Report Code: 12848 | Available Format: PDF | Pages: 310

Electrolyzers Market Size and Share Report by Type (Alkaline, PEM, SOEC, AEM), Capacity (Less than 500 KW, 500-2,000 KW, More than 2,000 KW), Application (Energy, Mobility, Industry, Grid Injection) - Global Industry Demand Forecast to 2030

- Report Code: 12848

- Available Format: PDF

- Pages: 310

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Electrolyzers Market Size & Share

The electrolyzers market size stood at USD 496.7 million in 2023, and it is expected to advance at a compound annual growth rate of 94.7% during 2024–2030, to reach USD 51,992.8 million by 2030. This is ascribed to the increasing demand for clean energy sources, including green hydrogen, and its rising usage in various industries. Essentially, various emission regulations and efforts to achieve zero emissions are propelling the usage of these devices.

Many large-scale green hydrogen projects are being initiated by governments around the world, including the HyDeal Ambition, which aims at producing around 3.6 Mt of green hydrogen by 2030 with 95 GW of solar and 67 GW of electrolyzer capacity. The project also aims to create an integrated upstream, midstream, and downstream hydrogen system spanning Spain, France, and Germany. Other such projects are the Western Green Energy Hub (28 GW) in Australia, AMAN (16–20 GW) in Mauritania, Asian Renewable Energy Hub (14 GW) in Australia, and Oman Green Energy Hub (14 GW) in Oman.

Essentially, the rising demand for green ammonia produced by electrolysis is contributing to the market growth. Ammonia, most of which is produced by traditional methods, requires more energy, and it contributes around 1.8% of the global carbon dioxide emissions. The increasing focus of countries across the globe on net-zero CO2 emissions is the biggest factor behind the increasing usage of the electrolysis method for producing green ammonia.

Positive Impact of Government Clean Energy Initiatives and Zero-Emission Goals

The electrolyzers market is driven by the government regulations and initiatives aimed at environmental conservation. One of these, the Energy Earthshots of the U.S. government, aims at increasing the availability of more-affordable and cleaner energy solutions. Similarly, the Green Hydrogen Policy is one of the initiatives taken by the Government of India to reduce emissions and ensure energy transition to clean sources. Under this initiative, the government has announced a waiver of inter-state transmission charges for the producers of green NH3 and green H2 from the commissioned projects.

Due to these initiatives, the cost of clean hydrogen is expected to decrease by 80% in one decade, which will augment the availability of clean energy for various industries, allowing them to reduce emissions. Key applications that would benefit from this reduction in the price are energy storage in fuel cells for heavy-duty trucks and production of steel and ammonia through electrolysis.

Moreover, as all such initiatives are closely tied to countries’ zero-emission goals, the electrolyzers market revenue will witness a significant rise over this decade. Most countries are focused on cleaner energy sources to reach zero emissions by 2050. In the past few years, around two-thirds of the global greenhouse gas emission have been generated by the energy sector. Therefore, such energy transition and emission reduction initiatives are forcing companies to invest in renewable sources, such as green H2.

Additionally, since the onset of the Ukraine–Russia war, the prices of oil and gas have increased significantly, due to which countries across the globe are focusing on other sources of energy, such as green hydrogen, for electricity production.

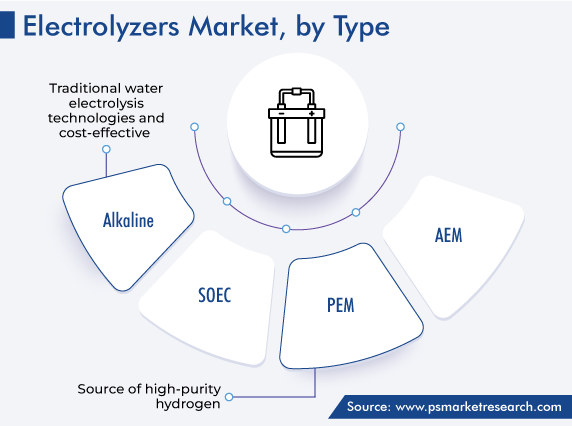

Alkaline Electrolyzers Held Largest Share in 2023

Based on type, the alkaline electrolyzer category held the largest share, of 40%, in 2023, as they are one of the traditional water electrolysis technologies and cost-effective over others. Additionally, these devices are robust and have longer operational lives, of a few decades. The latter is due to the relatively lower operational temperature range, of 50–100 degrees Celsius, which also makes it easier to start them up. Another factor responsible for the high adoption of these devices is the usage of relatively cheaper metals, such as nickel, as the catalyst, unlike other devices, which use precious metals.

Additionally, these variants have been deployed at many hyper-scale projects. For instance, Ningxia Baofeng Energy Group has commissioned its green hydrogen project of a capacity of up to 150 MW.

Proton exchange membrane (PEM) electrolyzers are expected to witness a significant growth in demand during the forecast period. This will be due to the advancements in this technology and the fact that these variants are a source of high-purity hydrogen. Other factors due to which the market for these devices is expected to grow ae their ability to utilize low-cost, surplus renewable energy and their compactness.

Mobility Category To Grow at High Rate

The mobility category is expected to advance at a CAGR of 95.0% in the forecast period, due to the increasing usage of fuel-cell electric vehicles across the globe. The shift from conventional to clean energy sources for vehicles can be achieved with the help of hydrogen. These vehicles do not emit tailpipe GHGs, but only heat and water, unlike conventional vehicles, which emit significant amounts of GHGs, primarily CO2—the biggest contributor to climate change.

The government of various countries has taken initiatives to increase the usage of FCEVs. For instance, China has started to focus on the development of heavy-duty trucks and buses powered by hydrogen fuel, aiming to have around 1 million FCEVs in operation by 2030. South Korea has also announced its vision of having around 3 million FCEVs by 2040.

Above 2,000 kW Category To Grow at Significant Rate

On the basis of capacity, the above 2,000 kW category is expected to advance at a significant rate in the forecast period, due to the increasing demand for electrolyzers of this capacity in the automotive and industrial sectors. Additionally, due to the increasing integration of these devices in electrical grids, the market is growing. As global warming and climate change continue to auger poorly for the human civilization, and fossil fuel reserves continue to deplete, the world has begun a rapid transition toward renewable energy.

However, due to the intermittent nature of wind and solar energy, uncertainties and power fluctuations across the grid are prevalent, which can complicate operations for industrial, commercial, and residential spaces. Therefore, high-capacity electrolyzers are being used to support electrical grids.

| Report Attribute | Details |

Market Size in 2023 |

USD 496.7 Million |

Market Size in 2024 |

USD 955.7 Million |

Revenue Forecast in 2030 |

USD 51,992.8 Million |

Growth Rate |

94.7 CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Type; By Capacity; By Application; By Region |

Explore more about this report - Request free sample

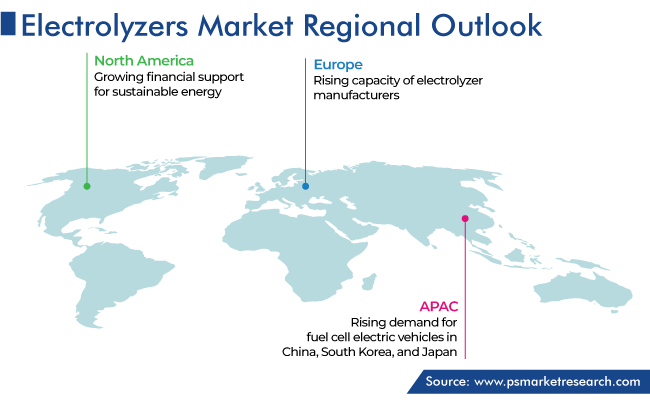

Europe Is Market Leader

The European region held the largest share, of around 50%, in 2023, due to the various large-scale green hydrogen projects under development or in operation, rising capacity of electrolyzer manufacturers, government support, and huge investments in R&D in the region.

For instance, the IPCEI Hy2Tech project aims at developing new technologies for the hydrogen value chain, to decarbonize various industries, including the mobility sector, via 41 sub-projects. Another such project implemented by the European Commission is IPCEI Hy2Use, which aims at supporting hydrogen-related infrastructure development and innovations in various technologies, for integrating this clean electricity source into the industrial sector.

Moreover, the Clean Hydrogen Partnership, which is a public–private partnership, is helping accelerate the research & development, deployment, and demonstration of hydrogen valleys. Another initiative is the European Clean Hydrogen Alliance, which has brought together national and local authorities, industries, the civil society, and other stakeholders to enable low-cost hydrogen and renewable energy production, for fulfilling the demands of transportation and various other sectors.

The APAC region is expected to grow at a high rate, due to the rising demand for fuel-cell electric vehicles in China, South Korea, and Japan and the initiation of major green H2 projects in Australia and China.

China is one of the largest hydrogen producers globally. In 2022, the Government of China announced plans to produce electricity from green hydrogen by 2035. Under the plan, China will also promote the use of hydrogen in heavy industries, transportation, and energy storage. The government has also improved its policies on electricity prices for green hydrogen production and the construction of the related infrastructure. As per these plans, the country is focusing on reaching an electrolyzer capacity of 80 GW by 2030 and an annual production of 200,000 tonnes of green H2 by 2025.

Key Electrolyzer Manufacturers Are:

- Nel ASA

- Siemens AG

- Plug Power Inc.

- Enapter S.r.l.

- Cummins Inc.

- ITM Power PLC

- McPhy Energy S.A.

- Beijing Sinohy Energy Co. Ltd.

- LONGi Green Energy Technology Co. Ltd.

- Bloom Energy Corporation

Market Breakdown

This report offers deep insights into the electrolyzers market, with size estimation for 2017 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Segment Analysis, By Type

- Alkaline

- Proton Exchange Membrane (PEM)

- Solid Oxide Electrolysis Cell (SOEC)

- Anion Exchange Membrane (AEM)

Segment Analysis, By Capacity

- Less than 500 KW

- 500–2,000 KW

- More than 2,000 KW

Segment Analysis, By Application

- Energy

- Mobility

- Industry

- Grid Injection

Region/Countries Reviewed for this Report

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

The 2030 revenue of the market for electrolyzers will be USD 51,992.8 million.

The electrolyzers industry is expected to have a CAGR of 94.7%.

The alkaline type has the highest value in the market for electrolyzers.

Electrolyzers industry players should target mobility applications.

Governments’ clean hydrogen initiatives and emission reduction targets are augmenting the revenue of the market for electrolyzers.

The electrolyzers industry is propelled by the rising air pollution levels and rapid fossil fuel resource depletion.

Europe is the largest market for electrolyzers.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws