicles, particularly when the electricity they utilize comes from renewable sources. The demand for electric vehicles has been rising steadily for years now in all vehicle classes, including cars, trucks, buses, and vans. Manufacturers’ focus on reducing CO2 emissions has been strong ever since the EU implemented its regulations and the Vehicle Energy Consumption calculation tool was launched.

Electric vehicles require access to charging stations, and their efficient usage is crucial for fleet operations. Smart fleet management systems can monitor the availability of charging points, optimize the charging schedule, and even provide real-time updates on the charging status. For instance, as per an article, in 2022, Volvo Trucks sold more than 4,300 electric trucks in more than 38 countries.

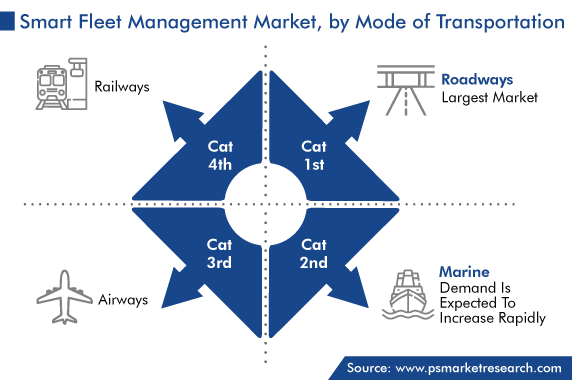

Based on mode of transportation, the roadways category holds the largest share, and it is expected to register the fastest growth, in the coming years. This is majorly due to the increasing number of vehicles, along with the increasing stringency of the government regulations implemented to ensure road safety. Fleet management during transportation by road helps improve safety through the real-time monitoring of vehicles and optimization of routes, in turn, also reducing fuel consumption and emissions. In addition, it increases operational efficiency through data-driven decision-making and enhances customer satisfaction by providing timely and accurate deliveries.

The railways category also holds a significant market share, as the rail transportation industry is highly dependent on modern technologies for tracking and safety. It is now using numerous sensors, detectors, scanners, and other smart devices to replace the lengthy and error-prone human checks.

Rail defect detectors are devices equipped with sensors that can scan for various faults or defects in trains as they pass over the rails. Additionally, wayside defect detectors are devices that are either integrated o to the tracks or installed alongside them. As the train passes over them, defect detectors automatically report over the radio to the train crew the condition of the axles, wheels, and bearings, as well as any issues they find.

Furthermore, the second-largest railroad in the U.S., Union Pacific, has created Machine Vision, an image recognition technology-based system that can remotely scan a mile-long train traveling at 70 mph. Thousands of photos are captured every second by specialized cameras, and to find anomalies, a number of algorithms analyze the images.

Based on application, the ADAS category holds the largest share in 2023, as the primary purpose of the ADAS technology is making driving safer, by reducing the risk of road accidents. Up to 27% fewer incidents on the roads are anticipated when ADAS gather data about the surroundings of the vehicle.

ADAS consists of interconnected components, such as software and communication devices. Additionally, for optimal operation, they use proprioceptive, sensor, and exteroceptive networks. The sensor network analyzes the situation on the road using a multi-sensory platform. Proprioceptive networks employ sensors that, by carefully examining the driver’s behavior and the vehicle’s operational metrics, can recognize and respond to dangerous circumstances. Additionally, radar, infrared, ultrasonic, LiDAR, and different vision sensors make up an exteroceptive network. These sensors enable the driver or the vehicle itself to respond to a possible danger, by predicting it.

Based on connectivity type, the short-range category holds the largest share, and it is expected to grow at 8.0% CAGR during the forecast period. Short-range connectivity enables V2V and V2I communication, which helps protect passengers and pedestrians. This is achieved by alerting drivers of a dangerous condition in time, to allow them take the necessary actions. In addition to this, it is used to share information regarding traffic jams and the best route possible, to avoid a collision.

Additionally, it has a low latency and high reliability, is secure, and supports interoperability. It receives little interference even in extreme weather conditions because of the short range that it works on. This makes it ideal for communicating with other fast-moving vehicles.

Moreover, short-range connectivity can offer functionalities such as remote vehicle monitoring, traffic flow optimization, and collision avoidance for fleet management. Due to the growing acceptance of connected vehicles and the increasing demand for safety and security, the need for such smart fleet management solutions is set to increase. For instance, in Europe, the eCall system is used in vehicles to automatically make a free 112 emergency call whenever a vehicle is involved in a serious road accident.

Furthermore, cloud-hosted smart fleet solutions can help operators optimize operations, while providing them with the flexibility to scale as needed and a lowering the total cost of ownership. Additionally, cloud solutions provide enhanced security features that can protect vital business data gathered from multiple sources. Thus, the cloud category is expected to expand at the highest CAGR over the forecast period.

Drive strategic growth with comprehensive market analysis

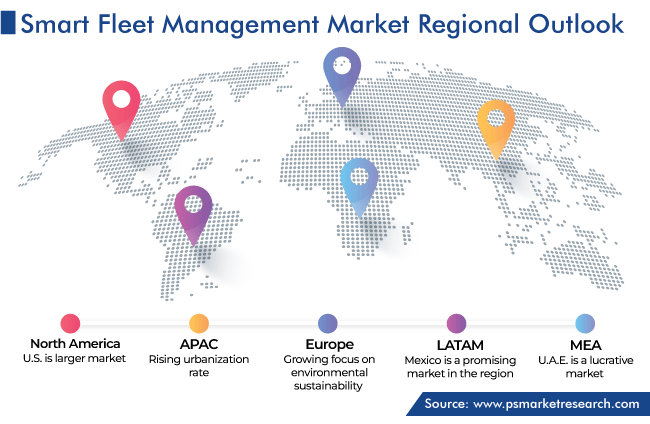

Geographically, Asia-Pacific holds the largest share, of 55%, in 2023, and it is projected to grow at the highest CAGR. This is mainly due to the rising urbanization rate, increasing population, and rapidly growing economy of Japan, China, and India. These factors create a huge demand for fleet management software to optimize transportation and logistics operations. In India, according to the IBEF, approximately 14.4% of the GDP contribution is accounted for by the logistics sector, on which more than 22 million people depend for income.

Additionally, the rising stringency of the government norms with respect to emissions is propelling the market growth, as fleet management can optimize routes, reduce fuel consumption, and promote eco-friendly driving behavior. In addition to this, the increasing number of road accidents across the region boosts the requirement for enhanced vehicle safety features. According to the Ministry of Road Transport and Highways, in 2021, there were 412,432 road accidents across India, which claimed 153,972 lives and injured 384,448 persons. In the wake of the same, the government has mandated the implementation of vehicle safety technologies to curtail the number of accidents and road fatalities.

Europe holds the second-largest market share due to the rising demand for commercial vehicles. According to the CEIC, the sale of commercial cars in Germany was reported at 312,391 units in December 2022. Additionally, the growing focus on environmental sustainability and the implementation of federal regulations to achieve it drive the adoption of smart fleet management solutions in Europe.

This fully customizable report gives a detailed analysis of the smart fleet management industry, based on all the relevant segments and geographies.

Based on Connectivity Type

Based on Mode of Transportation

Based on Application

Based on Operation

Geographical Analysis

The 2024 value of the market for smart fleet management solutions is an estimated USD 529.8 billion.

The smart fleet management industry CAGR during 2024–2030 will be 8.2%.

The roadways category dominates the mode of transportation segment of the market for smart fleet management solutions.

ADAS is the key application in the smart fleet management industry.

The adoption of EVs and cloud-based technologies is the key trend in the market for smart fleet management solutions.

APAC is the largest and Europe the second-largest region in the smart fleet management industry.

The market for smart fleet management solutions is propelled by the rising number of road fatalities and increasing need for fleet operational expense reduction.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages