Report Code: 12884 | Available Format: PDF | Pages: 320

Faux Finish Coatings Market Size and Share Analysis by Type (Metallic, Plaster, Marbleizing, Wall Glazing, Fabric), Technology (Water-Based, Powder-Based, Acrylic), Category (New Construction, Renovation), Application (Walls & Ceilings, Furniture), End User (Residential, Commercial, Industrial) - Global Industry Revenue Estimation and Demand Forecast to 2030

- Report Code: 12884

- Available Format: PDF

- Pages: 320

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Faux Finish Coatings Market Outlook

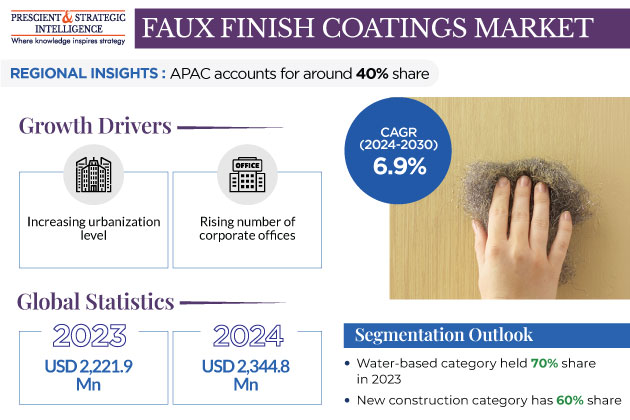

The global faux finish coatings market generated USD 2,221.9 million revenue in 2023, and it is projected to witness a CAGR of 6.9% between 2024 and 2030, reaching USD 3,498.2 million by 2030. It is attributed to the increasing urbanization level, rising number of corporate offices, and elevating standard of living of people. A faux finish hides imperfections, such as cracks and dents, repairing which could be more expensive; hence, this approach is a cheaper option compared to a new coat of high-quality paints.

- Faux finishing, also known as faux painting, is used as a decorative approach.

- The term faux is a French word that means false, because it acts like another material, such as granite, fabric, or wood.

- This technique creates the texture of these materials by replicating the look or feel of their surfaces.

- Other advantages associated with faux finish are long-lasting results, versatility, easy maintenance, cost-effectiveness, and a pleasant appearance.

Essentially, the increasing spending by governments for infrastructure development all around the globe is propelling the growth of the market. For instance, in November 2020, the Government of the U.K. invested around GBP 7 billion from the National Home Building Fund to build houses in the country for different communities. In the same way, the rising investment from the private sector in construction & renovation is boosting the growth of the market. Further, to acquire a larger market share, companies are setting up manufacturing facilities in developing countries, especially India, seeing the enhancing scope of the construction sector.

Plaster Accounted Significant Share

By type, plasters accounted for 20% share, in 2023.

- Plaster creates a durable and strong finish on a wall or ceiling.

- A reaction takes place when water is taken out of the cement mixture, which strengthens the bond, thereby making plastered walls stronger.

- It is a technique with which the coarse surfaces of the wall or ceiling roofs are changed to provide smoothness to the surface.

- Initially, wet materials are spread, and then, a range of equipment is used to make the surface smooth.

The metallic category leads the market with 35% share. There are several methods and techniques for metallic faux finishing, including sponging, color washing, crisscrossing, ragging, and two-tone smushing.

Water-Based Products Hold Largest Share due to Their Eco-Friendly Nature

By technology, the water-based category dominates the market, as water-borne paints and coatings offer protection to the substrate from abrasion and heat. Additionally, they have low VOC levels and cause low HAP emissions. Besides, they are cost-effective and have superior adhesion properties.

Acrylic variants are also commonly used for achieving faux finishes.

- An acrylate is any chemical compound that is derived from acrylic acid.

- It is available in different forms, such as fiber, glass, resin, and polymer.

- Acrylic paints are fast-drying paints made from pigments suspended in an acrylic polymer emulsion.

- They are water-soluble, versatile, elastic, water-resistant, and non-toxic, and they can be easily diluted.

- Besides, the surface on which they are applied can be easily cleaned with water.

Growing Construction Industry Is Strongest Driving Factor

The construction industry is growing at a significant pace in Sweden, the U.S., China, India, Canada, Australia, and the U.K., owing to the rising population and increasing urbanization level. This has been a result of the increasing investment in the construction of hotels, offices, apartments, civic infrastructure, and retail centers. For instance, construction output in India is expected to grow on an average of 7.1% each year till 2025. Such growth in the construction industry is driving the demand for decorative coatings in the APAC region, thereby supporting the market growth.

- In April 2020, the Government of India announced its targets to construct roads with an investment of USD 212.8 billion (INR 15 lakh crore) in the next two years.

- In addition to this, in the 2020–21 Union Budget, the government gave a massive push to the transportation infrastructure sector by allocating USD 24.3 billion (INR 1,69,637 crore).

- According to the European Construction Industry Federation, in 2019, investments in rehabilitation and maintenance activities represented 28% of the total investment in construction, which was a 2.3% increase from 2018.

This will increase faux finish paint and coating usage to improve the aesthetics of built structures. Additionally, the changes in the way of life of people are propelling the demand for sophisticated hoses, which has further fueled the expansion of the paints and coatings market globally.

| Report Attribute | Details |

Market Size in 2023 |

USD 2,221.9 Million |

Market Size in 2024 |

USD 2,344.8 Million |

Revenue Forecast in 2030 |

USD 3,498.2 Million |

Growth Rate |

6.9% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Type; By Technology; By Category; By Application; By End User; By Region |

Explore more about this report - Request free sample

New Construction Category Dominates Market

By category, new construction dominates the faux finish coatings market with a share of 60%.

- This is attributed to the rapidly growing construction, especially in India, China, the U.S., Australia, Canada, and the U.K.

- In this regard, the surge in their population is adding fuel for the growth of the market.

- India and China are the most populated countries in the world, and they are rather aggressively pursuing the construction of apartments, homes, hotels, shopping complexes, offices, and other pieces of infrastructure.

Renovation also held a significant share in the market. This is due to the increasing expenditure on home and office remodeling and renovation with the increasing disposable income.

Walls & Ceilings Category Held Largest Share

By application, the walls & ceilings category accounted for the largest share in the market. This is because walls & ceilings are major surfaces in any built structure, thereby requiring a large volume of coatings.

Residential Category Dominates Market

The residential category accounted for the largest share in the market. This is attributed to the increasing global population and rising level of urbanization, which are propelling the construction of all kinds of houses, including independent units, apartment complexes, and villas & condominiums.

Increasing Consumer Spending and Awareness

The increasing disposable income and upgrading living standards of people are supporting the growth of the global market.

- According to the World Bank, in 2021, world consumption expenditure was USD 69.47 trillion.

- As per the Bureau of Economic Analysis (BEA), in the first quarter of 2021, consumer expenditure reached USD 15.1 trillion.

- On an annualized basis, that was an 11.4% gain over the fourth quarter.

- In addition, gross private domestic investment increased by 4.2% in Q3 from Q1 2021, while the spending on construction increased from USD 565.0 billion in Q1 2021 to USD 576.2 billion in Q3 2021.

Furthermore, the increasing awareness among consumers about the importance of low-VOC paints and coatings, to keep diseases such as cancer at bay, will encourage them to invest more in such faux finish products, thereby contributing to the market growth.

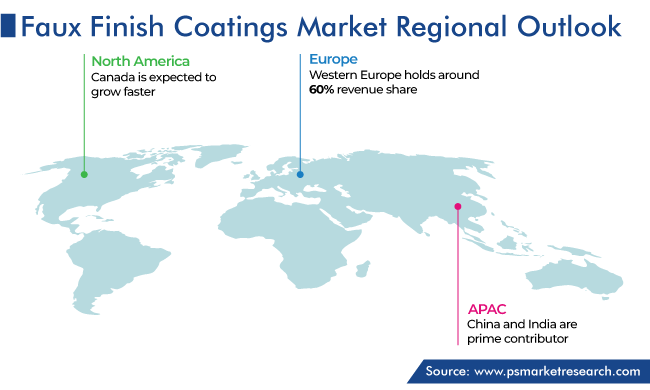

APAC Is Highest-Revenue-Generating Market

APAC held the largest share, of 40%, in the market in 2023. This is attributed to the surge in population, rapid industrialization, and increase in disposable income. The market in the region is mainly driven by the growing construction industry in China and India. Moreover, the rising government and private spending on commercial and residential construction projects is expected to increase the demand for all kinds of paints and coatings in the coming years.

North America also holds a significant share, and it is expected to growth with a robust CAGR during the forecast period.

- In North America, the demand for these coatings is mainly fueled by the rising number of infrastructure projects, both commercial and residential.

- Moreover, the resurgence of the manufacturing sector and the strong construction activity in the U.S., particularly in the housing sector, are expected to result in an increase in the demand for faux finish coatings in the region.

Key Players Are:

- Sherwin-Williams Company

- Nippon Paint Holdings Co. Ltd.

- Axalta Coating Systems Ltd.

- Kansai Paint Co. Ltd.

- Faux Effects International Inc.

- Jotun A/S

- PPG Industries Inc.

- RPM International Inc.

- BASF SE

- Asian Paints Ltd.

- Hempel A/S

- Akzo Nobel N.V.

Market Size Breakdown by Segment

The report analyzes the impact of the major drivers and restraints on the faux finish coatings market, to offer accurate market estimations for 2017 –2030.

Based on Type

- Metallic

- Plaster

- Marbleizing

- Wall Glazing

- Fabric

Based on Technology

- Water-Based

- Powder-Based

- Acrylic

Based on Category

- New Construction

- Renovation

Based on Application

- Walls & Ceilings

- Furniture

Based on End User

- Residential

- Commercial

- Industrial

Region/Countries Reviewed for this Report

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

The global faux finish coatings market will touch USD 3,498.2 million by the end of the decade.

The market will experience a CAGR of 6.9% in the coming years.

The industry is driven by reasons like fast urbanization, increasing corporate offices, and the desire for high living standards, which contribute to increased demand for decorative coatings.

The trend includes a shift towards faux finishes as a cost-effective option to hide imperfections like cracks and dents, mimicking the quality of real materials such as granite or wood.

APAC leads the market with a 40% share.

Acrylic faux finishes are gaining popularity due to their fast-drying, water-resistant, and non-toxic properties, making them ideal for various applications in the construction and renovation sectors.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws