Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | 107.8 Billion |

| 2030 Forecast | 226.3 Billion |

| Growth Rate(CAGR) | 13.1% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Nature of the Market | Consolidated |

Report Code: 12760

Get a Comprehensive Overview of the Electric Powertrain Market Report Prepared by P&S Intelligence, Segmented by Component (Motor/Generator, Battery, BMS, Controller, PDM, Inverter/Converter, On-Board Charger), Vehicle (BEV, FCEV, PHEV, HEV), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | 107.8 Billion |

| 2030 Forecast | 226.3 Billion |

| Growth Rate(CAGR) | 13.1% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Nature of the Market | Consolidated |

Explore the market potential with our data-driven report

The electric powertrain market size stands at an estimated USD 107.8 billion in 2024, and it is expected to witness a compound annual growth rate of 13.1% during 2024–2030, to reach USD 226.3 billion by 2030.

The rising demand for electric vehicles and the various initiatives taken by governments across the globe for greenhouse gas emission reduction are some of the major forces propelling the market expansion.

An electric powertrain is a system made up of components, such as battery packs, traction motors, inverters, power delivery modules, and on-board chargers, used for powering EVs. A battery management system (BMS) is also an important component as it ensures the safe and efficient operation of batteries, by monitoring the parameters associated with them.

The demand for conventional vehicles with internal combustion engines is declining, and the popularity of EVs has been growing considerably over the years. This can be ascribed to the rising environmental concerns, availability of advanced technological features in ZEVs, and government incentives for the adoption of electric mobility. According to a report by an inter-government agency, in 2022 itself, more than 10 million electric cars were sold globally.

Traditional combustible engines are dependent on fossil fuels, most commonly diesel and gasoline, thereby leading to the emission of various harmful greenhouse gases. Therefore, the electrification of vehicles aids in reducing the carbon footprint. EVs offer several other advantages, such as low running and maintenance cost, in addition to the tax advantages and incentives offered by the government in respective countries.

However, EV users need access to charging stations, which are commonly installed in a garage or parking lot and comprise EVSE ports and connectors. Charging infrastructure is being developed so that people can refuel their EV batteries on the go, thus promoting the adoption of such automobiles.

The governments of developing nations, such as India and China, are providing subsidies for the installation of . More importantly, they have launched several schemes for promoting the manufacturing and buying of electrified two-wheelers, three-wheelers, buses, and cars. Similarly, in the European Union, a target to have about 1 million publicly accessible EV chargers by 2024 has been set.

Hence, with the burgeoning manufacturing of electric vehicles, the demand for electric powertrains will increase proportionately.

There are several legislations around the world concerning environmental health and safety. For instance, in India, the Corporate Average Fuel Efficiency/Economy norms mandate that for every auto manufacturer, carbon emissions should be less than 130 g/km till 2022 and less than 113 g/km after 2022. Similarly, in April 2023, the Environmental Protection Agency of the U.S. introduced certain standards to reduce emissions from both light- and medium-duty vehicles from the model year 2027.

Furthermore, in April 2023, the European Parliament adopted an amended regulation for upgrading the carbon emission performance standards for new passenger cars and light commercial vehicles, to achieve climate goals. The amended regulation would aid in the reduction of emissions by more than 50% by 2030 from the levels in 1990, as well as in attaining carbon neutrality by 2050.

Hence, the gradual inclination of governments toward safeguarding the environment drives the demand for EVs, which will, subsequently, propel the electric powertrain market growth in the coming years.

The battery category, under the component segment, is likely to dominate the market and grow at a CAGR of 13.0% during the projection period.

The battery is one of the major components of electric automobiles and has a significant cost weightage. Thus, the surge in the demand for EVs is likely to propel revenue generation from the sale of traction batteries. Additionally, there are different types of batteries for EVs, such as lithium-ion batteries, nickel–metal hydride batteries, lead–acid batteries, and ultracapacitors, among which lithium-ion batteries are becoming increasingly common.

While driving, these power sources discharge, and then, the vehicle is plugged into a charging station. Manufacturers of vehicles provide a warranty on batteries, in terms of years or miles. Additionally, companies in North America are investing to set up plants for cathode manufacturing, to ensure a smooth supply chain for EV batteries.

The establishment of battery manufacturing units would, additionally, aid in creating job opportunities for people. Several nations are allowing private investments to build a conducive environment for promoting electrified means of transport, so that its adoption can be promoted among the residents.

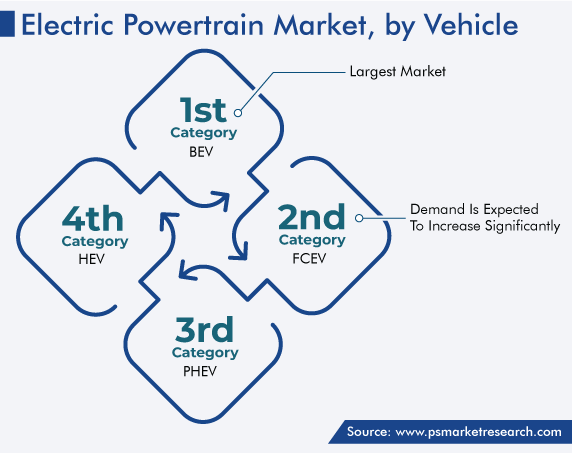

The battery electric vehicle (BEV) category, under segmentation by vehicle type, held the largest market share during the historical period, and it is likely to advance at a CAGR of 13.2% during the projection period. The growth can be attributed to the fact that these variants bring about a significant reduction in carbon emissions and, hence, receive the strongest policy and monetary support from governments. BEVs do not have engines and, instead, run on rechargeable batteries, thereby emitting minimal-to-zero amounts of greenhouse gases and other air pollutants. Thus, they are a clean and efficient means of transport with an added advantage of minimal-to-zero noise pollution.

To ensure considerable penetration of these environment-friendly vehicles, governments are taking several initiatives, such as spreading awareness, providing tax benefits, and upgrading the charging infrastructure. This is being done so that users do not face any issue due to depleted battery and unavailability of charging stations while traveling long distances.

For instance, in India, FAME is a scheme through which the government has allocated approximately $101.9 million (INR 800 crore) to oil companies for setting up charging stations. Private investments are also being encouraged for setting up efficient charging infrastructure, by allowing 100% FDI. Moreover, the introduction of DC fast chargers will aid in reducing the time EVs sit idle, which is of special importance for fleet owners.

Furthermore, China has made an announcement regarding the implementation of a digital infrastructure public spending program worth USD 1.4 trillion, wherein funds for charging stations will be dispersed.

Other variants, such as hybrids, plug-in hybrids, and fuel cell automobiles, also utilize electric powertrains, either on their own or in combination with ICEs or a hydrogen fuel cell. Thus, the growing investments in building and upgrading the necessary EVSE, for aiding in the penetration of EVs, is likely to propel the demand for electric powertrains.

Drive strategic growth with comprehensive market analysis

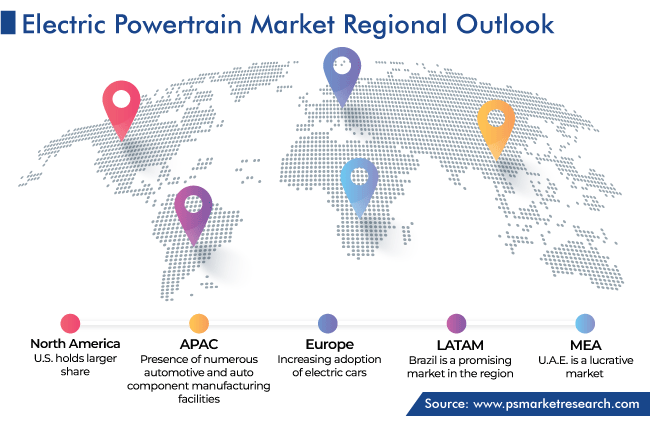

The Asia-Pacific region holds the largest share, of 45% in 2023. This can be attributed to the growing popularity of EVs, presence of numerous automotive and auto component manufacturing facilities, and support from the government for sustainable transportation.

According to a report by an inter-government agency, in India, more than 50% of the total three-wheelers registered in 2022 were electric ones. The electrification of two-wheelers as well as three-wheelers is more than of cars in developing nations as the former two are a cost-effective means of last-mile transport. Additionally, China is considering a ban on the usage of two-wheelers and three-wheelers with an internal combustion engine in some cities.

Additionally, EV manufacturing is quite concentrated in China; hence, the country’s share in the overall export of electric cars is significant. Additionally, it has dominance on the production and supply of raw materials, such as the minerals for anodes and cathodes, that are used in EV batteries. Additionally, new plants are being constructed for manufacturing solid-state lithium-ion batteries.

The North American and European regions are also likely to exhibit considerable growth in the coming years. They are already proposing new as well as revised regulations for emission reduction and carbon neutrality. For instance, the European Union aims at setting a zero-emission target for cars and vans starting from 2035. Moreover, it has launched a crediting system for manufacturers, who receive some relaxation in their emission target if their sales of EVs with specific emission levels cross a certain benchmark.

Essentially, in Europe, electric powertrain demand is expected to grow owing to the increasing adoption of electric cars. According to an article published by the respective regional environmental agency, more than 20% of the total new car registrations in 2022 were of electrified cars.

This report offers deep insights into the electric powertrain market, with size estimation for 2019 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Component

Based on Vehicle

Geographical Analysis

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages