Report Code: 12020 | Available Format: PDF | Pages: 191

Indian Electric Vehicle Component Market Research Report: Two-Wheeler (Scooters, Motorcycle), Three-Wheeler (E-Rickshaw, E-Auto, Retrofitted Rickshaw), Passenger Car, Commercial Vehicle - Industry Analysis and Growth Forecast to 2030

- Report Code: 12020

- Available Format: PDF

- Pages: 191

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Outlook

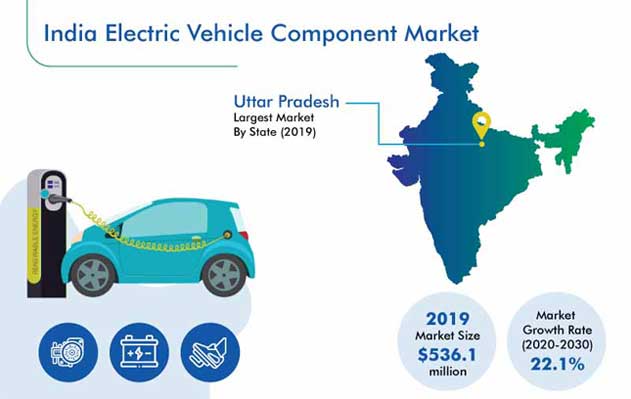

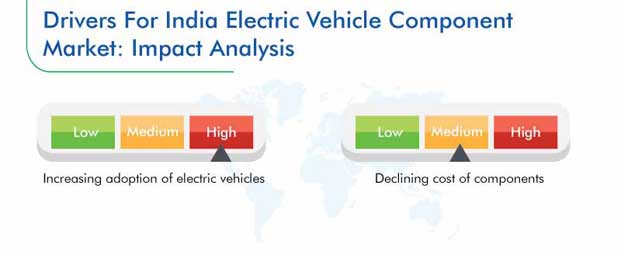

The Indian electric vehicle component market value was $536.1 million in 2019, and the market is predicted to advance at a CAGR of 22.1% from 2020 to 2030. The major factors fueling this expansion are the surging sales of electric vehicles (EVs) and falling prices of their components.

The COVID-19 pandemic has hurt the industry significantly due to the lockdowns and movement restrictions imposed around the country. These measures have led to the shutdown of EV manufacturing plants and curtailed imports of EV components from China. Moreover, many people have lost their jobs or are working on reduced salaries, which is discouraging them from spending on automobiles and their maintenance and repairs.

Segmentation Analysis of Electric Vehicle Component Market

The three-wheeler category generated the highest revenue in the electric vehicle component market in India, under the vehicle type segment, in 2019. This is credited to the huge sales of e-rickshaws in the country, which are the highest in the world. In the country, an e-rickshaw covers nearly 100 km every day on an average, which causes high wear and tear. Because of this reason, there is a high demand for its different replacement parts in the country.

From 2014 to 2019, the scooter category held the larger share in the Indian electric vehicle component market, on the basis of two-wheeler vehicle type. This was because of the higher sales of scooters on account of their cost-effectiveness over motorcycles. Due to their higher sales, the procurement rate of several e-scooter components was higher than that of e-motorcycle components in the country.

The aftermarket three-wheeler end-use category is predicted to register the faster growth in the future. This is credited to the emergence of various aftermarket companies, which sell more vehicle parts and components than original equipment manufacturers (OEMs), on account of the soaring number of three-wheeler vehicles requiring part replacement.

The battery pack category generated the highest revenue in the electric vehicle component market in India, based on passenger car component, during the last few years, and this trend is expected to continue from 2020 to 2030. This will be because battery packs are one of the most-expensive and -important components of electric passenger cars. Additionally, the rapid decline in the costs of battery packs, to $160 per kilowatt-hour (kWh) by 2030 from $230 per kWh in 2019, is causing a sharp surge in their sales across India.

The battery cell division category contributed the highest revenue to the Indian electric vehicle component market in 2019, under the commercial vehicle battery pack component category. This was due to the fact that the battery cell is a battery pack’s basic working unit. This is the component that stores and supplies the energy via the discharging and charging actions, inversely.

The market was dominated by Uttar Pradesh from 2014 to 2019. This was because the replacement and procurement rates of various parts and components of electric two- and three-wheelers, which are two of the most-widely sold EVs in the country, were the highest in the state.

Growing Popularity of High-Battery-Capacity EVs Major Market Trend

One of the most-prominent trends currently being witnessed in the Indian electric vehicle component industry is EVs with high battery capacities. Historically, the sales of batteries with lower capacities were higher on account of the large-scale deployment of cost-effective electric three- and two-wheelers equipped with these energy storage devices.

However, the sales of high-power electric two-wheelers, rickshaws, commercial vehicles, and cars, which can travel longer distances on a full charge than those with lower-capacity batteries, have increased sharply in India over the last few years. Furthermore, the enactment of the Goods and Services Tax (GST) and entry of organized players in the Indian electric vehicle component market, such as Exide Industries Ltd. and Amara Raja Batteries Ltd., have massively pushed up the demand for high-power EV batteries in the country.

Surging Sales of EVs Driving Market Expansion

The primary growth driver for the market is the ballooning sales of EVs. In 2019, 447.7 thousand electric three-wheelers, 2,000 electric passenger cars, and 32.4 thousand electric two-wheelers were sold in India, thereby causing a sharp surge in the requirement for OEM and aftermarket components. The growth in the deployment of EVs in India is a result of the implementation of favorable government policies and deteriorating air quality levels.

The transport sector contributes nearly 40% of the total carbon emissions in India, which has led to the enactment of several strict emission-control polices and favorable regulations regarding EV deployment here. One such policy is the Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles in India (FAME India) scheme, through which the Indian government plans to replace as much as 30% of the conventional automobiles running on the country’s roads with electric variants by 2030.

Increasing Component Replacement Rate Creating Lucrative Growth Opportunities for Market Players

The soaring replacement rate of EV parts and components is creating immense growth opportunities for the Indian electric vehicle component market. For example, replacement batteries accounted for over 70% of the number of e-rickshaw parts and components sold in 2019, as compared to their only 28.0% share in 2014. The surging adoption of e-rickshaws is, thus, fueling the industry growth. By 2024, more than 4 million e-rickshaws are predicted to run on Indian roads. This, coupled with the soaring sales of other EV variants, will cause a massive jump in the requirement for both OEM and replacement parts, thereby fueling the advance of the market.

Market Players Engaging in Product Launches to Gain Larger Revenue Share

In recent years, the Indian electric vehicle component market has witnessed a number of product launches, as the players are focusing on expanding their business, with the rising demand for EVs.

For instance, in January 2020, a new series of hydraulic shocker '43' -31 mm was launched by CY International, for electric three-wheeler loader rickshaws. The shocker, which can handle a 1,000–1,500 kg load, comes with a warranty of 12 months.

On similar lines, in February 2018, Greaves Cotton Ltd., which manufactures EV engines, unveiled two new powertrain solutions at Auto Expo 2018. Additionally, the company also showcased E3, a concept three-wheeler driven by this new powertrain, which comprises fewer moving parts and a lightweight battery.

The major companies in the Indian electric vehicle component market are Exide Industries Ltd., Amara Raja Batteries Ltd., Eastman Auto & Power Ltd., Okaya Power Pvt. Ltd., Sparco Batteries Pvt. Ltd., Panasonic Corp., Robert Bosch GmbH, Contemporary Amperex Technology Co. Ltd., CY International, and DENSO CORP.

Market Size Breakdown by Segment

The Indian electric vehicle component market report offers comprehensive market segmentation analysis along with market estimation for the period 2014–2030.

Two-Wheeler Market Segmentation

- By Component

- Battery

- Lithium-ion

- Lead–acid

- Motor

- Brushed motor

- Brushless direct current (BLDC) motor

- Controller

- Charging Kit

- Battery

- By Vehicle Type

- Scooters

- Motorcycle

- By End Use

- Original Equipment Manufacturer (OEM)

- Aftermarket

- By State

- Uttar Pradesh

- Haryana

- Gujarat

- Maharashtra

- West Bengal

- Rajasthan

- Tamil Nadu

- Delhi

- Andhra Pradesh

- Kerala

- Karnataka

- Uttarakhand

- Madhya Pradesh

- Rest of India

Three-Wheeler Market Segmentation

- By Component

- Battery

- Lithium-ion

- Lead–acid

- Motor

- Brushed motor

- BLDC motor

- Controller

- Charging kit

- Battery

- By Vehicle Type

- E-Rickshaw

- E-Auto

- Retrofitted Rickshaw

- By End Use

- OEM

- Aftermarket

- By State

- Madhya Pradesh

- Uttar Pradesh

- Delhi

- West Bengal

- Rajasthan

- Bihar

- Haryana

- Chhattisgarh

- Uttarakhand

- Punjab

- Jharkhand

- Assam

- Tripura

- Rest of India

Passenger Car Market Segmentation

- By Component

- Battery Pack

- Battery cell

- Battery management system (BMS)

- Battery thermal management system

- Motor

- Controller

- Electric Vehicle Supply Equipment (EVSE)

- DC–DC Converter

- High-Voltage Cable

- Power Distribution Module (PDM)

- Thermal Management System

- Vehicle Interface Control Module (VCIM)

- Battery Pack

- By State

- Maharashtra

- Gujarat

- Delhi

- Karnataka

- Tamil Nadu

- Kerala

- Telangana

- Uttar Pradesh

- Haryana

- Rest of India

Commercial Vehicle Market Segmentation

- By Component

- Battery Pack

- Battery cell

- BMS

- Battery thermal management system

- Motor

- Controller

- EVSE

- DC–DC Converter

- High-Voltage Cable

- PDM

- Thermal Management System

- VCIM

- Battery Pack

- By State

- Delhi

- Maharashtra

- Karnataka

- Rest of India

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws