Report Code: 11570 | Available Format: PDF | Pages: 70

Asia-Pacific (APAC) Electric Three-Wheeler Market by Vehicle (Passenger Carrier, Load Carrier), by Motor Power (<1,000 W, 1,000-1,500 W, >1,500 W), by Battery (SLA, Li-ion), by Geography (China, India, Japan, Indonesia, Philippines, South Korea, Malaysia, Singapore, Bangladesh, Nepal, Thailand) - Market Size, Share, Development, Growth, and Demand Forecast, 2013-2023

- Report Code: 11570

- Available Format: PDF

- Pages: 70

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

APAC Electric Three-Wheeler Market Overview

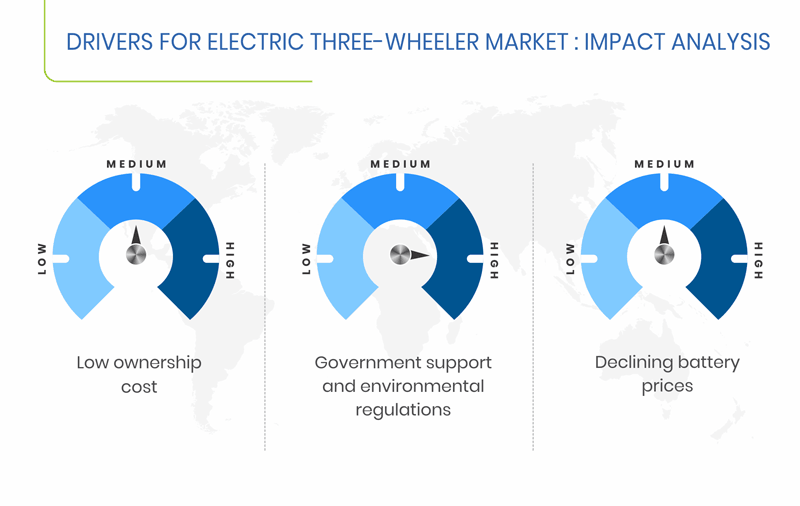

The APAC electric three-wheeler market is forecasted to amount to $11,935.1 million by 2023, registering a CAGR of 4.1% during the forecast period. The market has witnessed significant growth in the recent past, owing to low ownership cost, government support, environmental regulations, and declining battery prices.

.png)

Based on vehicle, the APAC electric three-wheeler market has been categorized into passenger carrier and load carrier. Of the two, the passenger carrier category recorded higher sales in the historic period. Also, the category is expected to continue dominating the market during the forecast period, owing to the demand for low-cost shared mobility and the presence of large consumer base in the region. However, faster growth is expected from the load carrier category during the forecast period, attributable to the growing e-commerce industry and low operational cost of electric load carrier as compared to the conventional fuel-based load carrier.

On the basis of motor power, the APAC electric three-wheeler market has been categorized into electric three-wheelers of less than 1,000 W, 1,000–1,500 W, and more than 1,500 W. Electric three-wheelers with motor power lying in the range 1,000–1,500 W recorded the highest volume sales in 2017, accounting for over 50% market share. Most of the electric three-wheelers in the region are equipped with the motors in the range 1,000–1,500 W because of their operational cost benefits, making it the leading category in the market. However, with the transition involving the venturing of conventional fuel-based three-wheeler manufacturers into this industry and growing demand for high-speed electric three-wheelers and high quality products, the demand for electric three-wheelers equipped with higher motor power is forecasted to increase in the coming years.

Based on the battery, the APAC electric three-wheeler market is classified into SLA and Li-ion batteries. Between the two, the electric three-wheelers running on SLA batteries had the higher volume sales in 2017. However, due to the continuously falling prices of Li-ion batteries, the market for electric three-wheelers running on Li-ion batteries is forecasted to grow faster than those running on SLA batteries during the forecast period. Other benefits of Li-ion batteries, such as higher energy density, light weight, greater life span, and much lower environmental damage as compared to the SLA batteries, are likely to benefit the market for Li-ion based electric three-wheelers.

APAC Electric Three-Wheeler Market Dynamics

Growth Drivers

The growth of the APAC electric three-wheeler market is primarily driven by the low ownership cost and favourable government policies and regulations. The operational cost of a battery-powered electric three-wheeler is around six times lesser than that of a gasoline/diesel powered three-wheeler because the battery-powered electric three-wheeler run on stored electric charge, which costs lesser than the gasoline. Also, due to the moving parts being fewer in electric three-wheelers as compared to the conventional three-wheelers, the maintenance cost of electric three-wheelers is considerably lesser than the conventional three-wheelers.

Also, the uptake of electric three-wheelers in APAC countries has increased over the recent years due to the favourable government policies and support in the form of subsidies and tax rebates. For instance, as per Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles (FAME) in India, the government is providing subsidies ranging from $370 (25,000 INR) to $900 (61,000 INR) based on the model and the OEM, thus, driving the growth of the electric three-wheeler market in India. Moreover, in other countries of the APAC region, such as China and Bangladesh, in order to curb the issue of rising environmental degradation due to the tailpipe emissions from the petrol/diesel based three-wheelers, the adoption of electric three-wheelers is on the rise, thereby driving the market growth.

Restraints

Long charging time and inadequate charging infrastructure are the major factors hindering the growth of the APAC electric three-wheeler market. The long charging time issue arises the range anxiety. Also, the inadequate number of charging stations further adds to the woes of the end users. A conventional fuel-based three-wheeler user can go to a fuel station and add fuel worth around 200 miles of range in about five minutes; this, however, is not possible for an electric three-wheeler user. It usually takes about six-to-eight hours for an electric three-wheeler to get charged worth around 35–45 miles of range. Besides, the fast charging technology that is currently available in the market is quite expensive, thus, hindering the market growth.

APAC Electric Three-Wheeler Market Competitive Landscape

Some of the key manufacturers in the APAC electric three-wheeler market are Terra Motors Corporation, Changzhou Yufeng Vehicle Co. Ltd., Xianghe Qiangsheng Electric Tricycle Factory, Jiangsu Kingbon Vehicle Co. Ltd., Jiangsu East Yonsland Vehicle Manufacturing Co. Ltd., Kinetic Green Energy & Power Solutions Ltd., ATUL Auto Ltd., and Lohia Auto Industries.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws