MaaS Industry Insights

Service Type

- The ride hailing category will hold the largest market share, of 40%, in 2024.

- The expansion in the travel and tourism industry across the world and the shift from conventional offline systems to online systems are boosting the demand for ride hailing services.

- The micromobility category is expected to witness the fastest growth in the forecast period.

- Local travel habits are rapidly shifting in response to steps to manage the COVID-19 disease, such as shelter-at-home directives.

- Since the beginning of the epidemic, average micromobility journey distances have increased by 26%, with rides in major places, such as Detroit, increasing by up to 60%.

- Some towns are also witnessing a shift in consumer use cases on a more specific level.

- In San Francisco, for example, the lockdown has resulted in a significant shift toward excursions to the pharmacy and to eateries to pick up food.

The service type analyzed in this report are:

- Ride Hailing (Largest Category)

- Ride Sharing

- Micromobility (Fastest-Growing Category)

- Car Rental

- Shuttle Service

Vehicle Type

- The car category will hold the largest market share, of 55%, in 2024 due to the early introduction of car rental and carsharing services.

- In addition, the developed value chain and regulatory support in various countries drive the demand for car rental and carsharing services.

- Two-wheeler category will grow at a CAGR of 18.5% in the forecast period.

- Many players are offering shared bicycles in specific markets. As bike sharing is a cheaper and convenient transportation mode, commuters are rapidly integrating it in their daily commute.

- Another major driver for the market is the inclusion of electric bikes (e-bikes) in sharing services, as they provide more convenience and higher speeds than pedal bikes to commuters.

- Vélib Métropole is a large-scale public bicycle sharing system in Paris, France, which encompasses more than 16,000 bikes and 1,400 stations.

The vehicle types analyzed in this report are:

- Two-Wheeler (Fastest-Growing Category)

- Car (Largest Category)

- Bus

Commuting Pattern

- The daily commuting category will hold the largest market share, in 2024, and it is also expected to grow at the highest rate, of 18.6%, in the forecast period.

- The market growth in this category can be mainly attributed to the increasing demand for shared mobility services among the young population, such as students and young professionals, for meeting their daily commuting needs.

- Additionally, several initiatives aimed at reducing the number of private vehicles on roads are expected to encourage the use of shared mobility among people.

- Students and young professionals are among the younger populations who have the highest demand for shared mobility services.

- The advantages of shared transportation options in terms of cost-effectiveness, convenience, and environmental impact are driving this transition.

The commuting patterns analyzed in this report are:

- Daily Commuting (Largest and Fastest-Growing Category)

- Last-Mile Connectivity

- Occasional Commuting

- Others

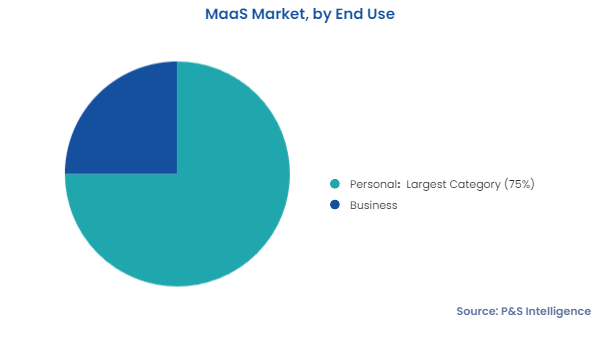

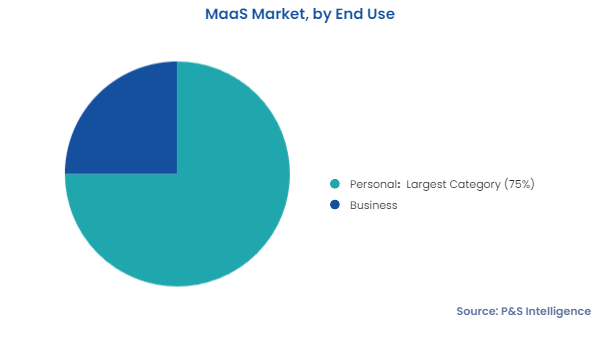

End Use Analysis

- MaaS utilized for personal use accounts for the larger share in the market, of 75%, in 2024 and it is expected to grow at CAGR of 18.4% in the forecast period.

- The majority of the customers use shared mobility services for personal work, which may include going to the workplace, running errands, such as grocery shopping; and undertaking short trips, such as escorting someone to the airport.

- In highly urbanized areas, traffic congestion and limited parking availability drive the preference for shared mobility services.

- In crowded cities, such Tokyo and New York City, where owning a car can be difficult, people are using services such as ar2Go and Zipcar more frequently for short-term rentals and leisure travel.

The end uses analyzed in this report are:

- Personal (Larger and Faster-Growing Category)

- Business

Payment Analysis

- The pay-as-you-go category will hold the major market share, in 2024.

- People prefer to pay once while availing of the services, due to their budget constraints.

- A customer does not need to commit to a prescribed plan and gets charged on a monthly or yearly basis by using this payment model.

- For instance, pay-as-you-go pricing is available for ride-hailing services from Uber and Lyft, enabling consumers to pay for each ride without committing to a long-term plan or subscription.

- The short-term subscription category is the fastest-growing, in the forecast period.

- This model provides a balance between pay-as-you-go and long-term subscriptions, offering users access to services for a fixed period, such as a month or a quarter.

The payments analyzed in this report are:

- Short-Term Subscription (Faster-Growing Category)

- Pay-as-You-Go (Larger Category)

Propulsion Type

- The electric category is expected to grow at the highest CAGR, in the coming years, owing to the surging need for electrification of transport systems.

- Moreover, the mobility-as-a-service market has been rapidly incorporating electric vehicles, since the demand for EVs has increased globally.

- ICE category will hold the largest market share in 2024 due to the extensive network of fuel stations.

- ICE vehicles continue to be the most popular because of this vast infrastructure, which makes it easy for customers to refuel their cars.

The propulsion types analyzed in this report are:

- Electric (Fastest-Growing Category)

- Internal Combustion Engine (ICE) (Largest Category)

- Others

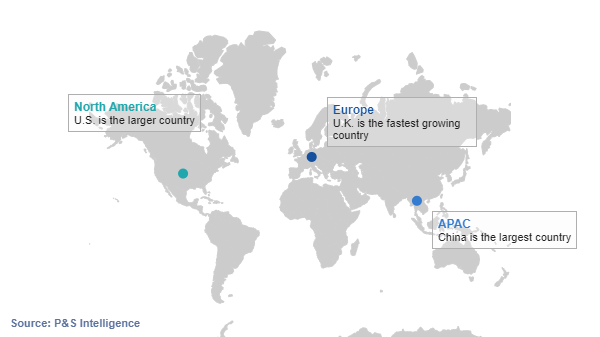

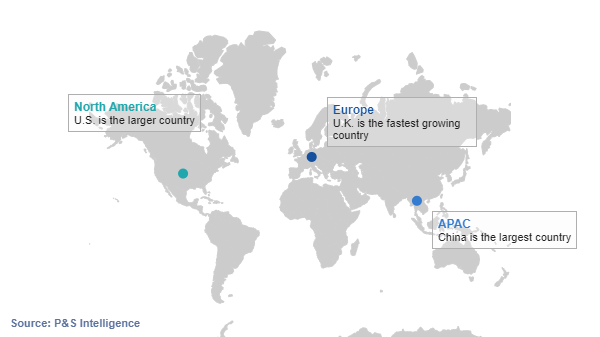

Geographical Analysis

- APAC will hold the largest market share, around 50%, in 2024 mainly on account of the rising consumer demand for shared mobility services, increasing disposable income, and growing government concerns over environmental pollution in the region.

- Among all the countries around the world, China continues to remain the largest market for shared mobility services.

- Several cities in China increased the usage of EVs across various service platforms, to promote a greener environment.

- For instance, the city of Shanghai mandates that by 2025, more than 50% of all vehicles in the online car hailing fleet be plug-in hybrid electric vehicles (PHEVs), BEVs, or fuel cell electric vehicles (FCEVs).

- With continuous support from the government in the form of policies and incentives, the market in China is expected to demonstrate robust growth in the near future.

- In addition, in the region, last-mile delivery is undergoing a big transformation. The increasing need for faster delivery times from an ever-increasing number of online buyers is propelling this business in a new direction.

The regions and countries analyzed in this report are:

- North America

- U.S. (Larger Country Market)

- Canada (Faster-Growing Country Market)

- Europe

- Germany (Largest Country Market)

- U.K. (Fastest-Growing Country Market)

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific (APAC) (Largest and Fastest-growing Regional Market)

- China (Largest Country Market)

- Japan

- India (Fastest-Growing Country Market)

- South Korea

- Australia

- Rest of APAC

- Latin America (LATAM)

- Brazil (Largest Country Market)

- Mexico (Fastest-Growing Country Market)

- Rest of LATAM

- Middle East and Africa (MEA)

- South Africa (Fastest-Growing Country Market)

- Saudi Arabia

- U.A.E. (Largest Country Market)

- Rest of MEA