E-Bikes Market Future Prospect

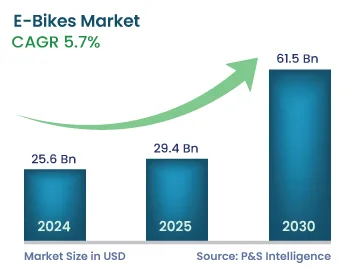

The global e-bikes market size is estimated to have stood at USD 25.6 billion in 2024, and it is expected to advance at a compound annual growth rate of 15.7% during 2024–2030, to reach USD 61.5 billion by 2030.

The growth of the market is ascribed to the cost-efficiency and environment-friendliness of these automobiles, government support and incentives, rising health concerns, increasing urbanization rate, and growing infrastructure in various countries. Moreover, e-bikes are lightweight, easy to charge and operate, and less expensive than other electric and gasoline two-wheelers, which make them one of the best options for micromobility.

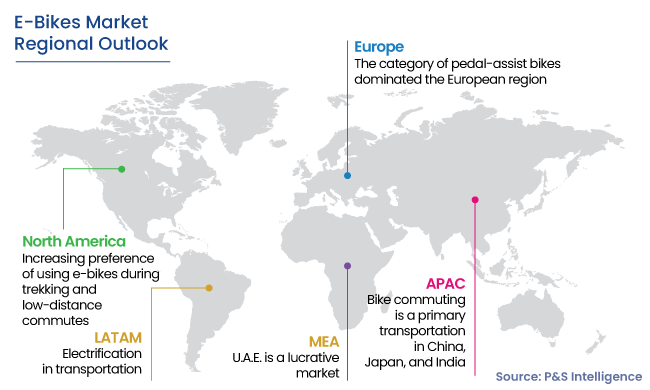

In addition, the rising population in urban cities has led to an increased number of daily commuters, leading to huge traffic and roadblocks, especially in peak hours. Thus, countries are looking to introduce new alternatives in order to combat this problem. For example, Mexico, Switzerland, France, Japan, and several other countries are encouraging daily commuters to use electric bikes as their mobility option and solution to their first- and last-mile connectivity problems.

This has resulted in a major contribution to reducing traffic congestion on the road, as these bikes are compact in size, take up less area to travel, and require fewer parking spaces, making enough areas available for adjusting public commuters. Hence, these factors drive the demand for electric bikes.