Key Highlights

| Study Period | 2019 - 2032 |

| Market Size in 2024 | 56.2 Thousand MW |

| Market Size in 2025 | 77.7 Thousand MW |

| Market Size by 2032 | 789.9 Thousand MW |

| Projected CAGR | 39.3% |

| Largest Region | APAC |

| Fastest Growing Region | APAC |

| Market Structure | Fragmented |

Report Code: 10972

This Report Provides In-Depth Analysis of the Energy Storage Market Report Prepared by P&S Intelligence, Segmented by Type (Mechanical, Electrochemical, Thermal), Application (Residential, Commercial, Distribution, Transmission), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | 56.2 Thousand MW |

| Market Size in 2025 | 77.7 Thousand MW |

| Market Size by 2032 | 789.9 Thousand MW |

| Projected CAGR | 39.3% |

| Largest Region | APAC |

| Fastest Growing Region | APAC |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The energy storage market size stood at USD 56.2 Thousand MW in 2024, and it is expected to advance at a compound annual growth rate of 39.3% during 2025–2032, to reach USD 789.9 Thousand MW by 2032.

The growing emphasis on alternative electricity sources, the high availability of batteries, and the increasing concerns over the rising pollution levels because of the combustion of fossil fuels are the major drivers for industry growth.

On the other hand, the COVID-19 had an adverse effect on market participants, such as component manufacturers, contractors, and utility firms. The sector’s slowdown was a result of project postponement or cancellation, logistical challenges, difficulty in procuring the equipment, and delay in obtaining the necessary permissions. These factors resulted in decreased revenue and workforce layoffs.

The market shows substantial technological progress especially through advanced battery systems while industry players focus on developing affordable and scalable solutions for supporting the worldwide energy transition toward sustainability. The market sees rising investments in big energy storage projects because governments activate policies that encourage renewable energy implementation. The market is fostering distributed energy storage systems that develop storage options for residential and commercial use which enables consumers to manage their energy. The electricity storage market continues to transform due to technological development together with government backing and the expanding need for dependable sustainable energy solutions which establishes it as essential for future energy infrastructure.

The mechanical category held the largest market share, of 35%, in 2024, and the category is further expected to maintain its dominance during the forecast period. The dominance is due to from its ability to deliver economical and massive energy storage capabilities which stabilize supply-demand dynamics in power grids containing high levels of renewable energy generation. The pumped hydro storage system collects potential energy from water elevation changes through reservoir transfer operations which function best in large grid solutions. The PHS operates best in topographically suitable areas where water exists. The power storage facility works as critical system which ensures electric grid stability during the peak hours when the load management is on its peak and accessibility for renewable energy integration. The need for PHS projects extends to 80 years due to their durability while their operational expenses remain low thus, they have become the electricity storage system of choice for utilities across the globe.

The electrochemical category will grow at the highest CAGR, of 39.5%, during the forecast period, within the electricity storage market due to improvements in technology and lowering price points. The segment shows quick market growth at residential, commercial, and utility-scale levels due to its dense energy efficiency and adaptable characteristics. The expansion of electric vehicles coupled with the growing demand for grid-scale energy storage and residential solar-plus-storage systems, has fueled the exponential growth of lithium-ion battery technology. Continuous advancements in battery chemistry, manufacturing processes, and energy management systems are enhancing the performance and affordability of lithium batteries, making them a preferred choice for a wide range of applications. The performance and versatility of lithium batteries improve through two technological advancements: variable-speed technology for enhanced control and hybrid integrated systems using lithium batteries with other storing methods.

The types analyzed here are:

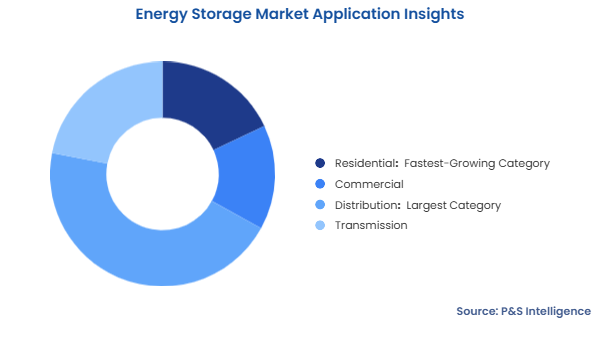

The distribution category held the largest market share, of 45%, in 2024, and it is further expected to maintain its position during the predicted period. The market is fueled by the need for grid modernization and the integration of renewable energy. Utilities and grid operators rely on deployments of storage solutions for renewable integration and operational stability management and peak load control. With the increasing involvement of distributed energy resources (DERs) like solar and wind, distribution-level storage helps mitigate voltage fluctuations, reduce transmission congestion, and improve overall power reliability.

The residential category will grow at the highest CAGR, of 40%, during the forecast period, because it is fueled by the increasing adoption of renewable energy sources. The homeowners choose home battery systems with rooftop solar PV installations or the use of inverters in the houses. Household customers purchase residential energy storage systems to store excess energy generated from solar panels, ensuring a reliable power supply during outages and peak demand periods. Because they want power independence, backup power capabilities, and reduced dependence on grid power. The demand for residential systems increases because of advancements in lithium-ion batteries, followed by decreasing battery costs and smart home energy management technology advancements. The residential segment will keep growing due to customer's interest in not relying on the traditional energy grids for power dependence and lower electricity costs make it much better for the users.

The applications analyzed here are:

Drive strategic growth with comprehensive market analysis

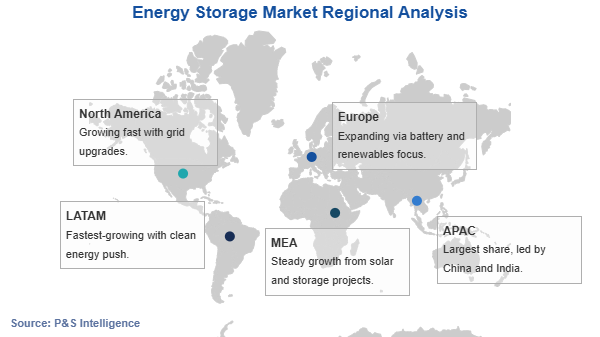

The APAC was held the largest market share, of 50%, in 2024 and it will grow at the highest CAGR, of 40.5%, during the forecast period, owing to the high-volume project engineering, procurement, and construction (EPC) activities in India, Japan, and China. At present, Asian power utilities consider power storage systems the next upgradation in smart grid technologies. With the increasing demand for stable grids and increasing focus of governments on smart grids, the region is expected to increase its investment in these technologies.

Modernizing transmission systems will further help the region counter the challenges in handling electricity requirements. Hence, the governments of various countries, including China, Japan, and India, are showing interest in grid-tied storage technologies and adopting smart grid community systems for electricity delivery, which can be owed to the escalating non-conventional power generation and decreasing reliance on traditional modes of power generation.

Energy storage plays a significant role in meeting the electricity demand by ensuring high reliability, improving the operational capabilities of the grid, lowering costs, and reducing infrastructure investments.

Moreover, in APAC, the adoption of solar energy storage systems is increasing at a significant rate, as these systems are cost-effective for users for controlling utility costs and for grid operators for managing network instability. The increasing amount of variable renewable power generation in the region, primarily solar and wind power is driving interest in grid-tied electricity storage technologies. Thus, it is fueling the market growth and will grow with CAGR of more than 56% during forecast period.

These regions are covered:

The electricity storage market displays a moderately fragmented structure that continues to show growing signs of merging operations. Tesla, LG Energy Solution, and Siemens among established energy and technology conglomerates remain prominent market participants yet minor specialized battery producers and integration firms, as well as software developers, serve the sector. Weaker companies thrive in storage market fragmentation because of its diverse technologies and application areas together with regional market differences.

Advanced batteries and flow batteries and hydrogen storage technologies receive ample opportunities for innovation in the current market although the industry experiences increasing market consolidation. The marketplace for storage solutions keeps encouraging established corporate giants together with new startup entities to develop the market through sustainable scalable innovative mechanisms.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages