Data Center Market Size & Share Analysis - Trends, Drivers, Competitive Landscape, and Forecasts (2024 - 2030)

Get a Comprehensive Overview of the Data Center Market Report Prepared by P&S Intelligence, Segmented by Infrastructure (IT Infrastructure, Support Infrastructure), Type (Co-Location, Hyperscale), Industry (BFSI, IT and Telecom, Healthcare, Government and Defense), and Geographic Regions. This Report Provides Insights From 2017 to 2030.

Data Center Market Size

Market Statistics

| Study Period | 2017 - 2030 |

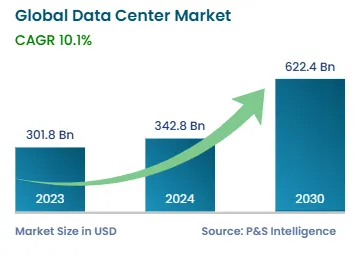

| 2023 Market Size | USD 301.8 Billion |

| 2024 Market Size | USD 341.8 Billion |

| 2030 Forecast | USD 622.4 Billion |

| Growth Rate (CAGR) | 10.5% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

| Largest Infrastructure Type | IT Infrastructure |

Market Size Comparison

Key Players

Key Report Highlights

|

Explore the market potential with our data-driven report

Data Center Market Analysis

The data center market size was valued at USD 301.8 billion in 2023, and it is expected to advance at a compound annual growth rate of 10.5% during 2024–2030, to reach USD 622.4 billion by 2030.

The exponential increase in data is the major factor that contributes to the growth of the market. Therefore, the demand for these centers is burgeoning due to the rising need for social, mobile, analytics, and cloud services around the world. The recent explosion in the usage of social media has boosted the construction of new centers, to store the gathered information.

The market is mainly driven by the next normal in the form of work from home, digitization and growth of industries, rising use of over-the-top (OTT) services, and burgeoning adoption of technologies that both generate and consume vast amounts of data, such as IoT and machine learning (ML). Moreover, internet users in 2015 numbered 3 billion and increased to 4.9 billion in 2021, which was a 60% rise. Therefore, internet traffic increased from 0.6 ZB to 3.5 ZB, which is 440%, during the period.

Moreover, the strong growth in the demand for data network services is expected to continue, driven primarily by data-intensive activities, such as video streaming, cloud gaming, and augmented and virtual reality applications. Mobile data traffic is also projected to continue growing quickly, quadrupling by 2027. In addition, 5G’s share of mobile data traffic is projected to rise to 60% in 2027 from 10% in 2021.

Moreover, based on square feet and MW capacity, North Virginia and Ashburn represent the largest data center hubs in the world, with more than 250 of these. In fact, due to the concentration of data centers in the area, North Virginia and Ashburn are known as ‘Data Centre Alley’. This reputation is made even more impressive when considering the fact that the U.S. completely dominates the world’s data center industry. Northern Virginia also hosts AWS’s largest cloud cluster and hosts some of the largest data center operations for Meta, Google, and Microsoft. The presence of pioneering industry representatives, such as the North Virginia Tech Council, have helped fuel this market’s exceptional growth and keep the pace sustainable.

Additionally, as of 2022, Canada ranks as the world’s fifth largest data center market, with 119 data centers, which have their operations spread across over 300 sites. Almost half of these are located in Toronto, making it the largest hub in the Canadian market. The most-successful data center providers in Toronto include Allied, TR2, Cologix, TR1, and Neutral Data Centers.

Data Center Market Trends & Drivers

Utilization of renewable sources of energy to power data centers

- Data centers specifically are expected to become carbon-neutral by 2030, and the steps being taken to ensure this are a key trend in the market. According to an article by the International Energy Agency (IEA), the U.K. has a goal to reduce economy-wide greenhouse gas emissions by at least 68% by 2030 from the 1990 levels and reach net-zero carbon emissions by 2050. Moreover, the Dutch government is taking numerous initiatives to prevent further climate change.

- Goals and measures to reduce the emission of greenhouse gases in the Netherlands have been laid down and agreed upon in the Climate Act and the National Climate Agreement. The Climate Act calls for a 49% reduction in greenhouse gas emissions by 2030 compared to the 1990 levels and a 95% reduction by 2050. In the same way, the U.S. government targets to reduce emissions by 50–52% by 2030.

- Moreover, governments across the globe are focusing on building green data centers, in order to save electricity. For instance, a data center in the U.K., Kao Data, is currently powered by 100% renewable energy. It was the first data center operator in Europe to transition its backup generators to 100% renewable HVO biofuel. Kao uses sustainable energy and still achieves high performance, achieving a PUE of 1.2 and a BREEAM classification of "Excellent" architecture.

Exponential growth in data generation is driving the market

- The growing databases are helping organizations grow and make better decisions, as they are leveraging this data to analyze historical patterns and make future decisions, accordingly. Businesses store, process, and use data to improve their products or services, maintain customer relations, and increase profitability. For this, businesses must be equipped to manage the incessantly growing data volumes.

- Billions of people in the world now have internet access. Every action they take online generates new data. Businesses across every industry want to use that data to collect customer information, track inventory, manage human resources, and achieve much more. Each day, around 2.5 quintillion bytes of data are generated. Further, there are currently over 44 Zettabytes of data in the entire digital universe, 70% of which is user-generated. The rate at which information creation is growing has been more or less predictable. By 2025, there will be 175 Zettabytes of data in the global datasphere, including medical data. Thus, spending on big data analytics by the healthcare industry could reach $79.23 billion by 2028.

- Industry experts suggest that most of the companies with more than 10 employees collect some form of digitized data, and the larger ones utilize data for improving their marketing, transferring it internationally as well. Hence, the growth in data generation is expected to propel the demand for data centers for meeting the storage and processing requirements of companies.

High capital requirement for initial setup, maintenance, management, and security purposes

- Data centers require high investments during their initial setup, due to the high capital expenditure associated with IT equipment and its supporting infrastructure, an appropriate location, and licensing costs, depending upon the type of data center. A regular expense has to be incurred for their efficient functioning as well. Cost is incurred on various components of the infrastructure, such as building construction, IT hardware and software, and networking services, along with hiring trained professionals to manage the entire setup in a secure way.

- The average yearly cost to operate a large data center ranges from $10 million to $25 million. A little less than half is spent on hardware, software, disaster recovery, continuous power supplies, and networking. Another large portion goes into the maintenance of applications and infrastructure. The rest is spent on heating, air conditioning, property and sales tax, and labor. Moreover, power consumption also adds to the cost of running the center. In addition, all its components need regular checks and maintenance, including inspection, testing & reporting, and repairs or replacement. This may hamper the market growth to some extent, especially with regard to operators who are not financed well enough.

Hyperscale Data Centers – The Future of IT Industry

As a result of the pandemic, cloud adoption is accelerating at a rapid pace. The IT sector has been collocating to hyperscale data centers, to enable better data management, having realized the dynamism of what can be done with data. Colocation has surged to the top of the queue for organizations all around the world when it comes to their IT infrastructure needs. Realizing the need for an efficient center to reduce barriers for customers and for higher margins, better data storage and management, higher security, and reliability, IT companies are moving toward hyperscale data centers.

In-Depth Segmentation Analysis

Infrastructure Type Analysis

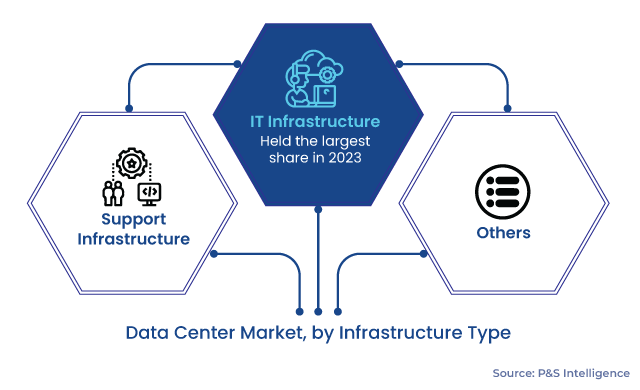

IT infrastructure is the largest market as it comprises server, storage, and network infrastructure, which are the backbone of such facilities. It is expected to grow with a CAGR of over 11.6%, allowing it to maintain its position in the market. Nowadays, businesses are shifting from their existing resources to well-equipped data centers, to enable better data management, as data analysis has become central to business growth as well as public good. In this regard, the concerns related to the efficient storage and privacy of data continue to propel the setup of IT infrastructure.

Infrastructure type covered in the report include:

- IT Infrastructure (Largest and Fastest-Growing Category)

- Support Infrastructure

- Others

Industry Insights

- The IT & telecom sector held the largest market share, of over 40.0%, of the market share in 2023. The main reason for this is the continuous deployment of advanced software and applications in the industry and the establishment of several startups across the nation.

- Meanwhile, the telecom sector has witnessed a surge in the count of mobile internet users, which has created a massive demand for data storage in the past few years. The advent of technologies such as 5G and IoT is expected to drive growth in the IT & telecom industry, thereby creating substantial data volumes and, in turn, driving the market in the forthcoming years.

- The healthcare category is expected to expand at the significant CAGR, of 10.4%, during the forecast period. The growth is attributed to the increasing importance of data storage in the healthcare industry.

It is further classified as:

- Banking, Financial Services, and Insurance (BFSI) (Fastest-Growing Market)

- IT and Telecom (Largest Market)

- Healthcare

- Government and Defense

- Others

Geographical Analysis

- North America holds the largest share of around 40% in 2023, in the data center market, and it will hold the same position till 2030.

- In North America, the U.S. holds the largest share, and it will grow with a CAGR of 9%, attributed to the existence of a large number of data centers. The U.S. has over 2,600 such centers, many of these in northern California, where many IT firms, such as Facebook, Google, Uber, Yelp, and Twitter, are headquartered. North America also has highly advanced, extensive, and efficient technological infrastructure.

- Furthermore, the region's investment in research and development is quite strong, which will lead to the establishment of next-generation centers that are more technologically advanced and efficient in terms of managing information. It is also home to multiple data center infrastructure providers, which is a major contributor to the region's rapid expansion and market share.

- The COVID-19 pandemic has contributed to the strong uptick in initiatives and investments in this industry across the globe. Furthermore, the adoption of cloud-based services by government agencies, as well as of online learning and contactless payments, helped the market grow. Therefore, during the pandemic, the number of data management centers increased globally. For instance, in 2021, there were nearly 8,000 such centers around the world, out of which around 33% are in the U.S. The IT sector is expected to spend approximately USD 222 billion in these facilities by the end of this year.

- Europe is also growing at a considerable rate because it is one of the key hubs for technology in the world. The increasing adoption of AI, 5G, and VR is bringing a revolution to the regional enterprise technology market. Furthermore, for data centers and their colocation facilities, the major driver boosting the industry is the rising demand for IoT, big data, and cloud computing. There are more than 2,600 data centers in Europe. Western Europe is a more-developed region and, therefore, has a large number of colocation data centers and service providers.

Further, regions and countries analyzed for this report include:

- North America (Largest Regional Market)

- U.S. (Larger and Faster-Growing Country)

- Canada

- Europe

- Germany

- U.K. (Largest and Fastest-Growing Country)

- France

- Italy

- Spain

- Netherlands

- Switzerland

- Rest of Europe

- Asia-Pacific (APAC) (Fastest-Growing Regional Market)

- China (Largest Country)

- Japan

- India (Fastest-Growing Country)

- Australia

- New Zealand

- South Korea

- Rest of APAC

- Latin America (LATAM)

- Brazil (Largest and Fastest-Growing Country)

- Mexico

- Colombia

- Chile

- Rest of LATAM

- Middle East and Africa (MEA)

- Saudi Arabia (Largest and Fastest-Growing Country)

- Turkey

- U.A.E.

- Rest of MEA

Market Nature - Fragmented

The market is fragmented in nature, owing to many domestic and international players. Market players are involved in launching advanced solutions to gain a competitive edge. They are engaged in launching advanced hardware and software components.

Key Companies in Data Center :

- Aermec UK Ltd.

- Airedale International Air Conditioning Limited

- Frigel Firenze S.P.A.

- Thermal Care Inc.

- Vertiv Holdings Co.

- Huawei Investment & Holding Co. Ltd.

- ABB Ltd.

- Eaton Corporation plc

- Schneider Electric SE

- Mitsubishi Electric Corporation

- General Electric Company

- Toshiba Corporation

- Fuji Electric Co. Ltd.

- Socomec

- Riello Electronica Group

Data Center Industry News

- In April 2022, Phison Electronics Corporation and Seagate Technology Holdings plc announced that they will expand their portfolio of SSDs, to enable data management centers to save on operational costs. This move was a response to the rising demand of corporate entities for higher-density, faster, and smarter storage infrastructure that can work with HHD storage to enable high-performance computing, hyperscale data centers, and AI to function efficiently.

- In June 2021, NTT Ltd. launched Global Data Center Interconnect (GDCI), which is an integrated global network fabric service delivering secure private connections between the major cloud service providers and NTT’s data centers.

Request the Free Sample Pages