Report Code: 12918 | Available Format: PDF | Pages: 270

Matting Agents Market Share Analysis by Material Type (Organic, Inorganic), Formulation Type (Waterborne, Solvent-Borne, Powder, UV, Radiation-Cured & High Solids), Application (Industrial, Architectural, Leather, Wood, Printing Inks) - Global Industry Demand Forecast to 2030

- Report Code: 12918

- Available Format: PDF

- Pages: 270

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Matting Agents Market Size & Share

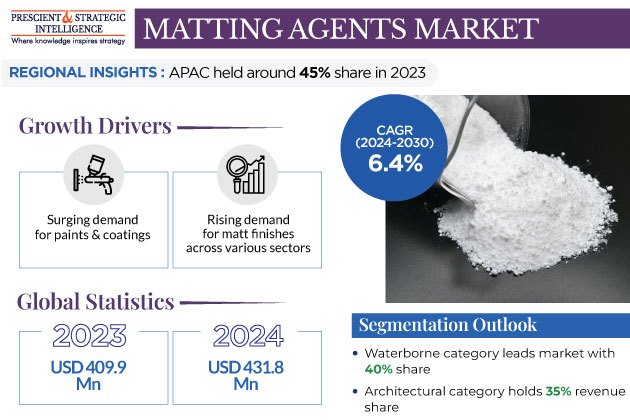

The global matting agents market was valued at USD 409.9 million in 2023, which is expected to reach USD 626.1 million by 2030, growing at a CAGR of 6.4% during 2024–2030.

The major factor contributing to the sector’s growth is the rising demand for matt finishes across various sectors, such as construction, packaging, automotive, and furniture.

Additionally, the surging demand for paints & coatings, along with the rising manufacturing of customized matting agents, is significantly contributing to the sector’s growth. These chemicals improve the performance of paints and coatings by creating a micro rough surface, which helps scatter light, thereby creating the impression of a matt finish.

- Essentially, the surging awareness of matt-finish products in recent years has significantly boosted the demand for such agents.

- This is because this finish is not only low-maintenance but also increases the overall aesthetics, which makes it highly desirable among every age group.

Furthermore, economic efficiency is a critical aspect a consumer considers when choosing between a matt or glossy finish. This is because in the case of the former, issues such as impurities, scratches, and craters are not easily visible, which is the opposite with the latter.

- Additionally, manufacturers are coming up with cutting-edge technologies that enable improved application as well as product performance.

- Matting agents possessing enhanced particle sizes as well as pore distribution are manufactured for ideal performance.

- Products that not only provide matting effect but also improve other characteristics, such as mark and scratch resistance, have been successfully developed by manufacturers.

In addition, the construction and infrastructure industry continues to grow incessantly. This is attributed to the growing need for residential units in emerging economies, such as China and India, because of the rapid growth in their populations as well as the levels of urbanization. A large number of individuals are settling in metropolitan cities, which, in turn, is rapidly increasing the need for commercial, industrial, as well as residential construction in urban areas.

The non-residential construction boom in Asian countries, including South Korea, China, and India, is credited to multinational corporations setting up their operations here. For instance, in July 2023, Samsung set up a manufacturing plant for mobile phones in Noida, India. Furthermore, government programs, such as the Smart City Mission in India, have a positive impact on the market growth.

Growing Demand for Sustainable and Environment-Friendly Matting Agents Is Driving Sales Growth

- Matting agents are significantly utilized in a number of industries, and they have multiple applications, such as adhesives, coatings, paints, and inks.

- The surging demand for sustainable and eco-friendly matting agents is significantly driving sales.

- Agents such as titanium dioxide are considered more environment-friendly in comparison to other such agents because of their non-toxic nature as well as low content of volatile organic compounds (VOC).

Essentially, the surging environmental awareness as well as the strict emission regulations in developed and developing regions is boosting the demand for bio-based matting agents. In order to decrease the adverse effects of chemicals on human health, aquatic life, and the terrestrial and aerial environments, governments across the world are concentrating on green practices. Due to this, the major players in the global market are focusing on supplying products that meet the environmental regulations as well as industry standards. Additionally, these regulations have led to the surging expenditure by matting agent producers in manufacturing processes that meet these standards.

Surging Demand for Long-Lasting and Waterproof Coatings To Drive Sales Growth

- For manufacturing coating materials for automobiles, infrastructure, machinery, energy generation equipment, consumer products, building materials, and other applications, huge investments are being done across the world.

- Such investments are driven by the requirement to manufacture coatings that are long-lasting, robust, and waterproof.

A number of inorganic and organic matting agents, such as wax and silica, are used in coatings to protect metallic as well as other kinds of surfaces from degradation from chemicals, salts, moisture, and other factors. Further, wax-based agents offer slip, mar, abrasion, and scratch resistance, as well as anti-blocking and anti-settling characteristics. This way, the utilization of wax, silica, and fillers in coatings significantly enhances the characteristics of coatings, by increasing the pigment volume concentration (PVC).

| Report Attribute | Details |

Market Size in 2023 |

USD 409.9 Million |

Market Size in 2024 |

USD 431.8 Million |

Revenue Forecast in 2030 |

USD 626.1 Million |

Growth Rate |

6.4% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Material Type; By Formulation Type; By Application; By Region |

Explore more about this report - Request free sample

Inorganic Category Dominates Material Type Segment

On the basis of material type, the inorganic category held a significant share, of 60%, in 2023.

- This is attributed to the increasing demand for inorganic matting materials, such as silica, in a number of applications, such as varnishes, lacquers, plastics, paints, inks, and coatings.

- Silica has a low stir-in capability and viscosity, and it also shows stability in dispersions in most formulations.

- In addition, the material is easily compatible with coating formulations.

- Both types of silica, i.e., pyrogenic and precipitated, are utilized in a broad range of applications.

- Nevertheless, few silica-based matting agents are treated with chemicals or waxes to enhance their finish, by changing their chemical characteristics.

The growing demand for silica-based matting materials in the automotive industry is significantly boosting the market advance in the category. This is attributed to the rising preference for matt-finish surfaces to enhance the vehicle aesthetics. Silica-based matting agents significantly improve grind performance, which, in turn, produces smooth surfaces with enhanced haptic as well as optical characteristics.

- As per the Association des Constructeurs Européens d’Automobiles (ACEA), approximately, 85 million motor vehicles were manufactured across the globe in 2022.

- A rise of 5.7% was observed in comparison to 2021.

- The growing production of vehicles across the world will significantly propel the demand for silica-based matting agents during the projection time frame.

Waterborne Category Leads Formulation Type Segment

On the basis of formulation type, the waterborne category leads the market with a share of 40%, and it is expected to maintain its dominance in the forthcoming years. This is attributed to the rising strictness of government regulations in a number of developing and developed countries for the usage of eco-friendly products. This has resulted in an increase in the spending by the players to come up with alternatives that meet these regulatory requirements. The utilization of water-based inks is increasing because of the issues related to the usage of organic solvents in coating additives, such as rheology and surface modifiers.

Furthermore, the powder formulation type is predicted to witness a high CAGR, of 7%, during the projection time frame.

- This is owing to the durability, cost-effectiveness, and other quality attributes of this formulation type.

- Additionally, it offers improved matting performance, while simultaneously maintaining coating attributes such as color and flow stability.

Architectural Category Leads Application Segment

The architectural category dominates the application segment with a share of 35%, and it is expected to maintain its dominance in the coming years. Matting agents offer temperature as well as corrosion resistance, along with anti-glare characteristics in final products. In addition, they provide scrub resistance, inertness, and film permeability control. Therefore, the rising popularity of matte finishes among individuals, accompanied with the growing construction sector, is likely to boost the demand for these products in architectural coatings.

Additionally, the industrial category held a significant share in 2023. This is attributed to the wide range of applications of such agents, such as in metals, printing inks, plastics, as well as papers.

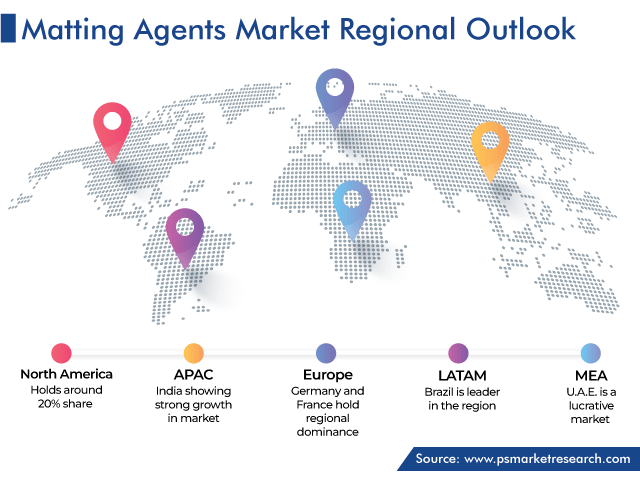

APAC Leads Market

On the basis of regional analysis, Asia-Pacific dominated the market in 2023, and it is expected to maintain its dominance in the forthcoming years.

- This can be attributed to the surging rate of industrialization in emerging economies, such as China and India.

- Moreover, the rapid urbanization in such countries and rising awareness regarding these products are propelling the matting agents market growth.

A huge number of international businesses associated with industries such as manufacturing, electronics, and aerospace are establishing their facilities in the region, thereby boosting the demand for these products.

- In July 2022, BASF SE, via its subsidiary BASF Coatings (Guangdong) Co. Ltd. (BCG), expanded its manufacturing competencies for automotive refinish coatings at its operational location in Jiangmen, Guangdong Province, in South China.

- The firm enlarged its production capacity to 30,000 tons per annum.

In addition, the rapid economic growth in the developing nations in the region, rising population, and surging personal disposable income drive the expenditure on electronic products. This will propel the growth of the regional market during the projection time frame.

North America also held a significant share in 2023.

- This is attributed to the growing investments in the leather and electronics sectors.

- The U.S. is the major contributor to the market in North America owing to the exponential growth of its automotive industry and the rise in the demand for these chemicals from the woodworking and architectural industries.

Furthermore, the European market is expected to grow at a significant CAGR in the forthcoming years. The surging demand for these chemicals for a wide array of applications, such as industrial coatings, architectural coatings, and wood coatings, drives the market. In addition, the presence of top players in the region is contributing in this regard.

Top Companies Providing Matting Agents Are:

- Evonik Industries AG

- PPG Industries Inc.

- Imerys S.A.

- W. R. Grace & Co.-Conn

- Arkema Group

- Huntsman Corporation

- Micro Powders Inc.

- Michelman Inc.

- J. M. Huber Corporation

- Aalborz Chemical, LLC

Market Breakdown

This fully customizable report gives a detailed analysis of the matting agents market from 2017 to 2030, based on all the relevant segments and geographies.

Segment Analysis, By Material Type

- Organic

- Inorganic

Segment Analysis, By Formulation Type

- Waterborne

- Solvent-Borne

- Powder

- UV

- Radiation-Cured & High Solids

Segment Analysis, By Application

- Industrial

- Architectural

- Leather

- Wood

- Printing Inks

Region/Countries Reviewed for this Report

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

The matting agents market value will reach USD 626.1 million in 2030.

The market for matting agents will reach USD 431.8 million in 2024.

The rising need for sustainable and eco-friendly matting agents is the key matting agents industry driver.

Waterborne hold the larger matting agents market share.

The APAC market for matting agents is the largest.

Architectural is the largest application in the matting agents industry.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws