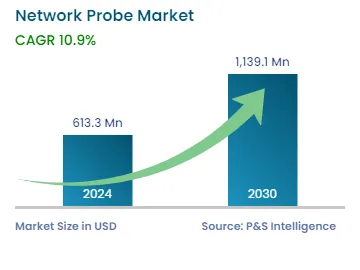

Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 613.3 Million |

| 2030 Forecast | USD 1,139.1 Million |

| Growth Rate(CAGR) | 10.9% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12691

Get a Comprehensive Overview of the Network Probe Market Report Prepared by P&S Intelligence, Segmented by Component (Solutions, Services), Organization Size (Large Enterprises, SMEs), Deployment Mode (On-Premises, Cloud), End User (Service Providers, Enterprises), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 613.3 Million |

| 2030 Forecast | USD 1,139.1 Million |

| Growth Rate(CAGR) | 10.9% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global network probe market generated revenue of USD 613.3 million in 2024, and it is further predicted to reach USD 1,139.1 million by 2030, exhibiting a CAGR of 10.9% between 2024 and 2030. This is due to the rising number of network-connected devices worldwide, the rapidly increasing adoption of monitoring tools and software solutions to reduce complexities in the IT infrastructure, and the surging need for centralized monitoring systems.

The market growth has been significantly influenced by the increasing reliance on remote work and digitalization and the rising prevalence of social media worldwide. Network probes help businesses in monitoring their traffic and further improve their performance, particularly in the work-from-home environment. Thus, their usage is rising for the real-time monitoring of the network traffic and quick identification of the causes of any slowdown.

Moreover, with the increasing investments of enterprises across industries for the expansion of their infrastructure and to tackle the challenges of an advancing IT infrastructure, the requirement for these solutions to manage the additional layer of network has risen. Thus, the rising adoption of this centralized approach with the use of visualized dashboards has led to the rapid deployment of the associated monitoring software and tools by service providers and enterprises.

Additionally, the rising frequency of cyberattacks is a major factor that has created a greater requirement for these probes. This is because of small businesses and IT departments’ strengthening focus on protecting their valuable data, preventing network disruptions, resolving issues quickly, and improving their IT infrastructure's performance. In addition, the growing adoption of cloud-based technologies by several enterprises, with an emphasis on cybersecurity management, is propelling the industry.

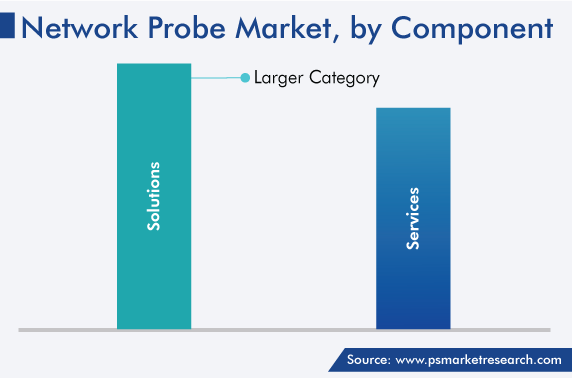

The solutions category, based on component, holds the larger market share, because of the rising demand for these tools from various industries, including BFSI, aerospace & defense, ICT & media, public services, and telecommunications. These solutions offer a wide range of services that allow network administrators and engineers to gather important information about the network performance, to detect security threats and ensure the smooth operations of the telecom infrastructure. Market players also provide solutions for performance monitoring, troubleshooting, security analysis, bandwidth management, and cloud monitoring.

Moreover, these solutions provide enterprises with complete, real-time visibility into their traffic and application issues. This enables the monitoring, analysis, and optimization of network performance, while addressing the challenges posed by encrypted, evasive, IoT, and SCADA traffic in hybrid IT & cloud environments.

The services category is expected to witness the faster growth, at a CAGR of more than 11.2%, over the forecast period. This can be because consulting services related to these probes assist businesses in tackling the challenges and seizing the opportunities associated with their networking infrastructure. These services also aid in strategically aligning and prioritizing operational, networking, and business needs. Companies operating in this field offer comprehensive services ranging from assessment and strategic planning to deployment and design, along with ongoing management and monitoring.

Based on organization size, small & medium enterprises is expected to grow faster with a CAGR of more than 11.5% during the forecast period. This is due to the rising utilization of advanced technologies, such as software-defined networking (SDN), AI, cloud computing, and IoT, by them to improve their operational efficiency. In addition, SMEs are using these solutions and services to efficiently manage and optimize their intercommunication infrastructure, simplify management, and edge out competitors, driven by network probes’ advantages such as affordability, scalability, and flexibility.

Furthermore, these enterprises struggle with management due to the complexity of their IT infrastructure, which makes them more susceptible to attacks. Due to the limited budgets for IT management, SMEs often have gaps in their network security. By enabling their monitoring, real-time analysis, and visibility, these probe solutions play an important role in protecting SMEs against cyberthreats and improving their performance.

The large enterprises category is projected to witness the faster growth over the forecast period. This can be attributed to the rising investments by large enterprises to address cyberattacks. These enterprises operate in various challenging environments, including geographically dispersed locations and cloud-based infrastructure, which are susceptible to cyberthreats. As a result, there is a growing demand for network monitoring solutions to mitigate these risks.

The on-premises deployment mode dominates the market due to its increasing usage at small & medium enterprises as well as large enterprises. This mode provides several benefits, including enhanced security, performance, control over data usage and access, and the ability to handle setup, configuration, maintenance, and deployment locally, at customers' premises. This deployment strategy allows for offline data analytics and package filtering, as well as improved system and data control. It also gives users the power to customize their security settings and the freedom to update their software themselves, whenever necessary.

Additionally, it brings advantages such as reduced bandwidth costs, heightened security and privacy, and greater control over server hardware.

Based on enterprise end users, the BFSI category accounts for a significant market share, due to the growing emphasis on cybersecurity. With the rise in the need for the real-time monitoring of traffic, as well as its timely analysis and appropriate management, because of the sensitive nature of financial transactions and data, these probes are being used for achieving the best possible performance, transparency, security, and compliance.

The need for these solutions has been further spurred by the industry's ongoing digital transformation and increasing investments in infrastructure that enables the deployment of advanced technologies. Moreover, as the sector is adopting cutting-edge technologies, such as cloud computing, mobile banking, and IoT, these solutions are playing a critical role in delivering complete network visibility and management.

These solutions are even more significant for the BFSI sector because of the imperative need for regulatory compliance and risk management. They make it possible to continuously monitor and analyze IT activity, thus guaranteeing compliance with data privacy laws, identifying potential security concerns, and aiding forensic investigations and incident response.

Moreover, by prioritizing value generation through ease of use, price differentiation, and variety in their offerings, fintech companies are challenging the old banking paradigm, which depended on client loyalty and trust. Further, with Industry 4.0, the BFSI business is changing as well. In this stage of the BFSI business model, human forces are more-heavily involved. Numerous business applications and academic research studies have already benefited greatly from developments in neural networks and computing.

The service providers category held a larger market share for network probes in 2023. Due to the rising need for cutting-edge technologies, including 5G and IoT, the demand for solutions to support their operations has risen. Here, network probes are essential for tracking and evaluating performance, security, and quality.

Service providers can identify and resolve problems, such as high latency, packet loss, and low throughput, by monitoring and analyzing network traffic, which eventually enhances the entire subscriber experience.

Furthermore, the necessity for improved monitoring technologies has increased due to the exponential expansion in the amount of data traveling through data centers. Service providers are emphasizing the deployment of reliable intercommunication infrastructure that gives optimal performance, in order to provide a better subscriber experience and outperform their rivals.

Drive strategic growth with comprehensive market analysis

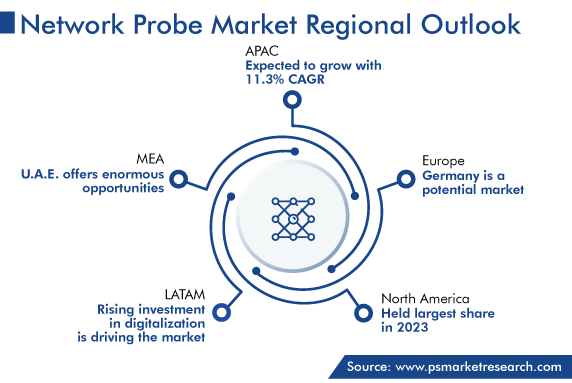

North America held the largest market share, of around 55%, in 2023, primarily due to the region's rapid expansion of internet connectivity and widening application area for network performance metrics. This is credited to the presence of many top companies across industries that have a strong commitment to financial stability and a need for accurate and dependable performance monitoring solutions, for protection, monitoring, and performance enhancement. This is why they are and significantly investing in cutting-edge tools and technologies for network monitoring.

APAC is the fastest-growing regional market as a result of the significant rise in infrastructure investments and the presence of well-known IT and telecom enterprises. Additionally, the adoption of network probing solutions among the SMEs in the region is expected to be influenced by the increasing IP traffic, growing intercommunication complexity, and rising acceptance of SaaS-based monitoring solutions.

Additionally, the rise in data traffic leads to an increase in the frequency and severity of cyberattacks on enterprise networks, including malware, viruses, and denial-of-service (DoS) attacks. The need for these probing solutions among enterprises in the region has grown as a result of the rise in the number of cyberthreats in rapidly developing nations, including China and India, and other major economies, such as Japan and South Korea.

This fully customizable report gives a detailed analysis of the network probe industry from 2019 to 2030, based on all the relevant segments and geographies.

Based on Component

Based on Organization Size

Based on Deployment Mode

Based on End User

Geographical Analysis

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages