Report Code: 12857 | Available Format: PDF | Pages: 280

Packaging Resin Market Size and Share Analysis by Type (LDPE, PP, HDPE, PET, EPS, PVC), Application (Food & Beverages, Pharmaceuticals, Consumer Goods, Healthcare, Industrial) - Global Industry Revenue Estimation and Demand Forecast to 2030

- Report Code: 12857

- Available Format: PDF

- Pages: 280

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Packaging Resin Market Size & Share

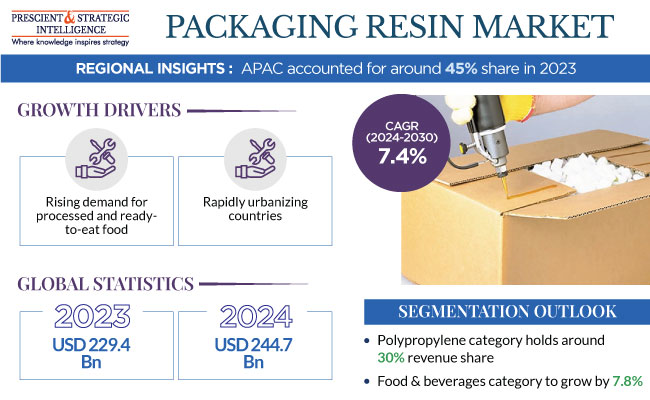

The global packaging resin market is estimated to have stood at USD 229.4 billion in 2023, and it is predicted to reach USD 374.9 billion by 2030, advancing at a CAGR of 7.4% during 2024 and 2030. This will be due to the increasing demand for packed food & beverages, itself owing to the growing trend of ready-to-eat food and online ordering, increasing population, and swift urbanization. Thus, the expanding food packaging sector, driven by the increasing demand for ready-to-cook and on-the-go food products, plays a pivotal role in the expansion of the market.

Packaging resins are versatile polymer materials that can be shaped through processes such as molding, extrusion, and solidification to produce a wide range of packaging items, including bottles, containers, and films. This is done by modifying their molecular structure, chemical composition, and physical properties for specific applications. These chemicals help maintain product quality, prolong shelf life, and prevent contamination.

Polypropylene Is Largest Shareholder in Market

The polypropylene market held the largest share, of 30%, in 2023, in terms of revenue. Polypropylene is a type of thermoplastic polymer that is widely used for packaging due to its durability, flexibility, and chemical resistance. It can be used in flexible and rigid packaging, such as films and containers. Being a lightweight material, it can save cost in transportation. Moreover, it is recyclable; therefore, it reduces the environmental impact. It can be used in the packaging of warm food products, such as soups and ready-to-eat dishes, and containers that can be microwaved, as it can withstand high temperatures.

HDPE To Experience Rapidly Growing Consumption

The HDPE category is expected to generate revenue of more than USD 65 billion in 2030. The rise in the demand for HDPE from various sectors, such as personal care and consumer goods, is due to its durability and strength. It is mostly required for the production of the containers, bottles, and caps to be used for beverages, personal care items, and cleansing products. Additionally, its exceptional resistance to a wide range of chemicals, including acids and bases, renders it suitable for the storage of various beverages and substances. HDPE is also employed in the fabrication of pallets, crates, and various types of rigid packaging.

Its robustness and ability to withstand strong impacts make it a prime choice for the safe transportation and storage of goods. Further, unpigmented bottles made from it are transparent, yet act as a strong barrier against environmental forces, making them suitable for packing goods with a short shelf life, such as milk.

The LDPE category also holds a significant share, as this plastic is used in packaging films, especially those meant for food items, due to its clarity and processability. It is also used to manufacture cables and wires.

Further, the PVC classification is witnessing a high CAGR. This polymer is transparent, restricts the transfer of oxygen, and provides strong resistance to oils. It is used in the manufacturing of a wide array of packaging products, such as plasma and blood component containers; flexible, unbreakable bottles and jars; tubes, as well as heart–lung bypass machines, since it offers strong barrier capabilities for conservation.

| Report Attribute | Details |

Market Size in 2023 |

USD 229.4 Billion |

Market Size in 2024 |

USD 244.7 Billion |

Revenue Forecast in 2030 |

USD 374.9 Billion |

Growth Rate |

7.4% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Type; By Application; By Region |

Explore more about this report - Request free sample

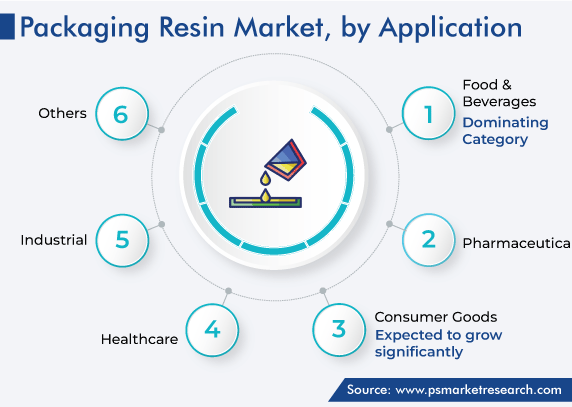

Food & Beverage Application To Lead Market

Based on application, the food & beverage category leads the market, and it is expected to grow at a rate of 7.8% during the forecast period. The packaging resin demand primarily originates from the food & beverage sector owing to the increasing sale of packaged and processed food, which is itself supported by the rising population. Here, HDPE and LDPE are used widely to produce bottles, plastic bags, and food containers, while PVC is used for shrink wraps and blister packaging. Furthermore, the growth in disposable income is forecast to boost the need for processed, ready-to-eat, and ready-to-cook food products.

Further, the necessity for an extended product shelf life, which serves the dual purpose of safeguarding food items over long periods and ensuring consumer safety, has led to an elevated demand for packaging materials. The polymer resin used must be compatible with the food products, while also enhancing the visual appeal of the packaging. The need for flexible packaging has been on the rise due to the hectic work–life schedules, an aging population, the growing demand for convenient packaging, the expansion of e-commerce, the growth of the online food delivery market, and the need to package products in various sizes and quantities.

Seeing this demand, market players are making efforts to come up with advanced plastic materials specifically designed for food & beverage companies. For instance, at Anuga FoodTec, held in Cologne in April 2022, Mondi plc introduced new food packaging solutions made using advanced polypropylene materials. These solutions preserve food, reduce waste, and ensure the integrity of the products through the supply chain.

Further, bioplastic packaging is in high demand in this industry due to its capacity to reduce the carbon footprint and eradicate the need for extensive waste disposal methods. With over a million tonnes of plastic waste produced annually, posing significant disposal challenges, there is growing importance on scaling up the production of bioplastic packaging to reduce waste.

The pharmaceutical category is expected to have a robust CAGR during this decade, as this sector heavily depends on packaging to safeguard medicines and medical devices. Resins such as HDPE, LDPE, and PVC offer great barrier properties, protecting these products from oxygen, light, and moisture. Polystyrene and PVC are used for the blister-packaging of tablets and capsules. Further, plastics with strong chemical resistance and minimal reactivity are preferred in this sector for aseptic packaging, as they stop interactions between the packaging material and the contents, keeping the efficacy of the pharmaceutical products intact.

Further, medical devices, such as catheters, syringes, and surgical instruments, are often packaged in plastic. Packaging for over-the-counter medications and prescription drugs is equipped with tamper-evident seals to ensure the integrity and safety of the products for the end user and stop the trade of counterfeits. Further, the packaging materials used in the pharmaceutical industry must adhere to strict regulatory guidelines, such as those established by the FDA, EMA, and other global national, regional, and international bodies.

The electronics category holds a significant share, due to the growing demand for smartphones, laptops, tablets, wearable consumer and medical devices, AR/VR headsets, and various other kinds of gadgets. Protective enclosures for electronic devices are designed to provide heat resistance and insulation, to shield delicate components from external elements that could, otherwise, impair their performance.

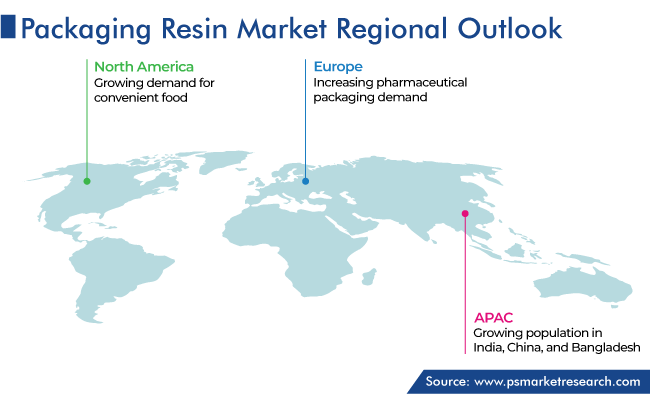

Asia-Pacific Dominates Market

The Asia-Pacific packaging resin market is expected to continue to be the largest till 2030. The growing population in India, China, and Bangladesh is projected to fuel the demand for convenience food, thus creating sufficient opportunities for the manufacturers of plastics for packaging purposes. According to the Agricultural and Processed Food Products Export Development Authority (APEDA) of India, foreign direct investment in the food processing sector in 2022–23 was USD 895.34 million. Furthermore, the existence of expansive manufacturing units for polymer resins, such as PVC, PE, and polystyrene, in China is expected to foster the market growth.

The need for FMCG items has been driven by urbanization, rising disposable income, expanding consumer spending, and evolving choices, which has, in turn, augmented packaging requirements in APAC. The growth in the production of beauty and personal care products in China, Japan, India, and ASEAN countries also contributes to the demand for packaging in the region.

Moreover, considering the growing demand for environment-friendly packaging, numerous countries in the region are actively exploring biodegradable materials and recycling methods. Regulatory measures and industry initiatives are being implemented to minimize the use of single-use plastics and promote biodegradable and recyclable resins. Some of the recently developed bioplastics are polyhydroxyalkanoate (PHA), polylactic acid (PLA), and crystallized polylactic acid (CPLA).

PLA is biodegradable, recyclable, as well as compostable, as it is derived from sugarcane or corn starch. Its applications are in food packaging, 3D printing filaments, and disposable cutlery. For instance, NatureWorks manufactures PLA under the brand name Ingeo and provides several other biopolymer resins and fibers for injection-molding, extrusion & thermoforming, printing, and films & cards.

Key Global Players in Packaging Resin Market Are:

- China Petrochemical Corporation

- Exxon Mobil Corporation

- BASF SE

- SABIC

- Dow Chemical Company

- LyondellBasell Industries Holdings B.V.

- Borealis AG

- INEOS Group Limited

- Sinopec Corporation

- Indorama Ventures Public Company Limited

- Reliance Industries Limited

- Braskem SA

- Mitsubishi Chemical Corporation

Market Size Breakdown by Segment

This report offers deep insights into the packaging resin market, with size estimation for 2017 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Segment Analysis, by Type

- Low-Density Polyethylene (LDPE)

- Polypropylene (PP)

- High-Density Polyethylene (HDPE)

- Polyethylene Terephthalate (PET)

- Polystyrene (PS) & Expanded Polystyrene (EPS)

- Polyvinyl Chloride (PVC)

Segment Analysis, by Application

- Food & Beverages

- Pharmaceuticals

- Consumer Goods

- Healthcare

- Industrial

Region/Countries Reviewed for this Report

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

The market for packaging resins will have a CAGR of 7.4%.

The packaging resin industry valued USD 229.4 billion in 2023.

Biodegradable and naturally sourced polymers are trending in the market for packaging resins.

Polypropylene will have the largest packaging resin industry size in 2030.

Food & beverage application dominates the market for packaging resins.

The packaging resin industry is growing with the booming food & beverage and pharmaceutical sectors, rising population, and increasing spending power.

APAC holds the biggest share in the market for packaging resins.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws