Report Code: 11096 | Available Format: PDF

Disposable Medical Sensors Market Size & Share Analysis - Global Growth and Demand Forecast to 2030

- Report Code: 11096

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

Disposable Medical Sensors Market Size

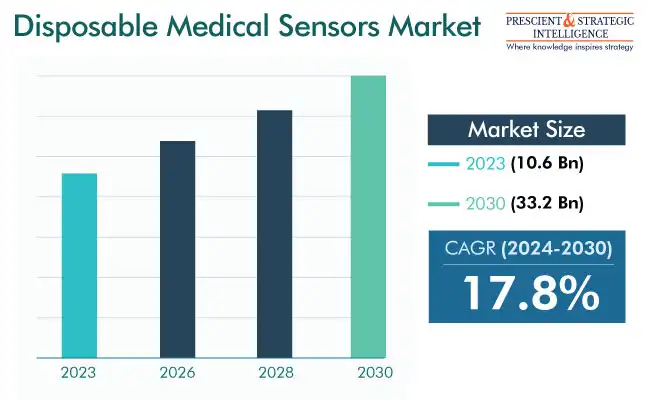

The disposable medical sensors market size was USD 10.6 billion in 2023, and it will grow at a rate of 17.8%, to reach USD 33.2 billion in 2030.

This growth of the market can be credited to technical improvements and the growing need for health data monitoring and less-costly medical devices. Essentially, the surging occurrence of chronic illnesses throughout the world is likely to fuel the requirement for disposable medical detectors. As per the Frontiers in Public Health, in recent years, chronic non-communicable diseases have been responsible for close to 80% of the deaths in China among people aged 60, with ischemic heart illness, chronic obstructive pulmonary disease, stroke, and type 2 diabetes being the most common.

Further, healthcare expenses keep going up every year, and there are many reasons for this. Mainly, the demand for diagnostic devices is increasing, as more people need them. Additionally, in a few places, there are extra taxes on such devices, especially if they are imported, and there are more guidelines to follow, which makes it costlier to manufacture them. This higher cost is an issue for nations with average and below-average incomes.

To deal with this, there is a rising requirement for medical tools that do not cost a lot. Hence, medical device companies are making concrete efforts to create low-cost yet efficient, safe, and small medical devices. The government is also trying to lower healthcare expenses, and this would aid the market advance too. The demand for medical detectors is increasing due to the evolving technology and the growing need for advanced monitoring devices.

Rising Importance of Wearable Technology amidst COVID-19 Pandemic

Wearable technology is helpful for patients with the novel coronavirus, which is why the lessons learned during this pandemic are projected to fuel industry development. For example, the DETECT research study was initiated by the Scripps Research Translational Institute in 2020. The project utilizes consumer electronic devices, such as Fitbit, Apple Watch, and Garmin, to study sleep patterns and heart rate and matches them with the symptom reports submitted by patients, to monitor COVID-19 cases. As per a recent study, Fitbits can forecast COVID-19 symptoms in 78% of the patients.

Presently, many new devices are available for use at home or right by the patients, at their bedside. These tools are accurate, easy to use, convenient to carry, and compact in size. They mainly work on people-centered methods of healthcare, utilizing an array of sensors, an internet connection, and electronic health records, without any untidy wires. The aim is to make healthcare smart, simple, and something people can have round-the-clock access to, regardless of where they are.

Growing Trend of Portable Diagnostic and Monitoring Tools

The usage of portable and disposable medical detectors at home is mainly propelled by the growing count of aging individuals suffering from long-term illnesses and disabilities. This factor motivates the players to create medical devices that patients can carry easily, even in public places. For example, in June 2020, BioIntelliSense and Philips came together to integrate the former’s BioSticker sensor into the remote patient monitoring devices created by Philips. This partnership aims to make it more suitable for doctors to monitor patients getting treatment at home, mainly those with severe health issues.

The market advance is, thus, set to be influenced by technological progress, including cancer tracking sensors, microelectromechanical system (MEMS) sensors, and fiber optic technology. There is a growing demand for new products due to the changing lifestyles and a desire for improved ease of usage and portability.

Advanced Disposable Sensors For Faster and Quick Diagnoses

The diagnostics category is leading the industry on the basis of application. Sensors are widely utilized in various diagnostic devices, such as spirometers, endoscopes, and several kinds of imagers. They contribute to the advancement of diagnostic devices, enabling the early detection of illnesses. For instance, carbon nanotube-based detectors are employed for detecting microorganisms, such as E. coli and S. aureus, which are sources of major infections in humans.

Further, blood glucose test strips are in huge demand around the world due to the increasing incidence of diabetes. Regular monitoring of the blood sugar is vital for these patients, as too high as well as too low levels are both fatal. In addition, HIV is one of the biggest healthcare burdens globally, which is why the demand for HIV test strip sensors is increasing. Another widely selling class of disposable diagnostic sensors are those used for drug of abuse testing, as DOA consumption is quite significant among teenagers and adolescents.

| Report Attribute | Details |

Market Size in 2023 |

10.6 Billion |

Revenue Forecast in 2030 |

USD 33.2 Billion |

Growth Rate |

17.8% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

Wireless Biosensors Spearhead Innovation in Diagnostics

During the projection period, the patient monitoring category is expected to experience the highest compound annual growth rate. Medical sensors play a crucial role in patient health screening devices, such as blood pressure monitors and pulse oximeters. However, among the most-important patient monitoring sensors currently are those used in ECGs and EEGs, both of which are vital for patients with chronic diseases. Further, during the pandemic, the demand for capnography sensors rose in order to track patients’ respiratory function.

Biosensors Leading the Industry

In terms of product, biosensors are leading the industry. These detectors are used for identifying analytes, collecting biological components through a physiochemical sensor, and measuring the signals obtained from the analyte. Further, the introduction of new products, such as Philips' next-generation screening biosensor, is enhancing the quality of care, by continuously and automatically measuring vital signs, such as the respiratory rate, skin temperature, and heart rate.

The image sensors category is expected to witness the most-significant CAGR during the projection period. Image detectors play a vital role in changing light waves into signals and forming images, which is why they are widely deployed in diagnostic tools and electronic imaging devices. The key applications of these sensors are X-ray imaging, endoscopies, and minimally invasive surgeries, the volume of all of which is growing.

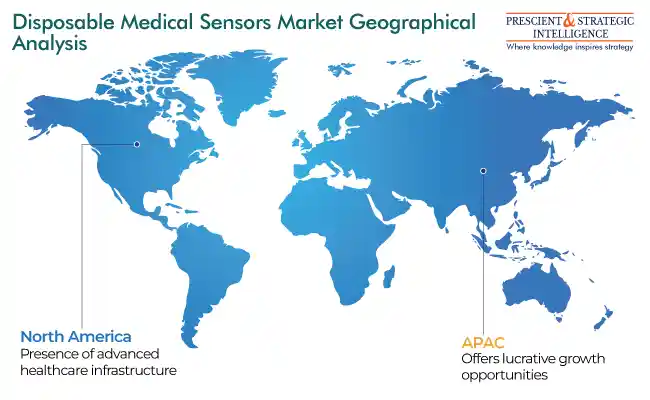

North America Is Largest Revenue Generator

North America stands as the largest revenue generator, attributed to a well-established healthcare infrastructure, high healthcare expenditure, presence of all major industry players, and rapid adoption of innovative technologies. The market in the North American region is also driven by the rapid acceptance of patient health tracking and homecare gadgets in order to reduce the frequency of hospital visits.

Asia-Pacific Offers Most-Lucrative Opportunities for Players

The Asia-Pacific market is projected to experience the fastest growth during the projection period, primarily attributed to the rising occurrence of cardiac disorders. Further, India and China have the largest diabetic populations on earth, which continues to augment blood glucose test strip sales at healthcare centers as well as among patients themselves. Additionally, with regional nations spending increasingly on making healthcare more-easily accessible, the demand for wearable healthcare monitors continues to rise.

Top Market Players Producing Disposable Medical Sensors:

- ACE Medical Devices Pvt. Ltd.

- Analog Devices Inc.

- General Electric Company

- Honeywell International Inc.

- Koninklijke Philips N.V.

- Medtronic plc

- NXP Semiconductor Inc.

- Sensirion AG

- SSI Electronics Inc.

- TE Connectivity Ltd.

- Abbott Laboratories

- F. Hoffmann-La Roche Ltd.

- STMicroelectronics N.V.

- OMNIVISION

- Renesas Electronics Corporation

- Texas Instruments Incorporated

- GENTAG Inc.

- ICU Medical Inc.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws