Report Code: 11727 | Available Format: PDF | Pages: 186

3D Printing Filaments Market Research Report: By Type (Plastics {Polylactic acid, Acrylonitrile butadiene styrene, Polyethylene terephthalate glycol, Acrylonitrile styrene acrylate}, Metals, Ceramics), Application (Food Additives, Pharmaceuticals, Agricultural Products, Personal Care Products, Plasticizers, Fuel Additives) - Global Industry Analysis and Demand Forecast to 2030

- Report Code: 11727

- Available Format: PDF

- Pages: 186

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

3D Printing Filament Market Overview

The global 3D printing filament market generated revenue of $693.1 million in 2019. The market size is expected to reach $7,082.0 million by 2030, showcasing a CAGR of 26.8% during the forecast period (2020–2030). This massive growth can be attributed to the rising rate of adoption of the 3D printing technology in the aerospace industry, which is growing at a considerable pace itself, thereby increasing the demand for 3D printing filaments.

Due to COVID-19, the demand from the 3D printing filament market, for filaments, has witnessed a decline, since most of the companies are reducing their capital and operational expenditure. Since the 3D printing technology is expensive in comparison to other available options, the demand for such filaments is expected to witness a negative impact, owing to the crisis. However, the fall in the demand is temporary, since 3D printing is an effective way for companies to reduce the dependence on raw material or equipment suppliers.

.jpg)

Segmentation Analysis

Plastics Generated Largest Demand in 2019

Based on type, plastic-based filaments accounted for the largest size in the 3D printing filament market in 2019. The low material cost, easy availability, and less intricacy of plastic-based filaments make them the preferred choice over other types of filaments. Moreover, since the cost of 3D printing is high, it is quite essential to decrease the overall cost of printing a product using this technology. Plastic, to some extent, decreases the manufacturing cost, thus becoming the preferred choice of manufacturing companies.

Consumer Goods Industry To Showcase Fastest Growth

On the basis of application, the consumer goods category is expected to demonstrate the fastest growth in the 3D printing filament market during the forecast period. The consumer goods industry is highly competitive and requires new products in a short time, to attract consumers. Therefore, companies are adopting the 3D printing technology to improve the product aesthetics and functional appeal. Since the technology takes less time to develop a model or product, which eventually reduces the time for research and development (R&D), it increases the available time for the product’s marketing. Owing to such factors, the technology is likely to witness a fast-paced adoption in the consumer goods sector, in turn, helping this category grow the fastest during the forecast period.

Geographical Outlook

North America Took First-Mover Advantage

Geographically, the North American region held the largest share in the 3D printing filament market in 2019, and the trend is likely to continue during the forecast period. The region adopted the technology in its initial stages, and from then onward, companies in the region have been investing in it, in order to integrate it with the traditional manufacturing machines, which has led to the large market size of the region in the 3D printing filament market.

Moreover, the presence of big players in the region, such as DuPont de Nemours Inc., Stratasys Ltd., 3D Systems Corporation, and Huntsman Corporation, is also aiding in the growth of the 3D printing filament industry, as these companies are actively developing new products and methods to decrease the cost of the 3D printing technology.

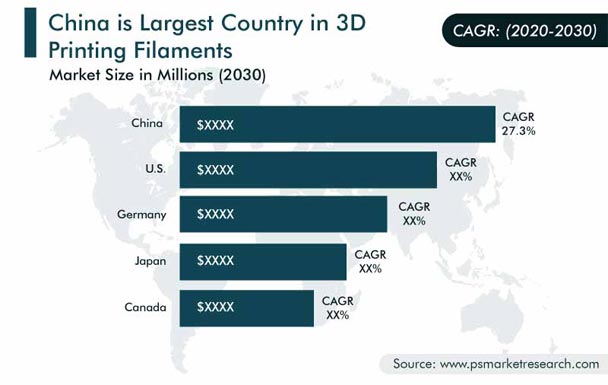

Asia-Pacific (APAC) To Demonstrate Fastest-Growing Demand

The APAC region held the second-largest share in the 3D printing filament market in 2019, after North America. The demand in the APAC region is expected to increase in the near future, owing to the rapid advancement in 3D printing technologies, as well as a rise in the digital manufacturing of industrial tools, automobile parts, agriculture machinery, and medical prototypes. China, in particular, is growing at a high pace in the 3D printing market, and subsequently, the 3D printing filament market, owing to the strong government support to promote the industry.

In addition, according to the China Industry Information Institute, the 3D printing industry in the country would have an output value of $7.68 billion, or one-third of the global market, by 2020. Therefore, such factors are expected to propel the 3D printing filament market growth in the region during the forecast period.

Trends & Drivers

Shift from Traditional Manufacturing Methods to Filament-Based 3D Printing Processes

The manufacturing industry is mostly dominated by subtractive manufacturing, which involves molding, casting, forging, extruding, and cutting processes, for product manufacturing. The method is capable of mass production of objects having fewer complex designs. However, during intricate designing, the method is not as effective, in comparison to when used for less-complex products. Therefore, in recent times, companies have started using filament-based 3D printing processes, which enable product development with improved aesthetics. This is leading to the increasing demand for filaments, which is subsequently boosting the 3D printing filament market.

Moreover, in traditional methods, several fixed and variable costs are associated, such as a larger number of machines and higher manpower, which is not the case with the 3D printing technology. Owing to such factors, several industries, such as automotive and medical device, have started adopting this technology in their regular manufacturing operations, which again results in the growth of the 3D printing filament market.

.jpg)

Increasing Demand for 3D Printing Filaments in Aerospace Industry

As per the International Air Transport Association (IATA), the total global revenue generated by commercial airlines reached $876.0 billion in 2019, compared to $845.0 billion in 2018. The data shows the growing aerospace and aviation industries, which, in turn, is leading to the increasing demand for new aircraft, in order to ferry more passengers and cargo than ever. To meet this demand, the production of aircraft components has witnessed a rise.

In order to produce these components, the 3D printing technology is proving to be effective, as it uses filaments to produce components, which results in a reduction in the weight of the manufactured products, increase in strength, achievement of complex and customized designs, and minimal wastage. Owing to the abovementioned benefits, the demand for 3D printing filaments in the aerospace industry is expected to continue to rise during the forecast period.

| Report Attribute | Details |

Historical Years |

2014-2019 |

Forecast Years |

2020-2030 |

Base Year (2019) Market Size |

$693.1 Million |

Forecast Period CAGR |

26.8% |

Report Coverage |

Market Dynamics, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Company Share Analysis, Companies’ Strategic Developments, Competitive Benchmarking, Company Profiling, COVID-19 Impact |

Market Size by Segments |

Type, Application, Geography |

Market Size of Geographies |

U.S., Canada, Germany, U.K., France, Italy, China, Japan, South Korea, Australia, Brazil, Mexico, Saudi Arabia, U.A.E. |

Secondary Sources and References (Partial List) |

Additive Manufacturing Association of Taiwan, Advanced Manufacturing Association of Tokyo, Additive Manufacturing Community, American Society for Testing and Materials, Association for Metal Additive Manufacturing, International Air Transport Association, International Monetary Fund, German Trade & Invest, Global Alliance of Additive Manufacturing Associations, Global Manufacturing and Industrialization Summit, Organization Internationale des Constructeurs d'Automobiles, National Additive Manufacturing Association, National Additive Manufacturing Innovation Institute, Plastics Industry Association, Shanghai Additive Manufacturing Association, Society of Manufacturing Engineers, United Nations Industrial Development Organization, World Bank, World Plastics Council |

Explore more about this report - Request free sample

Rise in Demand for 3D Printed Components and Parts from Automotive Industry

Currently, the automotive industry is going through a tough phase, due to a drop in the sale in 2019, because of demand and supply imbalance and COVID-19 impact in 2020. despite that automobile manufacturers are making hefty investments in R&D to reduce the weight and increase the strength of vehicles, as well as to make vehicles more aesthetically appealing. Owing to such factors, companies have started to create components such as interior accessories, air ducts, full-scale panels, and functional mounting brackets via filament-based 3D printing, which propels the growth of the 3D printing filament market.

Further, as per Organisation Internationale des Constructeurs d'Automobiles (OICA), the total number of vehicles produced throughout the world was 95.6 million in 2018. The large-scale production of vehicles is eventually resulting in an increasing demand for automotive components and parts, some of which are now being developed using the 3D printing technology. This is likely to increase the demand for 3D printing filaments in the automotive industry and aid in the development of the 3D printing filament market

Companies Engaging in Product Development to Increase Market Share

The 3D printing filament market is highly consolidated in nature, with the presence of several large-scale players, such as DuPont de Nemours Inc., Koninklijke DSM N.V., Evonik Industries, SABIC, Huntsman Corporation, Stratasys Ltd., and 3D Systems Corporation.

These players are using the strategy of product development, in order to capture new customers and enhance their market share. For instance,

- In May 2020, MakerBot Industries LLC, a subsidiary of Stratasys Ltd., launched a METHOD carbon fiber material for 3D printing. The new material is designed to enable engineers to print stronger and more-accurate parts, for manufacturing tools, jigs, and fixtures and for end-use production; it can also be used to print replacement metal parts in some applications. The launch of the new material will help the company increase its product portfolio and share in the 3D printing filament market.

- In February 2020, Evonik Industries AG launched its first software tool for 3D printing, based on the Castor technology. The software was developed by Castor, an Israeli start-up, in which Evonik Venture Capital had invested in late 2019. The software is designed to assist manufacturers in selecting the appropriate additive manufacturing process for their desired parts, depending on the geometry, material, and financial analysis of the design, thereby saving costs in the process. The tool is designed to help the company capture a larger share, in both the 3D printing and 3D printing filament markets.

Some of Key Players in 3D Printing Filament Market Are:

-

Stratasys Ltd.

-

3D Systems Corporation

-

Airwolf 3D

-

ColorFabb B.V.

-

Markforged Inc.

-

Shenzhen Esun Industrial Co. Ltd.

-

Push Plastic

-

Solidspace Technology LLP

-

TreeD Filaments

-

Innofil3D BV

-

Koninklijke DSM N.V.

-

Evonik Industries AG

-

DuPont de Nemours Inc.

-

SABIC

-

Huntsman Corporation.

3D Printing Filaments Market Size Breakdown by Segment

The 3D printing filaments market report offers comprehensive market segmentation analysis along with market estimation for the period 2014–2030.

Based on Type

- Plastics

- Polylactic acid (PLA)

- Acrylonitrile butadiene styrene (ABS)

- Polyethylene terephthalate glycol (PETG)

- Acrylonitrile styrene acrylate (ASA)

- Metals

- Ceramics

Based on Application

- Industrial

- Aerospace and Defense

- Automotive

- Consumer Goods

- Healthcare

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Asia-Pacific (APAC)

- China

- Japan

- Australia

- South Korea

- Rest of World (ROW)

- Brazil

- Mexico

- Saudi Arabia

- U.A.E.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws