India Electric Scooters and Motorcycles Market Future Prospects

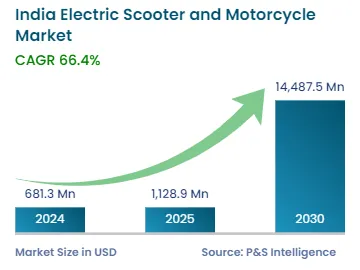

The Indian electric scooters and motorcycles market size will stand at an estimated USD 681.3 million in 2024 and advance at a compound annual growth rate of 66.4% during 2024–2030, to reach USD 14,487.5 million by 2030. This is due to the growing need for energy-efficient commutes, favorable government policies, rising demand for zero-emission vehicles, and increasing fuel prices, which have compelled two-wheeler manufacturers to explore alternative power sources for their models.

The requirement for cost-efficient two-wheelers is also driven by the increasing ICE vehicle prices due to BS 6 norm implementation and the low maintenance cost of EVs. In addition, to regulate the pollution by vehicles, central, state, and local authorities have taken several initiatives, such as purchase rebates, tax exemptions, and financial incentives, for the buyers of EVs. The rising government focus on curbing pollution levels in the country promises an even stronger regulatory push for electric two-wheelers in the coming years.

About 20% of the CO2 emissions and 30% of the particulate matter emissions in India are caused by scooters and motorcycles. The recent government guidelines have taken into regard the need to electrify this fleet. For this, in 2019, the national government proposed a plan to make the sale of all two-wheelers up to 150 cc electric by March 2025.

Electric vehicle adoption in India over the next few years is going to be largely driven by two- and three-wheelers. Particularly, the expected surge in the demand for high-speed models and the fall in their retail prices will propel the market value in India during the forecast period.

The FAME-II scheme links the demand incentive to the size of the battery, with the government providing INR 10,000 per kWh for a two-wheeler. Moreover, as per the Ministry of Heavy Industries and Public Enterprises, after the modification of the FAME-II scheme in June 2021, the demand for electric two-wheelers rose to over 5,000 units per week from 700 units per week before the modification.

The lower battery cost reduced the GST rate, which, combined with the FAME-II demand incentives, is expected to further lower the cost of ownership, and hence, increase the viability of EVs.