Report Code: 11895 | Available Format: PDF | Pages: 317

Outdoor Lighting Market Research Report: By Lighting Type (HID Lights, LED Lights, Fluorescent Lights, Plasma Lights), Component (Fixture, Control), Application (Streets, Highways, Parking Lots, Stadiums, Tunnels), Distribution Channel (Direct Sale, Retail)- Industry Trends and Demand Forecast to 2030

- Report Code: 11895

- Available Format: PDF

- Pages: 317

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

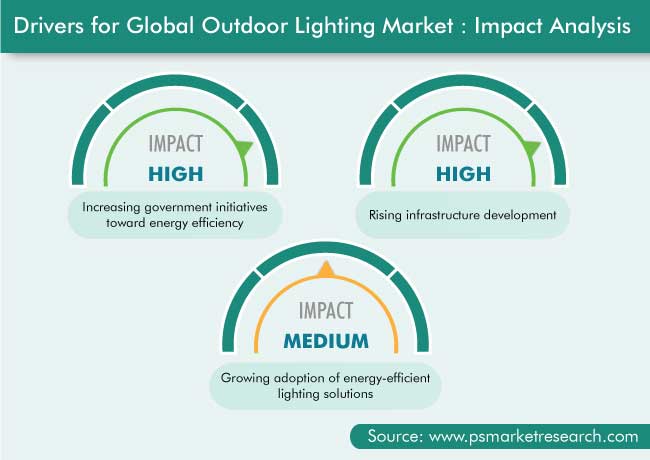

The global outdoor lighting market generated revenue of $10,352.1 million in 2020, and it is expected to grow at a CAGR of 7.0% during the forecast period (2020–2030). The key factors responsible for the growth of the industry include the increasing adoption of energy-efficient lighting solutions, growing government initiatives toward energy efficiency, and rising infrastructure development.

Due to the COVID-19 pandemic, the market for outdoor lighting witnessed a major impact. China is a hub of raw materials and a significant manufacturer of lighting products, and COVID-19 hampered the production of different forms of lighting systems and products as well as the export of raw materials from China to other countries. Moreover, several governments imposed restrictions on traveling from one country and state to another, which impacted the hospitality and travel industry, thereby resulting in a negative influence on the market.

LED Lights, Fixture, and Direct Sale Category Dominated the Market

The light-emitting diode (LED) lights category accounted for the largest share in the outdoor lighting market in 2020, based on lighting type. It is further expected to be the fastest-growing category during the forecast period. This can be attributed to the escalating penetration of LEDs as a light source in several applications, such as streets, parking lots, and stadiums. Moreover, LED enables the effective use of light intensity controls and increases energy savings potential.

The fixture category dominated the market during the historical period (2015–2020), on the basis of component type. This is attributed to the mass installation of lighting fixtures, which are used to generate artificial light through the use of various lighting sources, such as LED, fluorescent, and plasma lights.

The direct sale category recorded a larger share in the market in 2020, based on distribution channel. This is attributed to the surging distribution of lighting products through a direct sale channel for commercial areas, such as highways, airports, parking lots, jogging tracks, village square streets, and bridges.

Streets Category To Witness High Growth Rate

The streets category is expected to observe the fastest growth in the market during the forecast period, based on application. This can be mainly due to the development of smart cities, wherein the installation of smart street lights would help save energy, reduce maintenance costs, control light intensity, and reduce carbon emissions.

Asia-Pacific (APAC) Market To Witness Fastest Growth in the Coming Years

Geographically, APAC generated the largest revenue in 2020 in the market for outdoor lighting. This is attributed to the deployment of smart LED lighting systems in the region and proliferating government initiatives in this regard. The region is also predicted to continue maintaining its lead in the market in the coming years as well, owing to the increasing number of smart city projects in countries like China, India, and South Korea.

Further, local governments are focusing on energy saving via the adoption of LED-based lighting or solar-based lighting products on streets. The high-efficiency and low-power-consumption features of LEDs are the key factors facilitating the growth of the street lighting sector in the region.

Emergence of Smart Outdoor Lighting Is a Key Market Trend

The concept of smart outdoor lighting is gaining popularity, as it finds promising applications in several areas of outdoor lighting, including roadways and highways, city parks and public areas, sports parks, commercial sites, outdoor parking lots, and university and college campuses. As electricity prices are increasing, a number of municipalities across the globe are switching over to smart lighting to reduce functional costs, while improving system efficiency and ensuring safety.

Benefits associated with the deployment of smart lighting include up to 40–50% energy savings, automation, real-time diagnostics, and creation of communication-connected infrastructure. Thus, the use of smart and connected lighting solutions diminishes energy expenditure, decreases maintenance cost, enhances safety in public spaces, and reduces environmental impact.

Growing Adoption of Energy-Efficient Lighting Solutions and Rising Infrastructural Development Boosting the Market Growth

The surging adoption of energy-efficient lighting solutions is driving the market growth, due to the increasing government focus toward promoting energy saving with the usage of energy-efficient lighting sources, predominantly LEDs. LEDs are particularly advantageous in outdoor lighting applications, as they work efficiently for long-operating hours at low-maintenance costs. In addition, LEDs are excellent directional light sources, and exhibit a long lifetime. Owing to these benefits, many local authorities, including municipalities of various countries, have commenced projects to completely transition their outdoor lighting systems to LEDs.

Further, the rising traffic has been one of the major reasons for the development of new highways and streets. The surging number of passenger vehicles is the major factor for traffic congestion across the globe, which is fueled by increasing urbanization and rising disposable income. To reduce traffic jams on the road, governments in various countries, including the U.S., China, and India, are strongly focusing on making investments in road infrastructural development. For instance, in the U.S., the $3.3 billion Hampton Roads Bridge-Tunnel (HRBT) expansion project includes the construction of a four-lane tunnel and a widening from four to eight lanes on I-64 in an area between Hampton and Norfolk and it is expected to complete by 2024, which, in turn, propel the demand and use of streets, highways, and tunnel lightings.

| Report Attribute | Details |

Historical Years |

2015-2020 |

Forecast Years |

2021-2030 |

Base Year (2020) Market Size |

$10,352.1 Million |

Market Size Forecast in 2030 |

$20,269.7 Million |

Forecast Period CAGR |

7.0% |

Report Coverage |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Company Profiling |

Market Size by Segments |

By Lighting Type; By Component; By Application; By Distribution Channel; By Region |

Explore more about this report - Request free sample

Market Players Involved in Mergers and Acquisitions and Geographical Expansions to Gain Competitive Edge

The global outdoor lighting industry is fragmented, with the presence of numerous market players; and in recent years, the players have been involved in mergers and acquisitions and geographical expansions in order to attain a significant position. For instance:

- In March 2021, SMART Global Holdings Inc. announced that it completed its acquisition of Cree Inc.’s Cree LED products business unit (Cree LED). Cree LED operates as the Cree LED business unit of the company for up to $300.0 million, including fixed upfront and deferred payments and contingent consideration. The company would leverage its track record of integrating companies and unlocking margin and revenue growth, and continue to offer best-in-class specialty lighting solutions.

- In July 2021, Iwasaki Electric Co. Ltd. installed LEDioc LED lightbulbs in parks of Kumamoto city, Japan. With a plan to curb energy consumption across the parks under its management, in 2020, Kumamoto City carried out a city-wide blanket upgrade of all luminaires to LEDs across the 550 parks where public lighting was installed, focusing on developing a lighting environment with a comforting and reassuring ambiance, whilst also effectively addressing the relevant environmental considerations.

Key Players in Global Outdoor Lighting Market Are:

- Signify N.V.

- General Electric Company

- OSRAM Licht AG

- Zumtobel Group AG

- Hubbell Incorporated

- SMART Global Holdings Inc.

- Acuity Brands Inc.

- Dialight Plc

- Stanley Electric Co. Ltd.

- Iwasaki Electric Co. Ltd.

Market Size Breakdown by Segments

The global outdoor lighting market report offers comprehensive market segmentation analysis along with market estimation for the period 2015-2030.

Based on Lighting Type

- High-Intensity Discharge (HID) Lights

- Light-Emitting Diode (LED) Lights

- Fluorescent Lights

- Plasma Lamps

Based on Component

- Fixture

- Control

Based on Application

- Streets

- Highways

- Parking Lots

- Stadiums

Based on Distribution Channel

- Direct Sale

- Retail

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- Italy

- France

- Spain

- Asia-Pacific (APAC)

- China

- India

- Japan

- South Korea

- Australia

- Latin America (LATAM)

- Brazil

- Mexico

- Middle East & Africa (MEA)

- Saudi Arabia

- Turkey

- U.A.E.

- South Africa

In 2030, the value of the outdoor lighting market will be $20,269.7 million.

Light-emitting diode (LED) lights are the largest category under the lighting type segment of the outdoor lighting industry.

The major outdoor lighting market drivers are the increasing adoption of energy-efficient lighting solutions, growing government initiatives toward energy efficiency, and rising infrastructure development.

APAC is the largest and the fastest-growing outdoor lighting market.

Most outdoor lighting market players are adopting mergers and acquisitions and geographical expansions strategies to sustain their business growth.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws