Report Code: 11578 | Available Format: PDF | Pages: 232

Automotive Cybersecurity Market Research Report: By Application (ADAS & Safety System, Infotainment, Body Electronics, Powertrain, Telematics), Vehicle Type (Passenger Cars, Commercial Vehicles), Form (In-Vehicle Services, External Cloud Services)- Global Industry Analysis and Growth Forecast to 2030

- Report Code: 11578

- Available Format: PDF

- Pages: 232

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Automotive Cybersecurity Market Overview

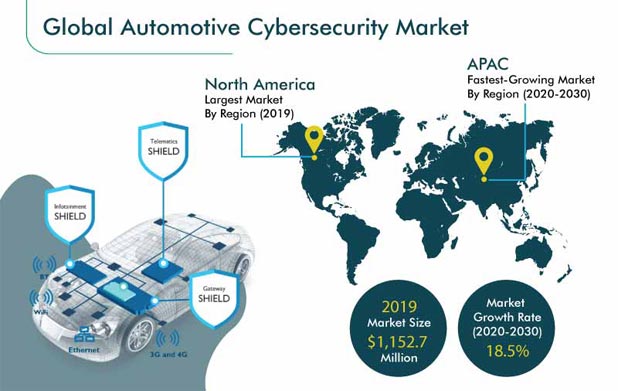

The global automotive cybersecurity market size was $1,152.7 million in 2019, which is projected to reach $7,280.2 million by 2030, growing at a CAGR of 18.5% during the forecast period (2020–2030). Factors such as the rising demand for improved safety features in vehicles, increasing adoption of connected vehicles, and existence of supportive government regulations are expected to boost the demand for automotive cybersecurity solutions. Key players across regions are investing heavily in the development of telematics and improving and adding safety features, which is expected to benefit the market during the forecast period.

The novel coronavirus (COVID-19) outbreak has had a significant impact on the global automotive industry, with an expected 20–25% drop in global vehicle sales in 2020. The shutdown of automotive production hubs across the globe, due to import restrictions and restricted travel allowances, have negatively impacted the automotive cybersecurity market in the short term. However, COVID-19 has compelled the automotive industry to shift to the cloud. The increasing research and development activities, to strengthen automotive cybersecurity services, are expected to create ample growth opportunities for the market players in mid and long terms.

Segmentation Analysis

Passenger Cars Category Accounted for Major Share in Market in 2019

In 2019, the passenger cars bifurcation held larger share in the automotive cybersecurity market, on the basis of vehicle type. This was mainly due to the laws in different countries across the world that are well suited for the deployment of autonomous vehicles, which, in turn, is boosting the demand for cybersecurity solutions in these vehicles. For instance, Europe has mandated several driving-assistance features in vehicles. Thus, the increasing government support toward the adoption of autonomous cars, in the form of the introduction of mandatory regulations, is propelling the demand for cybersecurity software in passenger cars.

Telematics Category Expected To Grow at Highest Rate during Forecast Period

The automotive cybersecurity market is expected to witness the fastest growth in the telematics category, on the basis of application. This would mainly be due to the increased integration of telematics solutions in commercial vehicles, especially by fleet owners, as this offers improved fleet productivity and vehicle efficiency. Additionally, the growing demand for commercial vehicle data analysis, along with the lower costs for repair and maintenance of telematics-integrated vehicles, is also expected to help in the future advance of this category.

In-Vehicle Services Held Larger Market Share in 2019

Based on form, the automotive cybersecurity industry has been bifurcated into in-vehicle services and external cloud services, of which the in-vehicle services bifurcation held larger share in 2019 in the automotive cybersecurity market. This was mainly due to the growing demand for premium, secure, and connected vehicles, which is why automotive manufacturers are increasingly developing automobiles with integrated cybersecurity systems. These systems can be integrated into an automobile’s infotainment system, advanced driver-assistance system (ADAS), and other connected systems, to provide overall security against hackers.

Geographical Outlook

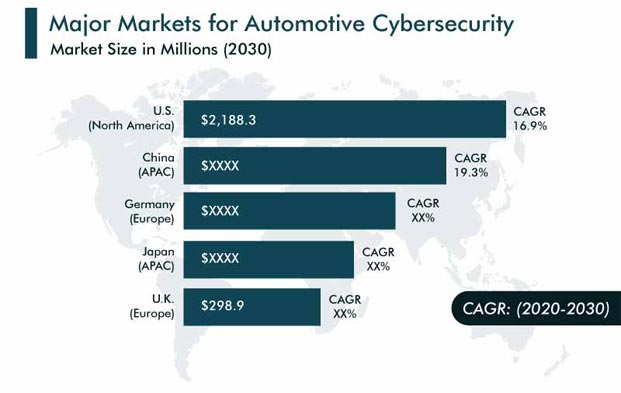

North America – Largest Region in Automotive Cybersecurity Industry

Globally, North America was the largest market for automotive cybersecurity solutions in 2019. The region is home to developed countries — the U.S. and Canada — which are major markets for connected-vehicle solutions. The increasing government regulations are also benefiting the market growth in the region. In the U.S., the Federal Motor Carrier Safety Administration (FMCSA) has mandated the installation of electronic logging devices (ELD) in commercial vehicles. Moreover, the increasing sales of long-haul trucks with pre-installed telematics and fleet solutions, in the country, would continue to benefit the regional automotive cybersecurity market during the forecast period.

Asia-Pacific (APAC) – Fastest Growing Region in Market

The APAC automotive cybersecurity market is expected to witness the fastest growth during the forecast period. APAC, which is home to emerging nations, such as China and India, along with developed economies such as Japan, is the largest market for automobiles. In recent years, the region has emerged as a center for automobile production. Continuous infrastructure developments, coupled with industrial development activities in emerging economies, have opened new avenues, thus creating several opportunities for automotive original equipment manufacturers (OEMs) offering connected vehicles. Therefore, as a result of the increasing adoption of these vehicles in the coming years, the automotive cybersecurity market in the region is expected to witness extensive growth.

Trends & Drivers

Rising Threat of Cyberattack and Data Breach is Key Market Trend

One of the major trends being witnessed in the market is the rising threat of cyberattacks and data breaches, for consumers as well as automakers. With the increasing penetration of connected systems in automobiles, a variety of personal information, such as address books, location data, and credit card numbers, are now entering and leaving the confines of vehicles. As automakers have started taking serious actions against hackers and illegal use of the data stored in the in-vehicle connected systems or cloud systems, they are installing security software in vehicles, thereby driving the automotive cybersecurity market advance.

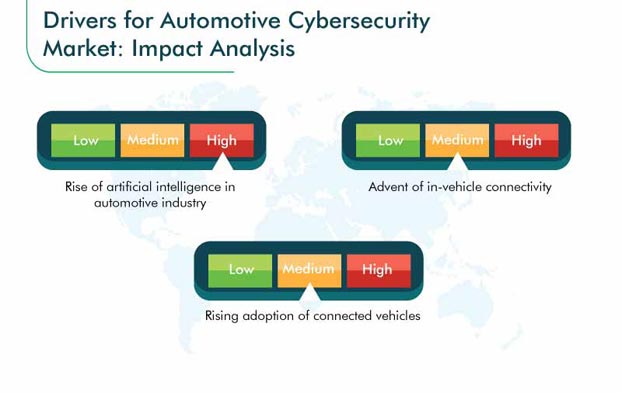

Rise of Artificial Intelligence (AI) Is Driving Global Automotive Cybersecurity Market

The expansion of the automobile industry, with the development of level 4 and 5 autonomous cars, is mainly triggered by the integration of artificial intelligence (AI). The collection of vehicular data has become easier, due to the availability of connected devices and services. However, the collected data must be stored safely and used only for in-vehicle systems. Therefore, the increasing integration of AI in autonomous cars, by automakers, is expected to further result in a rise in the penetration of security and safety solutions in new vehicles. Stringent safety regulations, coupled with the surging end-user preference for safety features, is expected to boost the growth of the automotive cybersecurity market.

Advent of In-Vehicle Connectivity Will Fuel Growth of Market during Forecast Period

People wish to stay connected with the outside world, even while traveling. In the near future, automobiles too would become more connected with the outside world, through cloud services. Responding to customer preferences, automotive manufacturers, through partnerships with information technology (IT) and consumer electronics vendors, are increasingly integrating in-vehicle connectivity features, including smartphone connectivity, roadside assistance, real-time traffic monitoring and collision warnings, and automobile diagnostics. Therefore, the automotive cybersecurity market is expected to witness considerable growth, driven by the increasing consumer preference for staying connected to the internet, while traveling.

| Report Attribute | Details |

Historical Years |

2014-2019 |

Forecast Years |

2020-2030 |

Base Year (2019) Market Size |

$1,152.7 Million |

Forecast Period CAGR |

18.5% |

Report Coverage |

Market Trends, Components to Automotive Cybersecurity, Publicly Reported Automotive Cyber-Attack Incidents (2019–2020), Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Analysis, Companies’ Strategic Developments, Product Benchmarking, Company Profiling |

Market Size by Segments |

By Application; By Vehicle Type; By Form; By Geography |

Market Size of Geographies |

U.S., Canada, Germany, France, Italy, U.K., Japan, China, India, South Korea, Brazil, Mexico, Argentina |

Secondary Sources and References (Partial List) |

Chinese Association for Artificial Intelligence (CAAI), Connected Vehicle Trade Association (CVTA), Danish Artificial Intelligence Society (DAIS), European Association for Artificial Intelligence (EurAI), European Automobile Manufacturers Association (ACEA), Federal Highway Administration (FHA), Insurance Regulatory and Development Authority of India (IRDAI), Intelligent Transportation Systems Joint Program Office (ITS JPO), Interactive Customer Experience Association (ICXA), International Council on Clean Transportation (ICCT) |

Explore more about this report - Request free sample

Rising Adoption of Connected Vehicles

The demand for connected vehicles is constantly increasing, as they offer added features over conventional vehicles. As a downside, this increases the vulnerability of vehicles to potential attacks by hackers. Therefore, with more connected cars on the road, the need for appropriate security measures, to protect the vehicle’s functions against manipulation, will also increase. The integration of cybersecurity systems with ADAS features helps automakers ensure the success of fully connected vehicles, which are highly secure, thereby fueling growth in the global automotive cybersecurity market.

Market Players Launching New Products and Services for High User Adoption and Brand Growth

The automotive cybersecurity market is moderately fragmented, with the presence of numerous global players and few domestic players. In recent years, the major players in the market have taken several strategic measures, such as product launches, partnerships, and facility expansions, to gain a competitive edge.

For instance, in January 2020, Continental AG introduced a new online platform that automates and standardizes software development and integration into the vehicle. With the Continental Cooperation Portal, carmakers and Tier-1 suppliers can save time and money in the vehicle development process and increase software quality and security. System integration is a key competency for the development of complex hardware and software, for future generations of vehicles.

In January 2020, Aptiv PLC unveiled its new vehicle architecture that enables automakers to improve safety and security, increase vehicle efficiency, and deliver an intelligent, connected, software-defined experience to consumers. Aptiv’s Smart Vehicle Architecture (SVA) is an open platform that lowers the total cost of ownership and enables feature-rich, highly automated vehicles. It is also built to meet the prevalent functional safety and cybersecurity standards.

In January 2019, Argus Cyber Security, a major player in the automotive cybersecurity industry, demonstrated its cybersecurity solutions on NVIDIA Corporation’s NVIDIA DRIVE computing platform for autonomous vehicles, at Consumer Electronics Show (CES) 2019. Argus is working closely with NVIDIA to add layers of cybersecurity to NVIDIA DRIVE, an energy-efficient AI computing platform designed to safely enable the functioning of autonomous vehicles of all types.

Key Players in Automotive Cybersecurity Market include:

-

Continental AG

-

DENSO CORPORATION

-

Honeywell International Inc.

-

Harman International Industries Inc.,

-

NXP Semiconductors N.V.

-

Aptiv Plc

-

Robert Bosch GmbH

-

Visteon Corporation

-

Vector Informatik GmbH

-

Trillium Secure Inc.

-

Herjavec Group

-

Oracle Corp.

-

NortonLifeLock Inc

-

VMware Inc.

-

Kaspersky Lab

-

CENTRI Technology

-

Arxan Technologies Inc.

-

DellFer Inc.

-

Argus Cyber Security

-

Guardknox Cyber Technologies Ltd.

Automotive Cybersecurity Market Size Breakdown by Segment

The research offers size of the global automotive cybersecurity market for the period 2014–2030.

Based on Application

- Advanced driver-assistance systems (ADAS) & Safety System

- Infotainment

- Body Electronics

- Powertrain

- Telematics

Based on Vehicle Type

- Passenger Cars

- Commercial Vehicles

Based on Form

- In-Vehicle Services

- External Cloud Services

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- Italy

- France

- APAC

- China

- Japan

- India

- South Korea

- LAMEA

- Brazil

- Mexico

- Argentina

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws