India Electric Car Market Analysis

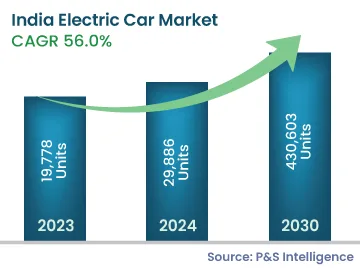

The Indian electric car market stood at 19,778 units in 2023, which is expected to witness a CAGR of 56.0% during 2024–2030, to reach 430,603 units by 2030. The major factors driving the market are the rising FDI, construction of manufacturing plants, and government push for developing the charging infrastructure. Further, the EV industry is driven by the support of the government and rising petroleum prices, which is making people look for ways to shrink their monthly expenses.

The Paris Agreement, which seeks to reduce carbon emissions, enhance the urban air quality, and shrink oil imports, is the basis for the EV strategy of India. With the booming populace and its rising automobile demand, those running on gasoline (petrol) and diesel are becoming increasingly impractical as India gets most of its crude oil from outside. Thus, the government is focusing on promoting usage of EVs, including cars, to reduce carbon emissions to net zero by 2070.

Further, in November 2021, at the Conference of the Parties COP26 Summit in Glasgow, India launched the website e-AMRIT, which serves as a one-stop resource for all information on electric cars. It discusses the important points related to EVs and their purchase, including the locations of charging stations and EV financing choices, as well as offering the details of investment opportunities, regulations, and manufacturers.

In addition to the more-well-known advantages, such as lower carbon dioxide emissions and air and noise pollution, EVs also offer significant efficiency gains and have the potential to become a storage source for renewable energy.

OEMs are dedicatedly working on imparting training to their sales and aftersales teams on EVs. Meanwhile, the entire ecosystem of manufacturers, central and state governments, dealers, and investors is concentrating on ensuring that everyone in the supply chain has significant know-how about handling and maintaining these automobiles. Owning an electric car requires a behavioral change with respect to the maintenance of the vehicle and battery. Thus, manufacturers are also focusing on making it a core principle to educate consumers about the usage and maintenance of their battery models.