Report Code: 12788 | Available Format: PDF | Pages: 280

Ethyleneamines Market Size & Share Analysis by Type (Ethylenediamines, Diethylenetriamine, TETA, AEP-HP), Manufacturing Process (Reaction between Ethylene, Dichloride and Ammonia), Application (Chelating Agents, Corrosion Inhibitors, Lube Oil & Fuel Additives, Processing Aids/Additives, Textile Additives, Curing Agents), End Use (Resins, Paper, Adhesives, Automotive, Water Treatment, Agrochemicals, Pharmaceuticals, Personal Care, Textiles) - Global Industry Revenue Estimation and Demand Forecast to 2030

- Report Code: 12788

- Available Format: PDF

- Pages: 280

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

The global ethyleneamines market is valued at an estimated USD 2,298.9 million in 2023, and the market size is predicted to reach USD 3,177.3 million by 2030, advancing at a CAGR of 4.8% during 2024–2030. The key factors driving the growth of the market are the booming agriculture industry, increasing demand for automobiles, and surging use of personal care items and cosmetics. Additionally, the rising consumer awareness concerning cleanliness and hygiene is likely to propel the demand for laundry detergents, which will further augment the market value.

Booming Automotive Sales

The increasing demand for lightweight and fuel-efficient vehicles is a key market driver. This is because ethyleneamines are used in a variety of automotive applications, such as corrosion inhibitors, fuel additives, and plastics, to reduce their weight and improve their fuel efficiency. According to the International Trade Administration (ITA), China is the world’s largest vehicle market, and the Chinese government expects automobile production to reach 35 million units by 2025. Further, according to the Society of Indian Automobile Manufacturers (SIAM), in 2021–22, over 17,617,606 vehicles were sold, while 21,204,162 were sold in 2022–23 in India.

Essentially, the rising per capita income of individuals leads to a massive demand for automobiles. Ethyleneamines are used as fuel additives to improve fuel quality and reduce emissions. They can also help prevent the formation of deposits in fuel injectors and combustion chambers, which can improve engine efficiency and reduce harmful emissions. Thus, their ability to enhance fuel combustion efficiency aligns with the global drive for cleaner transportation solutions. In addition to this, they are used in rust inhibitors and coatings for automotive parts and underbody protection. They help prevent corrosion on metallic surfaces, which is especially important in regions with harsh weather conditions.

Growing Demand in Agrochemical Industry

Ethylenediamine (EDA) and diethylenetriamine (DETA) can be used as chelating agents to bind with metal ions in the soil. This can help prevent the precipitation of metal ions, which may be harmful to plant growth. Chelating agents can also improve the availability of essential micronutrients, including iron and zinc, for plants. Thus, these organic substances serve as a fundamental ingredient in the manufacturing of agricultural chemicals, such as pesticides and fertilizers.

The U.S. Department of Agriculture has taken the Agricultural and Food Research Initiative (AFRI) to enhance human nutrition, enhance food safety and security, and train the next generation of the agricultural workforce. Similarly, in 2020, the Canadian government invested a total of USD 560,000 in the Canadian Federation of Agriculture to support the Canadian Agri-Food Sustainability Initiative.

With the rising population, the global food demand is expected to increase by 60% to 99% by 2050. Thus, agricultural production needs to rise massively, which will essentially boost the advance of the industry. One of the most-common ethyleneamines, EDA is a crucial ingredient of mancozeb, a powerful fungicide used on a number of crops and effective against a wide spectrum of fungal infections. Mancozeb is also used in the manufacturing of imidacloprid, a frequently used insecticide.

Ethylenediamine Contributes Majority of Revenue

Based on type, the ethylenediamine category dominates the market, and it is projected to witness the same trend in the future. This is mainly due to the rising demand for EDA for chelating agents, ethylene urea resins, corrosion inhibitors, ion exchange resins, petroleum additives, polyamide resins, thermoplastic resin lubricants, surface-active agents, and rubber chemicals. Additionally, EDA is used as an intermediate in the manufacturing of tetraacetyl ethylenediamine (TAED), which is used as a bleaching activator in laundry and dishwashing detergents and additives.

It is also used as an excipient in many pharmacological preparations, especially creams. Additionally, aminophylline is a drug combination of theophylline and EDA in a ratio of 2:1. This drug is used in the treatment of bronchospasms due to asthma, emphysema, and chronic bronchitis.

In addition to this, this organic compound has a low molecular weight, single component, clarity, and colorlessness. Further, ethylenediamine can form complex compounds with metals, which leads to its use in the formulation of chelating agents, such as EDTA (ethylenediaminetetraacetic acid). This agent also finds application in water treatment, paper pulp production, and detergents.

| Report Attribute | Details |

Market Size in 2023 |

USD 2,298.9 Million |

Market Size in 2024 |

USD 2,395.5 Million |

Revenue Forecast in 2030 |

USD 3,177.3 Million |

Growth Rate |

4.8% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Type; By Manufacturing Process; By End Use; By Application; By Region |

Explore more about this report - Request free sample

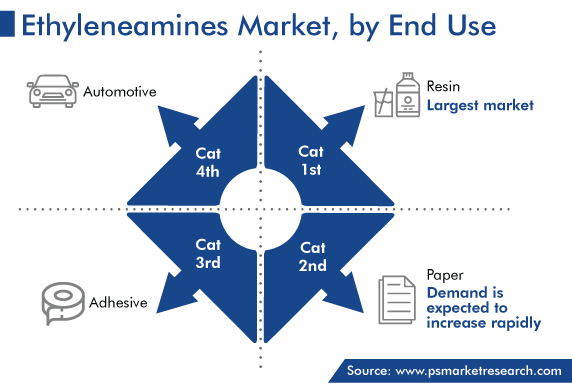

Resins Category Holds Largest Revenue Share

Based on end use, the resins category dominates the market, with a market share of 25%, in 2023, and it is expected to display a significant growth rate in the upcoming years. Ethyleneamines are used in the production of various types of resins, including epoxy resins and polyamide resins, which are commonly used in adhesives, coatings, and composites. Moreover, DETA-based polyamines are used to improve the wet strength of paper. When paper products come into contact with moisture or water, they tend to lose their strength and disintegrate. Wet strength additives, such as DETA-based polyamines, help prevent this by crosslinking the fibers in the paper.

Moreover, the construction industry uses resins in various applications, such as coatings, adhesives, and sealants, which often contain ethyleneamines. As the construction industry grows, the consumption of resins will rise in tandem. In the same vein, in the automotive industry, epoxy resins are used as an ingredient of coatings, sealants, and adhesives. Hence, as the automotive sector expands, the demand for ethyleneamines would rise, due to their usage in resin-based products.

In addition to this, polyamide resins are used as binders in flexogravure printing inks that are used on certain kinds of paper, foil, and film webs. They are also a key ingredient of pressure-sensitive, hot-melt, and heat-seal adhesives for usage on leather, plastics, paper, and metals. The main type of polyamide resin, apart from the liquid resins that find application as epoxy hardeners, is produced via the condensation reaction of diamines with poly- and di-basic fatty acids. In the same way, thermoplastic polyamides are used in producing abrasion-resistant, glossy, overprint varnishes. Thus, the wide applications of resins made from or containing ethyleneamines will boost the market growth during the forecast period.

Moreover, in the textile industry, EDA and DETA are used as crosslinking agents in the production of wrinkle-resistant and durable-press fabrics. They react with cellulose fibers to form crosslinks, helping the fabric retain its shape and resist wrinkling. Moreover, they can be used in conjunction with resins to create durable finishes on textiles. They improve the adhesion of resins to fabric and enhance the fabric's resistance to abrasion, chemicals, and washing.

Curing Agents Hold Significant Share

On the basis of application, the curing agents category makes a significant revenue contribution to the market. The selection of the curing agent plays an important role in determining the final performance of the epoxy–amine thermosetting agent. Ethyleneamine curing agents, such as DETA, triethylenetetraamine (TETA), tetraethylenepentamine (TEPA), and aminoethylpiperazine (AEP), have excellent chemical resistance. Moreover, when cured with epoxy resins, they provide excellent reactivity and physical properties, including a solvent-like nature. In industries such as construction, automotive, and aerospace, which are witnessing a growing need for high-performance materials and energy-efficient manufacturing processes, they are commonly employed.

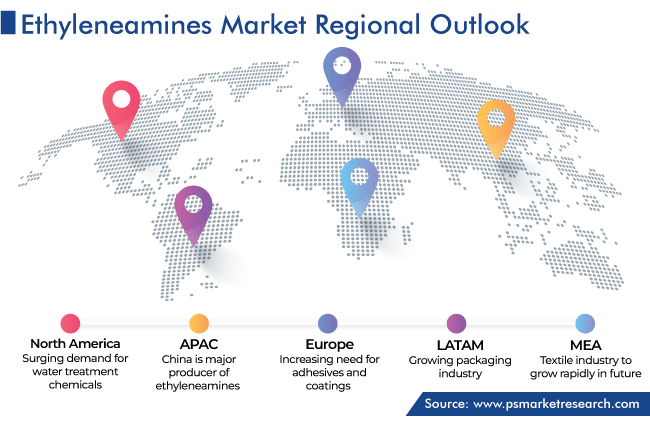

Asia-Pacific Makes Largest Contribution to Global Revenue Generation

Geographically, Asia-Pacific has the dominating market share in 2023, and it is expected to maintain its dominance during the forecast period. This is mainly due to the economic growth and rising demand for automobiles. Moreover, China is the major producer of ethyleneamines for various industries, such as textile, adhesives and paints, and personal care. Moreover, the increasing concerns over hygiene and the rising tourism activities lead to an increasing need for textiles and washing products to keep hotels neat. This further raises the demand for laundry detergent products, thereby boosting the progress of the market in the coming years.

Moreover, China is considered a hub for the automobile industry, and it continues to be the world’s largest automobile market by both annual sales and manufacturing output. Its domestic production is expected to reach 35 million vehicles by 2025. As per the Ministry of Industry and Information Technology, over 26 million vehicles were sold in 2021, including 21.48 million passenger vehicles, an increase of 7.1% from 2020. This has been leading to an increase in the demand for the fuel additives.

Furthermore, India is the second-largest producer of textiles and garments and the fifth-largest exporter of apparel, home furnishings, and technical textiles. The textile and apparel industry contributes 2.3% to the country’s GDP, 13% to industrial production, and 12% to exports. Additionally, around 45 million people are working in the textile business, including 3.5 million people who work on handlooms. The unique properties of aminoethyl ethanolamine and its use as an intermediate in chelates, detergents, and fabric softeners are likely to boost the demand for these organic chemicals.

Further, the increasing construction activities are projected to propel the market. The rate of urbanization in China is one of the highest in the world. According to the American Institute of Architects (AIA) Shanghai, by 2025, China will have constructed 10 NY-sized cities. In addition, China unveiled an infrastructure development plan for the 14th Five-Year Plan period (2021–2025), in January 2022 in order to steer its economy on a greener, smarter, and safer path.

The second-largest market is North America, as it is home to developed economies: the U.S. and Canada. Here, the market growth is attributed to the surging demand for water treatment chemicals and pharmaceutical ingredients. Moreover, the rising demand for packaging materials, electronic devices, and consumer goods is likely to drive the market growth in this region.

Moreover, Europe also holds a significant market share in 2023. This is mainly due to the increasing need for adhesives and coatings in the construction and automotive industries and the rising awareness regarding eco-friendly packaging.

Top Ethyleneamine Providers Are:

- Nouryon Chemicals Holding B.V.

- The Dow Chemical Company

- BASF SE

- Tosoh Asia Pte. Ltd.

- Diamines and Chemicals Limited

- Balaji Speciality Chemicals Limited.

- Huntsman International LLC

- Oriental Union Chemical Corp.

- Prasol Chemicals Limited

- Arabian Amines Company

Market Size Breakdown by Segment

The report analyzes the impact of the major drivers and restraints on the ethyleneamines market, to offer accurate market estimations for 2017–2030.

Based on Type

- Ethylenediamines

- Diethylenetriamine

- Triethylenetetramines (TETA)

- Aminoethylpiperazine (AEP-HP)

Based on Manufacturing Process

- Reaction between Ethylene

- Dichloride and Ammonia

Based on Application

- Chelating Agents

- Corrosion Inhibitors

- Lube Oil & Fuel Additives

- Processing Aids/Additives

- Textile Additives

- Curing Agents

Based on End Use

- Resins

- Paper

- Adhesives

- Automotive

- Water Treatment

- Agrochemicals

- Pharmaceuticals

- Personal Care

- Textiles

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

Explore

The market for ethyleneamines values USD 2,298.9 million (E) in 2023.

The 2030 revenue of the ethyleneamines industry will be USD 3,177.3 million.

The market for ethyleneamines is driven by the growing demand for these chemicals in the automotive, agriculture, and construction industries.

Ethylenediamine dominates the type segment of the ethyleneamines industry.

Resins are the biggest end use category in the market for ethyleneamines.

APAC generates the highest revenue in the ethyleneamines industry.

North America is the second-largest market for ethyleneamines.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws