Report Code: 12893 | Available Format: PDF | Pages: 330

Hypercharger Market Size and Share Analysis by Vehicle Type (PC, LCV, HCV), Port Type (NACS, CCS, ChaoJi, MCS) - Global Industry Revenue Estimation and Demand Forecast to 2030

- Report Code: 12893

- Available Format: PDF

- Pages: 330

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Hypercharger Market Overview

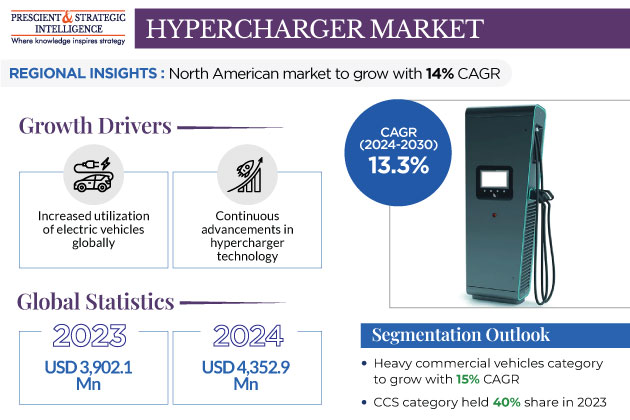

The hypercharger market generated revenue of USD 3,902.1 million in 2023, which is expected to witness a CAGR of 13.3% during 2024–2030, to reach USD 9,219.8 million by 2030. The market growth is associated with the increased utilization of electric vehicles globally, continuous advancements in hypercharger technology, and rising government investments along with supportive policies and incentives.

- Further, environmental regulations in the market are essential since these regulations help drive the implementation of hypercharger technology to improve fuel efficiency, which aligns with broader goals of sustainability.

- Private investments, collaborations among players, and automaker initiatives further boost the growth of the market.

- According to the World Economic Forum, 1 in 7 cars sold worldwide now is electric and 79% of new electric cars were sold in 2022 in Norway.

- Similarly, according to reports, USD 410 billion was spent on electric cars in 2022 globally.

Trends/Drivers/Challenges

Increased Utilization of Electric Vehicles

- The market is being driven by the increased utilization of electric vehicles (EVs) which has led to a dynamic environment in the automotive sector. Electric mobility solutions are increasingly growing among customers and governments as the global shift to sustainability and decrease carbon emissions.

- One of the key drivers contributing to the popularity of EVs is the surging demand for rapid and efficient charging options.

- There is a requirement to replace the traditional internal combustion engines as electric powertrains come with advanced charging infrastructure.

- Hyperchargers have an important role in handling critical issues of the charging time of EVs. These powerful charging systems have the ability to reduce the time needed for charging electric vehicle batteries, which is the attraction point for customers.

- The increasing popularity of electric vehicles is compelling automotive manufacturers and hypercharger manufacturers to work together to develop novel technologies. These partnerships will help make hypercharger systems that can smoothly combine with electric vehicles to optimize charging processes and enhance overall performance.

- The widespread adoption of EVs is also due to the convenience and availability of EV charging stations with a high charging speed. This adoption of EVs has led to an increasing demand for fast charging stations to fulfill the range standards of ICE vehicles.

- According to reports, EVs will have 62–86% of global sales by 2030 and China will reach to 90% of EV’s market share by 2030.

Government Investments Are Supporting Growth

- Globally, government policies and initiatives strengthen the impact of the increased utilization of EVs. Numerous countries are investing a lot of money in charging infrastructure and providing subsidies to encourage the transition to electric mobility.

- Several governments are compelling customers to purchase electric vehicles through the help of tax benefits and subsidies, which makes EVs more reasonable for customers.

- The integration of government support with advanced technology makes an appropriate environment that nurtures the demand for hypercharging solutions in collaboration with inexpensive electric vehicles.

- For instance, the Government of Delhi has extended its existing EV policy for another three months till March 2024.

Lack of Charging Infrastructure in Rural Areas May Hamper the Market

- The problem of charging infrastructure in rural areas prevents the widespread adoption of hyperchargers. Users of electric vehicles in these areas are facing problems in finding suitable charging stations, which eventually affects the market growth.

- The non-availability of charging infrastructure in rural areas is creating problems for electric vehicle owners.

- Rural charging stations are not getting specific incentives, which has resulted in roadblocks in their establishments.

- The U.S. presently has over 1,60,000 EV chargers but there is a need for an additional 70,000 Level 2 chargers and 70,000 Level 3 chargers to be installed for the rapid growth of EVs by 2030.

- Apart from major cities, rural America is suffering from the non-availability of EV charging infrastructure. This issue is forcing people to travel longer distances, which increases the need for accessible and convenient EV charging stations.

- According to the Environmental and Energy Study Institute, those areas that lack public EV chargers are called “charging deserts,” which have resulted in a lower rate of EV adoption.

| Report Attribute | Details |

Market Size in 2023 |

USD 3,902.1 Million |

Market Size in 2024 |

USD 4,352.9 Million |

Revenue Forecast in 2030 |

USD 9,219.8 Million |

Growth Rate |

13.3% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Vehicle Type; By Port Type; By Region |

Explore more about this report - Request free sample

Vehicle Type Analysis

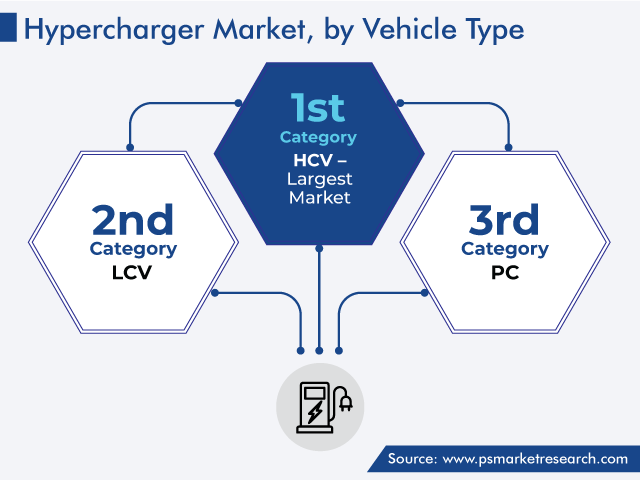

The demand for heavy commercial vehicles is expected to grow at the highest CAGR of 15% from 2024 to 2030 as well as this category holds the largest share of the market. This is associated with the rising need for electric buses and trucks, which, in turn, increases the demand for rapid charging solutions.

- Hyperchargers are widely used 7to enhance the efficiency and performance of heavy-duty engines, which meet the demands for increased power and fuel economy in commercial transportation.

- Advanced technology like dedicated high-power chargers and megawatt charging systems will help drive the adoption of hypercharging technology in the heavy commercial vehicle domain.

- Many production companies and suppliers are investing in novel solutions, which are designed for heavy-duty applications, further contributing to the growth of the market.

- The U.S. is one of the leading countries selling commercial vehicles because of its heavy dependency on road freight transport. Sales of commercial vehicles in the U.S. were three times bigger than the sales recorded in China in 2022 and three truck companies are U.S.-based in the world’s six largest trucking companies.

During the study, we analyzed three vehicle types in the report:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles (Fastest-Growing and Largest Category)

Port Type Insights

The CCS (combined charging system) category held the largest revenue share, of 40%, in 2023. This is due to its advantage of handling both alternating current (AC) and direct current (DC) charging, which makes it unique among all other systems. Thus, many automakers that produce high-performance electric vehicles are aligning with CCS.

- The global standardization of CCS in the infrastructure of electric vehicle charging can contribute to its adoption in hypercharger applications. Also, due to its compatibility and efficiency with many electric vehicle models, the adoption of CCS is increasing day by day.

Whereas, the ChaoJi category is projected to record the highest CAGR, of 12%, during 2024–2030 in the market. This can be due to its uniqueness as a new charging standard because it can give output up to 900 kW, which represents a great advancement in high-speed charging capabilities.

- Specifically, two major countries, China and Japan, worked together to make a ChaoJi port, which highlights a cross-border partnership with the goal of expanding hypercharging technology.

- International partnerships and new inventive features linked with ChaoJi make it a key port type, whose demand is increasing rapidly.

Further, port types are categorized into:

- NACS

- CCS (Largest Category)

- ChaoJi (Fastest-Growing Category)

- MCS

Regional Assessment

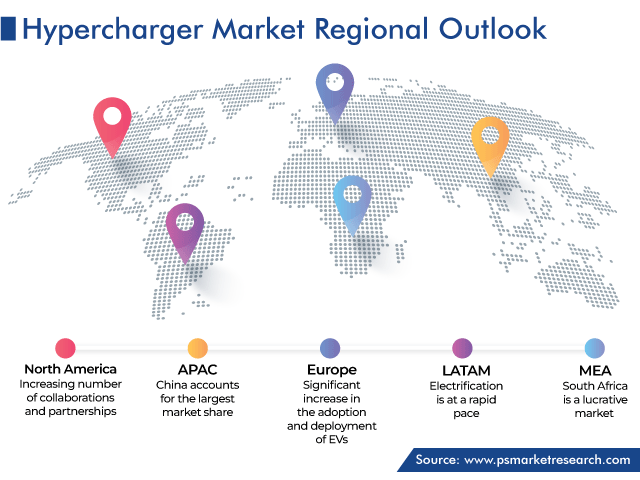

Geographically, the North American market is expected to witness the fastest growth, advancing at a CAGR of 14% from 2024 to 2030. This can be ascribed to the surging adoption of electric vehicles in the region.

- Electrify America firm is the primary reason behind the growth, which is expanding its way by making specific strategies.

- For instance, a partnership was made with Travel Centers of America (TA) to install around 1,000 DC fast chargers at 200 locations next to major highways over five years.

- Electrify America is known to design and maintain charging stations and further, it incorporated TA into its charging network to increase its impact.

- This association as well as other industry partnerships highlights the essential role of Electrify America in expanding high-speed charging availability in North America.

Whereas, Europe is the largest market, with a share of 50% in 2023. This dominancy is due to the significant increase in the adoption and deployment of EVs.

- Consumer awareness and a rising concern for environmental issues are also key factors.

- Sustainable transportation infrastructure is being developed on a large level by making investments in the region.

- Europe has a hub of innovative technology companies and automakers that actively contribute to the advancement in hypercharger technology.

- Supportive policies and incentives are being implemented by European governments to boost the shift to EVs.

Further, the following regions and countries were analyzed for this report:

- North America (Fastest-Growing Regional Market)

- U.S. (Largest and Fastest-Growing Country Market)

- Canada

- Europe (Largest Regional Market)

- Germany (Largest Country Market)

- U.K.

- France (Fastest-Growing Country Market)

- Italy

- Spain

- Rest of Europe

- APAC

- China (Largest Country Market)

- Japan

- India (Fastest-Growing Country Market)

- South Korea

- Australia

- Rest of APAC

- Latin America (LATAM)

- Brazil (Largest and Fastest-Growing Country Market)

- Mexico

- Rest of LATAM

- Middle East and Africa (MEA)

- Saudi Arabia (Largest Country Market)

- South Africa

- U.A.E. (Fastest-Growing Country Market)

- Rest of MEA

Hypercharger Companies News

- Electrify America made a plan in 2023 to install a total of 10,000 350 kW chargers by 2025.

- Alpitronic America Inc., a well-known producer of EV charging units and a subsidiary of Italy's Alpitronic SRL, selected Charlotte, North Carolina, for the establishment of its new North American headquarters in 2023. The company is expecting to generate 300 job opportunities by assigning a planned investment of USD 9.3 million for a facility on Westpark Drive. The upcoming headquarters will additionally revolve around testing, technology, and repair centers, which will strengthen the company’s capabilities in maintaining its infrastructure of EV charging stations.

- EVBox launched the most powerful separate charging station known as EVBox Troniq High Power with a 400-kW power output in 2023.

- CharIN introduced a megawatt charging system (MCS) at EVS35, Oslo, in 2022.

- Terra 360, which is the world’s fastest EV charging station, was launched by ABB in 2021, and it has the ability to charge maximum EVs in less than 15 minutes.

Competitive Analysis

The hypercharger market is seeing growth due to increased engine performance and the utilization of electric vehicles. Many leading companies are in the race to stay ahead of the competition. Companies are focusing on novel innovations and technologies such as advanced materials, enhanced efficiency, and smart integrations.

Strategic deals are important as companies are forming alliances with automotive manufacturers, technology firms, and charging network operators. These partnerships have a broad target to spread the market reach and smoothly integrate hypercharger solutions into several electric vehicles. Different product portfolios are meeting the emerging demand for various vehicle types which are coupled with customized options and provide companies with a competitive advantage.

Top Hypercharger Companies Are:

- ABB Ltd.

- Electrify America LLC

- Heliox

- Tritium

- IONITY GmbH

- Wallbox

- FreeWire Technologies Inc.

- MYENERGI LTD.

- Pod Point

- Span.IO Inc.

- EVBox

- CTEK Sweden AB

Market Size Breakdown by Segment

This fully customizable report gives a detailed analysis of the hypercharger market from 2017 to 2030, based on all the relevant segments and geographies.

Based on Vehicle Type

- PC

- LCV

- HCV

Based on Port Type

- NACS

- CCS

- ChaoJi

- MCS

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

The hypercharge industry will reach a turnover of USD 9,219.8 million by 2030.

Heavy commercial vehicles will experience the highest CAGR of 15% in the coming years.

The rising requirement for E-buses and trucks, leading to a rise in fast-charging solutions, is propelling the development of hyperchargers in the heavy commercial vehicle industry.

The trend towards soaring EV usage, driven by global sustainability efforts and reductions in carbon emissions, is fueling the development of the electrification mobility segment.

The North American region will witness the fastest development.

The acceptance of enhanced technologies like dedicated high-power chargers, investment by production companies in innovative solutions, and global standardization efforts are key factors contributing to the growth of the hypercharge industry.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws