Market Statistics

| Study Period | 2019 - 2032 |

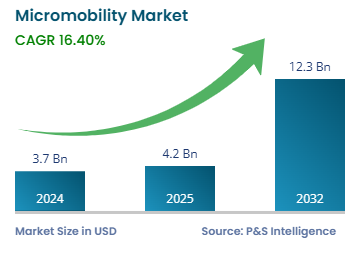

| 2024 Market Size | USD 3.7 Billion |

| 2025 Market Size | USD 4.2 Billion |

| 2032 Forecast | USD 12.3 Billion |

| Growth Rate(CAGR) | 16.4% |

| Largest Region | APAC |

| Fastest Growing Region | LATAM |

| Nature of the Market | Fragmented |

Report Code: 11753

This Report Provides In-Depth Analysis of the Micromobility Market Report Prepared by P&S Intelligence, Segmented by Service Type (Bike Sharing, Kick Scooter Sharing, Scooter Sharing), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 3.7 Billion |

| 2025 Market Size | USD 4.2 Billion |

| 2032 Forecast | USD 12.3 Billion |

| Growth Rate(CAGR) | 16.4% |

| Largest Region | APAC |

| Fastest Growing Region | LATAM |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The global micromobility market was valued at USD 3.7 billion in 2024, and this number is expected to increase to USD 12.3 billion by 2032, advancing at a CAGR of 16.4% during the forecast period (2025–2032). This can be attributed to the continuous advancements in smart cities and the automotive infrastructure across the globe, growing number of micromobility vehicles, numerous advantages of this concept, such as restricted passenger capacity, compact size, low weight, and ease of use; and increasing demand for ridesharing in metropolitan areas. Moreover, the rising number of service providers, increasing costs of vehicle ownership, and surging demand for emission-free vehicles are contributing to the market growth.

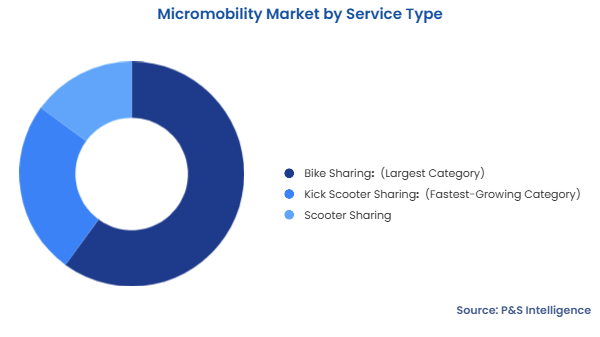

The bike sharing category accounted for the largest revenue share, of around 60%, in 2024, and it is further expected to maintain its position in the years to come. This can be ascribed to the massive usage of these services in the APAC region, as they are a low-cost and environment-friendly mobility option, which is extremely beneficial in combatting the problem of pollution. Moreover, the rapid entry of new players and growing count of collaborations among the major shared mobility service providers and existing service providers, to offer integrated services to consumers, are driving the demand for shared bikes.

The kick scooter sharing category is predicted to exhibit the fastest growth in the market during the forecast period. This is majorly due to the promising contribution of kick scooter services in solving the problem of traveling the last and first mile, as the other predominant public transportation options are not quite economical in this regard. Moreover, a lot of the kick scooter services are offered via a dock-less model, where the user does not have to worry about parking the vehicles at the pick-up dock; rather, they can simply pick up and drop off these kick scooters at any given parking lot, as per their convenience.

These service types are covered:

The dock-less category was the prime revenue contributor in 2024, and it is further predicted to maintain its dominance in the coming years. This is due to the rising number of companies opting for the dock-less concept as it requires less capital and entails less expenditure than a station-based system. Additionally, users find dock-less systems more attractive due to their cost-efficiency and convenient features, such as higher parking flexibility.

The station-based bifurcation will witness the higher CAGR, of 15%, over the forecast period. This is because of the operational problems associated with the dockless model and the fact that it is difficult to organize. The dockless model allows people to drop off the bike wherever they want, which raises the chances of thefts, vandalisms, and unavailability. This is why governments are promoting station-based models, in which the bikes must be picked up and dropped off at designated points.

These types were studied:

The first- and last-mile category dominates the market with 80% revenue, and it will also have the higher CAGR. In the face of the popularity of shared mobility across the world, different mobility services, such as ride hailing, carsharing, and ridesharing, have remained unsuccessful in addressing the problem of first and last-mile commuting. Additionally, the use of cars also adds up to other issues including parking problems, traffic congestion, and excessive emissions. Moreover, it was observed that most of the car trips worldwide covers less than 8 km (5.1 miles) on an average. Thus, the introduction of kick scooter sharing services has been successful in replacing the use of cars, especially for first and last-mile commuting, as it is best fitted for traveling shorter distances.

These models are covered:

The one-way category holds the larger share, a situation that will remain unchanged in the coming years. Convenient users/optimizers primarily avail scooter sharing services for a quick ride to nearby destinations, in order to optimize their travel time and expenses. People are increasingly using these services for first- and last-mile connectivity. Furthermore, these services are used as multimodal transit systems, which are availed to reach a point of availing of another transportation service.

The round category will have the higher CAGR during the forecast period, of 16%. This will be due to the increasing usage of these services by tourists, especially in Europe and increasingly in APAC, who prefer scooters to travel around different cities and then come back to their place of accommodation. This model is also ideal for daily commuters, such as college students and working people, as well as those going on short trips, such as to visit someone or to run errands.

These trips have been studied:

Drive strategic growth with comprehensive market analysis

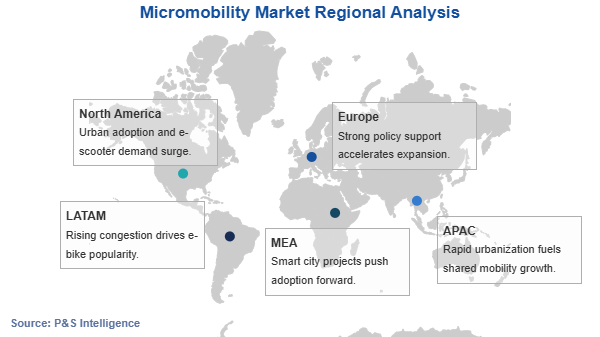

The APAC region held the largest share in the micromobility market in 2024, of 50%. Further, the region is expected to continue generating the highest revenue in the market during the forecast period. The presence of giant players, such as Mobike, Ofo, and Hellobike, is one of the main reasons for the growing adoption of these services in the APAC region. Moreover, micromobility services are much more economical than the shared mobility services, which also makes them an attractive option for the price-sensitive people in the APAC region.

The fastest growth is expected to be witnessed in the LATAM region during the forecast period. This is majorly buoyed by various factors, including the entry of global micromobility players in this region and supportive government measures, along with the enormous adoption rate of micromobility services by people. Various countries in the LATAM region have been witnessing a growing ridership, mainly due to the fact that bike sharing schemes are rapidly increasing in the region, for both public and corporates’ use. Additionally, the government in countries such as Mexico and Brazil is encouraging people to use shared bikes as their mode of short-distance transport. Local governments in few countries also built dedicated lanes for bikes, recently.

These regions have been analyzed:

The market for micromobility services valued USD 3.7 billion in 2024.

The micromobility industry is fragmented.

The market for micromobility services is driven by the rising traffic congestion, increasing need for first- and last-mile connectivity, and efforts to curb air pollution.

Bike sharing generates the highest micromobility industry revenue.

APAC is the largest market for micromobility services, and LATAM will witness the fastest growth.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages