Report Code: 10814 | Available Format: PDF | Pages: 230

Video Streaming Market Size and Share Analysis by Segment Analysis by Type (Liners, Non-linear), Offering (Solutions, Services), Platform (Gaming Consoles, Laptops & Desktops, Smartphones & Tablets, Smart TVs), Deployment (Cloud, On-Premises), Revenue Model (Advertising, Rental, Subscription), End User (Enterprise, Consumer) - Global Industry Demand Forecast to 2030

- Report Code: 10814

- Available Format: PDF

- Pages: 230

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Video Streaming Market Size & Share

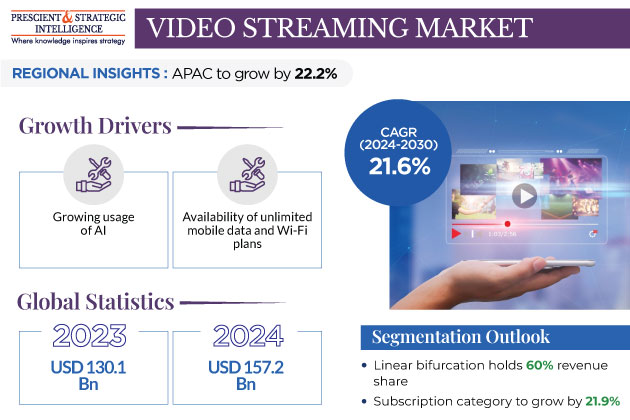

The global video streaming market revenue is estimated to have stood at USD 130.1 billion in 2023, and advancing at a CAGR of 21.6% during 2024–2030, it is set to reach USD 508.8 billion by 2030. This is attributed to the increasing utilization of artificial intelligence (AI) and blockchain technology to upgrade the video quality. AI is now playing an essential role in cinematography, editing, scriptwriting, voice-overs, and many other aspects of video production and upload.

Among the recent launches of AI video generators and editors are of Pictory in July 2020 and AVCLabs Video Enhancer AI in 2021. Both of them upscale video resolution without degrading quality. Moreover, the market for video streaming solutions is propelled by the rising adoption of smartphones. The increasing use of cloud-based solutions to increase the audience of video content is also positively shaping the market scenario.

Further, during the COVID-19 pandemic, online video streaming and entertainment services saw an increase of around 10% in audience. The pandemic boosted digital transformation globally. In this regard, the increasing adoption of online learning, work from home (WFH) and remote patient monitoring drove the demand for these services.

Linear Video Streaming Continues To Be Preferred

Based on type, the linear bifurcation held the larger share in 2023, of 60%. This is due to the increasing usage of digital media devices and the fact that this model offers easy and fast access to online video content. Moreover, the utilization of a vast amount of content, the advantages of analytics tracking and mobile viewing, and a massive audience propels this category. Linear video streaming is essentially scheduled programming, also known as traditional or live TV, where the content is played at a specified time, with no control over playbacks.

During the forecast period, the non-linear category is expected to grow at the higher rate, on account of the simplicity and series linking associated with this type of video streaming. Other factors fueling its growth are the comfort of watching on-demand content anytime, smooth streaming without buffering, ad-free content, no scheduled timing, unlike in linear streaming, and live pause feature.

Solutions Category Holds Larger Revenue Share

The solutions bifurcation generated the higher revenue under the offering segment, of around USD 98 billion, in 2023. This is credited to the burgeoning demand for internet protocol TV, over-the-top (OTT) content, and pay-TV services.

Among these, OTT solutions generate the highest revenue as they offer film and TV content without the need for a subscription to traditional cable or pay-TV services. Other key features that make OTT platforms popular are original content, hybrid monetization models, and content fragmentation, which are a result of the rigorous competition among market players. Further, the availability of unlimited data plans and public Wi-Fi hotspots encourages more companies to adopt the OTT model.

Another advantage of OTT video streaming is that it saves storage on hard drives and allows viewers to avoid waiting for the content to download. Besides this, consumers are opting for these services due to the increasing expenses on pay-TV and IPTV services.

Based on service, the managed category holds a significant share as these services bring together broadcast and OTT solutions in one online video management solution, to provide a personalized experience to viewers. These services provide highly evolved media to viewers, helping them stream better-quality content with higher monetization success. The services included are digital packaging & fulfillment, localization & access, compliance & metadata, and creative video.

Smartphones Generate Highest Revenue

The smartphones and tablets category held the largest revenue share in 2023, of 45%, under segmentation by platform. This dominance is due to the easy accessibility of the internet, increase in disposable income, and improvements and changes in lifestyles. These devices allow for uncomplicated live streaming, owing to the reliability of the internet connection in most urban areas. Smartphones and tablets are also preferred for online streaming as they provide offline viewing, are portable and easy to operate, and billions of people worldwide own one. Smartphones can also be used as a second screen to look for information related to the content while watching TV.

Moreover, the TVs category is expected to witness considerable growth in revenue over this decade. This will be on account of the accessibility of many video streaming applications, such as Hulu, DirecTV Stream, Sling TV, and YouTube TV. Further, smart TVs offer access to a wide selection of TV channels, in addition to video streaming services, such as Netflix.

| Report Attribute | Details |

Market Size in 2023 |

USD 130.1 Billion |

Market Size in 2024 |

USD 157.2 Billion |

Revenue Forecast in 2030 |

USD 508.8 Billion |

Growth Rate |

21.6% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Type; By Offering; By Platform; By Deployment; By Revenue Model; By End User; By Region |

Explore more about this report - Request free sample

Cloud Deployment Is More Popular

The deployment segment will continue to be led by the cloud category over the forecast period. The development of platforms, such as YouTube and Netflix, for streaming video has been made possible by the advances in cloud computing technologies. Cloud deployment is primarily utilized by market players to provide a bigger bandwidth and improved speed, control more-substantial data content, and offer a better watching experience. Moreover, cloud scaling helps in increasing the bandwidth and dealing with buffering and latency issues.

Furthermore, the rising preference for low-latency video streaming through social media platforms aids the market growth in this category. Thus, in January 2022, THEO Technologies Inc. introduced a HTTP-based, low-latency, real-time video streaming platform, hesp.live. Since not many enterprises have the infrastructure and networks capable of handling the heavy traffic of conventional online streaming, the demand for social-media-based online streaming is rising.

Subscription Revenue Model Possesses Largest Share

The subscription category dominates the market, and it is projected to grow at a CAGR of 21.9% over the forecast period. This revenue model, which has been adopted by Netflix, enables the streaming of online videos for an access fee or a monthly, quarterly, or annual subscription. The number of subscribers of video streaming apps in 2022 were 220 million for Netflix, 208 million for Amazon Prime Video, and 47 million for Apple TV+.

This is essentially because of the vast amount and variety of content available on OTT platforms, such as Netflix and Amazon Prime Video. The increasing adoption of digital media platforms has further resulted in the population’s preference for multiple streaming solutions and services.

The advertisement category also generates significant revenue in the market, as playing advertisements is a common method of monetizing streaming videos. Nowadays, advertisers pay an enormous amount to on-demand streaming platforms for promoting their product, owing to these platforms’ massive viewership.

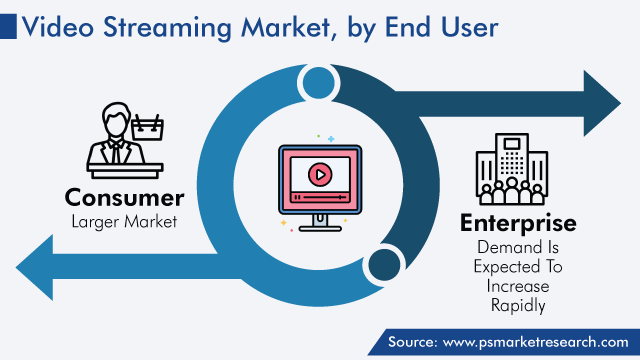

Consumer Category Dominates Market

The end user segment is dominated by the consumer category, as a result of the huge spectator numbers on live streaming and video on-demand platforms. The rising number of mobile subscriptions and the growing usage of connected devices, particularly smartphones, are predicted to contribute to the category’s future expansion.

The enterprise category is also growing rapidly, because of the increasing usage of video streaming services across industries for training and consulting. Advantages such as superior video codecs, captioning, web-based real-time transcoding, indexing, communication, and aggregation are expected to further stimulate the demand for video streaming among enterprise users. This improves the communication efficiency in an organization, which also enhances flexibility in remote working conditions.

For example, in April 2023, Haivision launched Haivision Hub, a FedRAMP video network service, which allows various government agencies to collaborate on live-streamed videos, to satisfy federal information assurance standards.

Further, in the education sector, video steaming is used during webinars, seminars, and courses to enhance the learning and teaching processes. Audio, along with visuals, has a powerful impact on students’ ability to retain information. Consequently, universities, colleges, and schools are creating multimedia content and delivering it in the form of presentations. The easy access to educational video content, increasing demand for mobile devices, and growing availability of the internet are positively influencing the market in this category.

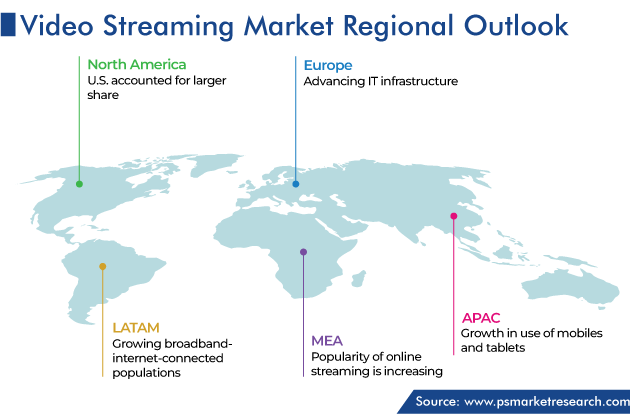

North America Is Highest Revenue Generator

Globally, North America is the largest market, generating revenue of around 50% revenue share in 2023, due to the speedy growth in the usage of cloud-based streaming services. The U.S. accounted for the larger market share in North America in 2023, and the trend is expected to continue until 2030. The U.S. is the most-developed market as it has advanced IT infrastructure, comprehensive training programs on technical skills, and the presence of several businesses. The market is also influenced by legal requirements, such as FedRAMP, a systematic attempt to assess security, authorize, and uninterruptedly monitor cloud products and services.

Furthermore, Asia-Pacific is expected to grow at the highest CAGR during the forecast period, of 22.2%. This will be due to the advancements in technology, growth in the use of mobiles and tablets, and increase in the popularity of online streaming. Further, telecommunications companies in the region are pursuing service innovations and adopting cutting-edge marketing strategies. Additionally, several market players in Asia offer multichannel video streaming services with fixed-mobile packages. This is especially true of the companies in Southeast Asia, which has one of the fastest-growing broadband-internet-connected populations in the world.

Some of Key Competitors in the Market Are:

- Netflix Inc.

- Amazon.com Inc.

- AT&T Inc.

- The Walt Disney Company

- Alphabet Inc.

- Warner Bros. Discovery Inc.

- Paramount

- AMC Networks Inc.

Market Breakdown

This report offers deep insights into the video streaming market, with size estimation for 2017 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Segment Analysis, By Type

- Liners

- Non-linear

Segment Analysis, By Offering

- Solutions

- Transcoding & processing

- Video management

- Video distribution

- Video analytics

- Video security

- Services

- Managed services

- Professional services

- Consulting

- Integration & implementation

- Support & maintenance

Segment Analysis, By Platform

- Gaming Consoles

- Laptops & Desktops

- Smartphones & Tablets

- Smart TVs

Segment Analysis, By Deployment

- Cloud

- On-Premises

Segment Analysis, By Revenue Model

- Advertising

- Rental

- Subscription

Segment Analysis, By End User

- Enterprise

- Corporate communications

- Knowledge sharing & collaborations

- Marketing & client engagement

- Training & development

- Consumer

- Real-time entertainment

- Web browsing & advertising

- Gaming

- Social networking

- E-learning

Region/Countries Reviewed for this Report

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

The market for video streaming valued USD 130.1 billion in 2023.

The video streaming industry will reach USD 508.8 billion by 2030.

The linear category is larger in the market for video streaming.

The video streaming industry is propelled by the rising internet access, growing smartphone adoption, and busy lives.

The OTT category dominates the market for video streaming, based on solution.

The subscription model is the most popular in the video streaming industry.

APAC is the fastest-growing market for video streaming.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws