Report Code: 10123 | Available Format: PDF

Printing Inks Market Size and Share Report - Global Trends, Strategic Developments, Segmentation Analysis, and Forecasts, 2024-2030

- Report Code: 10123

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

Printing Inks Market Size & Share

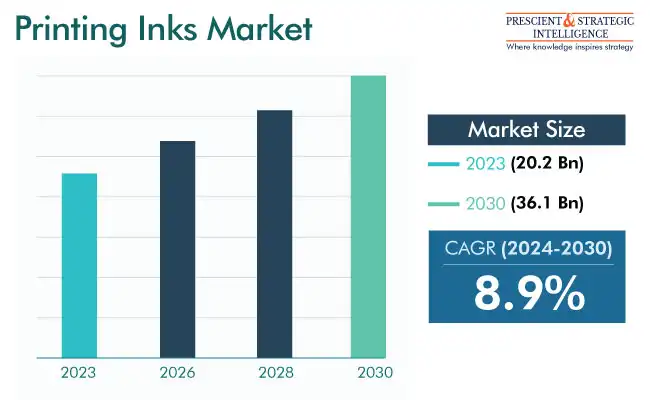

The size of the printing inks market has been estimated at USD 20.2 Billion in 2023, and it will touch USD 36.1 Billion by 2030, powering at a rate of 8.9% between 2024 and 2030.

Over the forecast period, the industry is expected to advance moderately because of its already huge size. The market is primarily driven by the rising need for colorful packaging with sharp characters and text in the food & beverages and personal care & cosmetics industries. Moreover, the growing demand for paperboard & cardboard packaging with the booming e-commerce sector is propelling the consumption of inks for printing purposes. Similarly, demand will remain strong in the future due to the increasing need for packaging products and commercial printing, with the shifting consumer preferences.

Growing Need in Packaging Sector Is Key Driver

The rising usage of printing inks in industrial printing, commercial printing, packaging, and publication applications is likely to boost the market advance in the coming years. Printing inks are extensively used in various food packaging applications, on materials including carton boards, paper, multilayered materials, and plastics.

Printing inks are utilized in food packaging to deliver customer information and for marketing purposes. The expansion in the usage of such chemicals in packaging applications is majorly because of the surging populace, rising acceptance of convenience food, and need for biodegradable products. All these factors are themselves a result of the shifting consumer lifestyles and their increasing income.

Increasing Use in Developing Nations To Create Opportunities

The printing inks industry is expected to grow significantly in China, India, Mexico, Indonesia, Cambodia, the Philippines, and Brazil. This increase will be due to the rise in these countries’ standards of living, economic development, and industrialization. With a larger gross domestic product (GDP) and a surge in manufacturing activities, these emerging economies will need more printing inks. In addition, consumption will be driven by their increasing application on consumer goods with complex packaging requirements.

Further, the growing middle class, with its rising purchasing power, in developing countries will continue to stimulate the demand for packaged food & beverages as well as pharmaceutical products. Providing the correct manufacturing, ingredient, packager, and other information on the packets of such products is a government mandate, which continues to push up the consumption of printing inks.

Lithographic Category Is Largest Category

In 2023, the lithographic inks category, based on product, led the industry, and it will further advance at a significant pace in the coming years. This is mainly because these variants offer a high print quality with appreciable efficiency, particularly with regard to handling large projects.

Another key reason behind the popularity of the lithography technology is that it can be applied to a variety of different media, including foil, cloth, plastic, paper, and even cardboard. Its versatility across these materials and suitability for industries demanding the best results from their printers essentially make this category dominant.

| Report Attribute | Details |

Market Size in 2023 |

USD 20.2 Billion |

Revenue Forecast in 2030 |

USD 36.1 Billion |

Growth Rate |

8.9% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

Oil-Based Category Is Significant Contributor

The oil-based category, based on formulation, was a significant contributor to the industry in 2023. The increasing demand for oil-based printing inks arises from their broad applications across various industries, particularly packaging, publication, and commercial printing.

Oil-based inks possess an intrinsic capacity to deliver bright colors, greater permanence, and suitability for various surfaces. Whether on different surfaces or capable of preserving print integrity over the long term, their high standards have caused them to be accepted in packaging applications where longevity and attractiveness are essential.

Packaging & Labels Are Leading Application Category

In 2023, the labels and packaging category, based on application, led the industry. The explosive growth of the middle-class populations in emerging economies, such as Thailand and India, has led to a sharp rise in consumerism and an accompanying surge for packaged products. At the same time, the shift in consumer preference toward easy-to-open packaging and the growth in online retailing activities brought about by the wide coverage of the internet have increasingly pushed up the demand for high-quality attractive packages.

Furthermore, the increasing focus on sustainability and eco-friendly products at a global level has accelerated the demand for bio-degradable goods. This, in turn, is directing printing ink vendors toward greener solutions to meet consumer needs. For instance, Siegwerk, in June 2021, revealed the next generation of sustainable water-based inks for paper and board applications. By introducing the new sustainable ink & coating range, UniNATURE, Siegwerk built on its advanced ink portfolio comprising bio-renewable carbons, as part of its plan to produce circular packaging solutions.

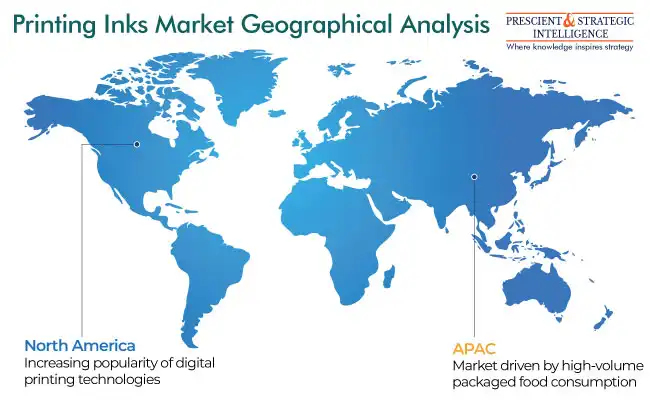

APAC Is Significant Contributor

APAC was a significant contributor to the industry in 2023. The surging consumption of packaged food products, along with the rapid development in the labeling and packaging sector, has positively impacted the progress in this region. In addition, the growing food & beverage, healthcare, e-commerce, and consumer goods sectors drive the market in the region.

Furthermore, an increasing fondness for flexographic inks in flexible packaging applications will offer significant growth opportunities for this industry in the region. This is because of their capability to be printed on non-absorbent material and quicker printing procedures with various colors on different substrates.

China leads the industry in APAC because of the growing need for inks in the packaging sector. These applications have observed substantial progress in recent years because of the speedy growth of e-commerce and the rising need for international shipping of non-consumer products.

North America is likely to advance at a significant CAGR in the years to come, with the U.S. leading the industry in the region. The need for printing inks in this nation is mainly driven by the increasing popularity of digital printing and the advancing packaging sector. The nation is observing a significant need for digital printing in the textile sector because of the constant evolution in the fashion sector and its swift acceptance against traditional techniques. In addition, the increasing need for processed food & beverages available in novel packaging drives the market.

Top Players in Printing Inks Market:

- Dainichiseika Color & Chemicals Mfg. Co. Ltd.

- T&K TOKA CO. LTD.

- Siegwerk Druckfarben AG & Co. KGaA

- DIC Corporation

- Epple Druckfarben AG

- DEERS I CO. Ltd.

- TOYO INK SC HOLDINGS CO. LTD.

- Huber Group Holding SE.

- Sakata Inx Corporation

- TOKYO PRINTING INK MFG CO. LTD.

- Flint Group

- Sun Chemical Group

- hubergroup

- Altana AG

- Fujifilm Holdings Corporation

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws