Report Code: 11077 | Available Format: PDF | Pages: 162

Emergency Lighting Market Research Report: By Power System (Self-Contained, Central, Hybrid), Battery Type (Ni-Cd, Ni-MH, Li-Ion, Lead-Acid), Light Source (Fluorescent, LED, Incandescent, Induction), Offering (Hardware, Software, Services), Application (Industrial, Commercial, Residential) - Global Industry Analysis and Demand Forecast to 2030

- Report Code: 11077

- Available Format: PDF

- Pages: 162

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Emergency Lighting Market Overview

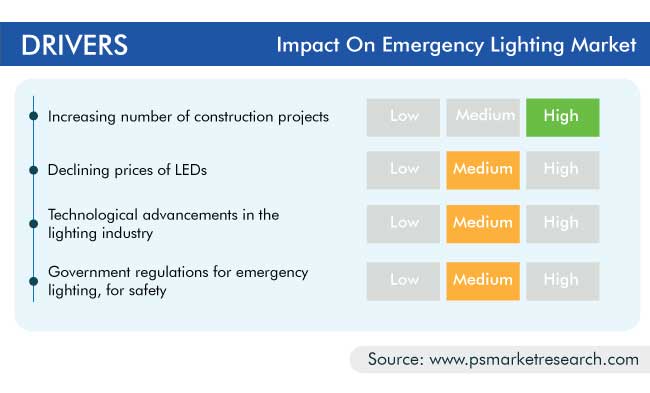

The global emergency lighting market was valued at $5,386.0 million in 2020, and it is expected to showcase a CAGR of 6.4% during the forecast period (2021–2030). This is primarily attributed to the increasing number of construction projects, declining prices of LED lights, and rising government initiatives to support the adoption of energy-efficient lighting solutions across the globe. Furthermore, the technological advancements in the lighting industry are contributing to the market growth.

COVID-19 has spread to almost every country around the world, and the World Health Organization (WHO) has declared it a public health emergency. The pandemic has affected every industry, including the construction industry. This is because of a decrease in the funding for public projects and postponement of the ongoing construction projects, owing to the supply chain disturbances and economic uncertainty across the globe. Due to these factors, the demand for emergency lighting solutions from new construction projects is likely to decrease, thereby impacting the market growth.

.jpg)

Less Installation Time and Cost-Effective Nature Led to Domination of Self-Contained Power Systems

In 2020, the self-contained category accounted for the largest size in the emergency lighting industry, on the basis of power system. This is primarily attributed to these variants’ requirement for less installation time and cost-effectiveness for small and medium enterprises (SMEs). Furthermore, this system provides emergency lighting from a decentralized source and does not include a central battery system, which is why they are easier to install. The aforementioned attribute has pushed the market for this category, which is why it is expected to retain its position during the forecast period.

High Energy Density with Longevity would Propel Demand for Lithium-Ion (Li-Ion) Batteries

The Li-ion category, based on battery type, is projected to witness the fastest growth during the forecast period. This can be attributed to the relatively low self-discharge rate and low maintenance required by Li-ion batteries as compared to others. The other major advantage of lithium-based batteries is their high energy density, coupled with a long life, which is up to twice that of Ni–MH (nickel–metal hydride) and nickel–cadmium batteries.

Rising Demand for Emergency Lighting Software Resulted in Dominance of This Category

Software was the largest offering category in 2020, and it is further expected to hold the largest share in 2030. This can be ascribed to the increasing demand for software for effectively monitoring and controlling the lights. Besides, the increasing usage of the related software by original equipment manufacturers (OEMs) to analyze the performance of their emergency lights and conduct related battery tests is expected to drive the market in this category, globally.

Rising Construction of Houses Driving Emergency Light Usage in Residential Application

In 2020, the residential category accounted for the largest size in the industry, on the basis of application. This can be attributed to the increasing construction of residential buildings and apartments in the APAC and Middle East and Africa (MEA) regions. The market demand for emergency lights in the APAC region is majorly generated by China and India, owing to the growing population, coupled with the rapid economic growth, in these countries.

Growing Construction Sector behind North America’s Leading Position

During the historical period (2014–2020), North America held the largest regional market share due to the increasing construction of commercial and residential buildings in the U.S. and rising focus of the U.S. government on energy-efficient lighting solutions. California currently accounts for the largest number of projects in the country.

Government Support Makes APAC Most-Expeditious Regional Market

The major factors responsible for driving the market in the APAC region are the growing smart home popularity, increasing government initiatives for the development of smart cities in India, China, South Korea, and Thailand, and rising government support for the adoption of LED lights in India and Japan. Further, the increasing spending on infrastructure in China and India is strengthening the APAC emergency lighting market. Moreover, the increasing consumer awareness on energy-efficient lighting solutions, owing to the rising power tariff, is a key factor boosting their sales in the region.

Increasing Emergency Lighting Adoption in Aviation Sector Is Key Market Trend

The most-prominent trend in the emergency lighting market is the growing awareness pertaining to such solutions among aviation companies, which is further leading to the former’s high adoption here. Moreover, the declining prices of emergency lights are escalating the demand for them in this sector, as aviation companies are targeting a reduction in their one-time cost for the installation of such components.

Plunging Prices of LEDs Propelling Market for Emergency Lighting

The declining price of LEDs is a major factor driving the market growth, by leading to a rise in the demand for these lights in various application areas, such as industrial, residential, and commercial. Companies involved in the manufacturing of lighting products have been broadening their LED emergency light portfolio owing to the rising demand for LEDs because of their high energy-efficiency. Furthermore, the increasing number of government initiatives for the adoption of LED lighting would drive the deployment of LED emergency lights.

Technological Advancements in Lighting Industry also Driving Market

Technological advancement is necessary for the sustainability of any technology. Companies involved in manufacturing emergency lights are investing heavily in research & development (R&D) to enhance the performance and lifespan of their products. The incorporation of LEDs in green and red exit signs is one of the important technological advancements in the emergency lighting market. Such lights offer more energy efficiency and are more cost-effective as compared to traditional lighting sources. With the increasing adoption of emergency green and red exit signs in residential areas, companies are focusing on expanding their portfolio of such products for residential buildings.

| Report Attribute | Details |

Historical Years |

2014-2020 |

Forecast Years |

2021-2030 |

Base Year (2020) Market Size |

$5,386.0 Million |

Forecast Period CAGR |

6.4% |

Report Coverage |

Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Impact of COVID-19, Market Share Analysis, Regional and Country Breakdown, Companies’ Strategic Developments, Key Offerings of Major Players, Company Profiling |

Market Size by Segments |

By Power System, By Battery Type, By Light Source, By Offering, By Application, By Region |

Market Size of Geographies |

U.S., Canada, Germany, France, Italy, U.K., Spain, Russia, Norway, Belgium, Japan, China, India, Japan, South Korea, Brazil, Mexico, Saudi Arabia, South Africa, U.A.E. |

Secondary Sources and References (Partial List) |

China Illuminating Engineering Society (CIES), European Lighting Designers' Association, Global Lighting Association (GLA), Indian Society of Lighting Engineers (ISLE), Institution of Lighting Professionals, International Association of Lighting Designers (IALD), Institute of Electrical and Electronics Engineers (IEEE), Lighting Controls Association (LCA), National Fire Protection Association (NFPA), Russian Lighting Research Institute |

Explore more about this report - Request free sample

Market Players Launching New Products to Gain Competitive Edge

The market is fragmented in nature with the presence of players such as Legrand SA, Hubbell Incorporated, Signify N.V., ABB Ltd., Acuity Brands Inc., Zumtobel Group AG, and OSRAM Licht AG.

In recent years, players in the industry have launched a number of new and advanced products in order to stay ahead of their competitors. For instance:

In April 2020, ABB Ltd. launched the Naveo Pro system, which allows customers to manage and check a tab on the maintenance requirements of their installation and maintenance with a mobile app.

In April 2019, Legrand SA launched a new range of self-contained emergency lighting units, which are suitable for commercial buildings, particularly for offices. With this new product, the company aims to bring a shift from corrective maintenance to predictive maintenance.

Key Players in Emergency Lighting Market include:

-

Signify N.V.

-

OSRAM Licht AG

-

Hubbell Incorporated

-

Zumtobel Group AG

-

Acuity Brands Inc.

-

Daisalux S.A.U.

-

Legrand SA

-

Syska LED Lights Private Limited

-

Larson Electronics LLC

-

ABB Ltd.

-

Schneider Electric SE

Market Size Breakdown by Segment

The global emergency lighting market report offers comprehensive market segmentation analysis along with market estimation for the period 2014–2030.

Based on Power System

- Self-Contained

- Central

- Hybrid

Based on Battery Type

- Nickel–Cadmium (Ni–Cd)

- Nickel–Metal Hydride (Ni–MH)

- Lithium-Ion (Li-Ion)

- Lead–Acid

Based on Light Source

- Fluorescent

- Light-Emitting Diode (LED)

- Incandescent

- Induction

Based on Offering

- Hardware

- Software

- Services

Based on Application

- Industrial

- Commercial

- Residential

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- Italy

- France

- U.K.

- Russia

- Spain

- Belgium

- Norway

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Latin America (LATAM)

- Brazil

- Mexico

- Middle East & Africa (MEA)

- Saudi Arabia

- U.A.E.

- South Africa

The emergency lighting market is set to have a CAGR of 6.4% during 2021–2030.

Self-contained power systems are the most popular in the emergency lighting industry.

North America is the dominant, while APAC is the fastest-growing region in the emergency lighting market.

The nature of the emergency lighting industry is fragmented.

Most of the players in the emergency lighting market are engaging in product launches.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws